Five Key Charts to Watch in Global Commodities This Week

(Bloomberg) -- At a time when crude prices are once again flirting with $100 a barrel on Saudi Arabia-led OPEC+ supply cuts, the Middle East will play host to the region’s largest energy conference. But unlike in years past, oil won’t be top of the agenda. Instead, the focus will be on the energy transition under the title “Decarbonising. Faster. Together.” Elsewhere, the offshore wind industry will gather in Boston for a two-day summit, while the US shale patch struggles to control record oil-field costs.

Here are five notable charts to consider in global commodity markets as the week gets underway.

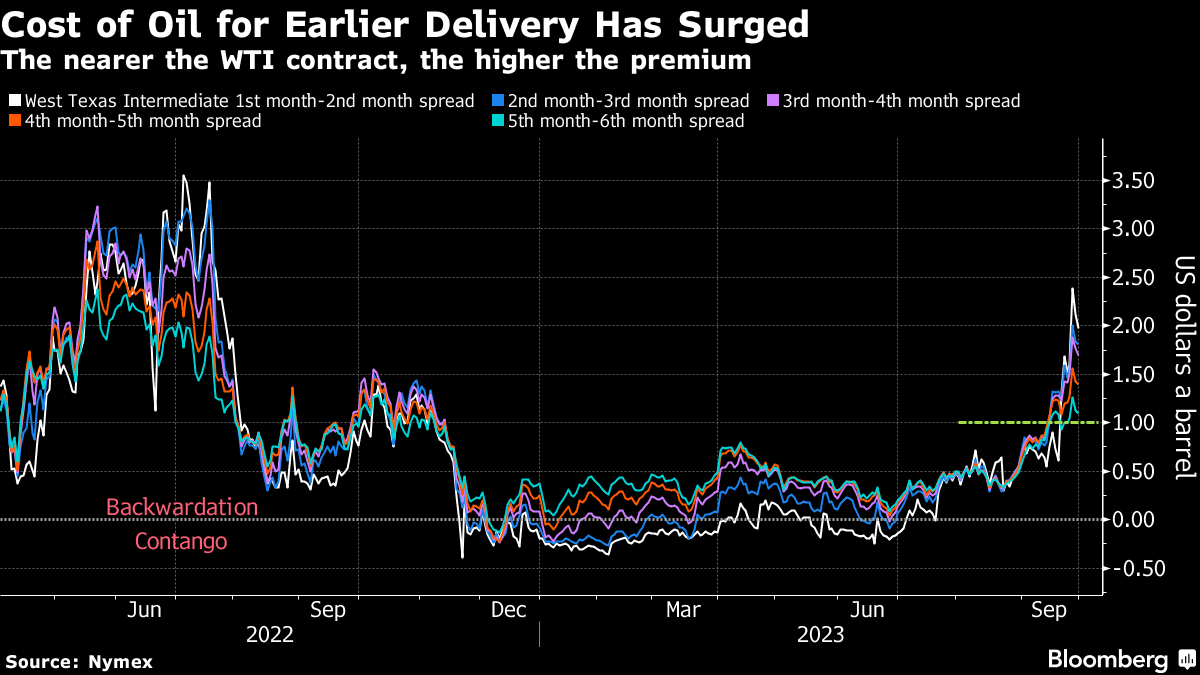

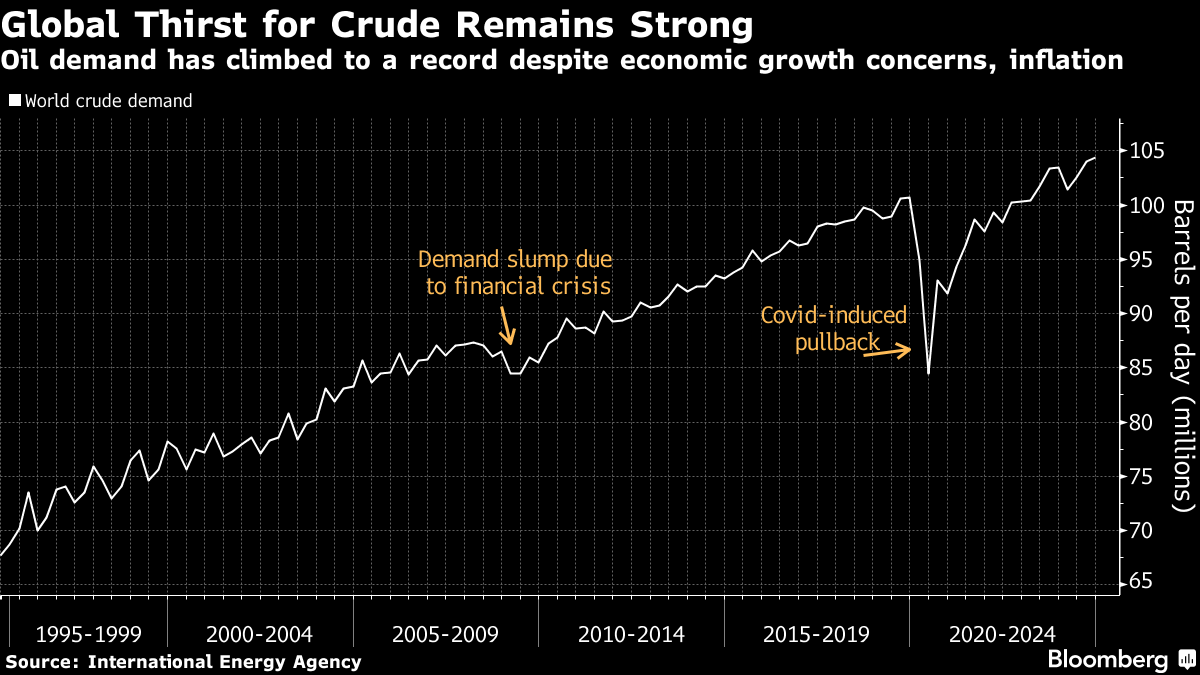

Oil Prices

Oil is fresh off its biggest quarterly advance since early 2022, a rally supported by production cuts in both Saudi Arabia and Russia and record demand. Tightening crude supplies have pushed up the premium that traders are paying for West Texas Intermediate deliveries a month earlier, with every pair of futures contracts through the next six months above $1 a barrel. The move deeper into a market structure known as backwardation highlights ongoing inventory concerns, forcing the market to bid up prompt contracts. WTI and Brent futures settled lower in Monday trading.

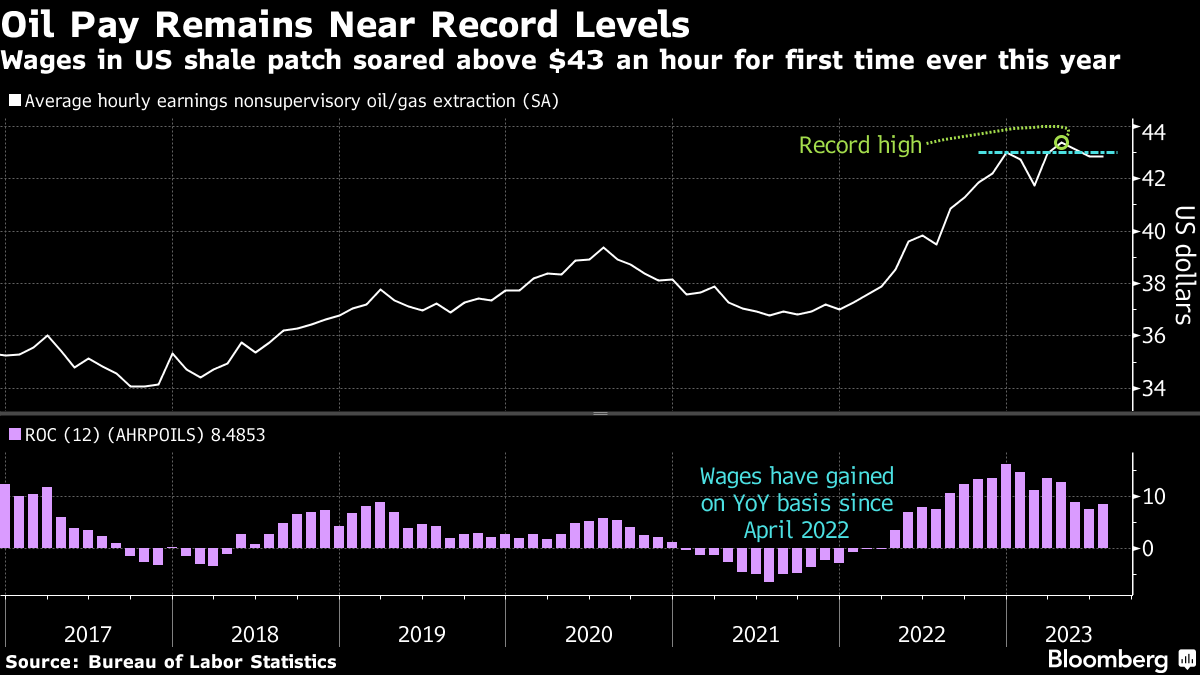

Shale Jobs

Inflation pressures in the US shale patch are far from abating. A survey last week from the Federal Reserve Bank of Dallas — a widely followed quarterly report — showed that most oil executives polled now expect drilling and fracking expenses to climb next year. That’s sobering news in light of near-record labor costs and other expenses. Friday’s monthly US payrolls report will shed further light on the state of the shale jobs market. Earlier this year, average hourly earnings for front-line oil-and-gas workers topped $43 an hour for the first time ever.

Energy Transition

Efforts to decarbonize the energy industry will be a central focus at this week’s Adipec conference in Abu Dhabi, where oil ministers and executives from the world’s biggest producers gather to tackle some of the sector’s most pressing issues. The discussions come at a critical moment, with oil prices surging amid tightening supplies and ahead of the United Arab Emirates hosting important COP28 climate talks later this year. The energy sector accounts for about three-quarters of global greenhouse gas emissions today, according to an International Energy Agency report, meaning the industry holds the key to responding to global environmental challenges. Fossil fuel demand would need to collapse by at least 75% over the next three decades to put the world on a pathway to net-zero emissions by 2050, the IEA estimates.

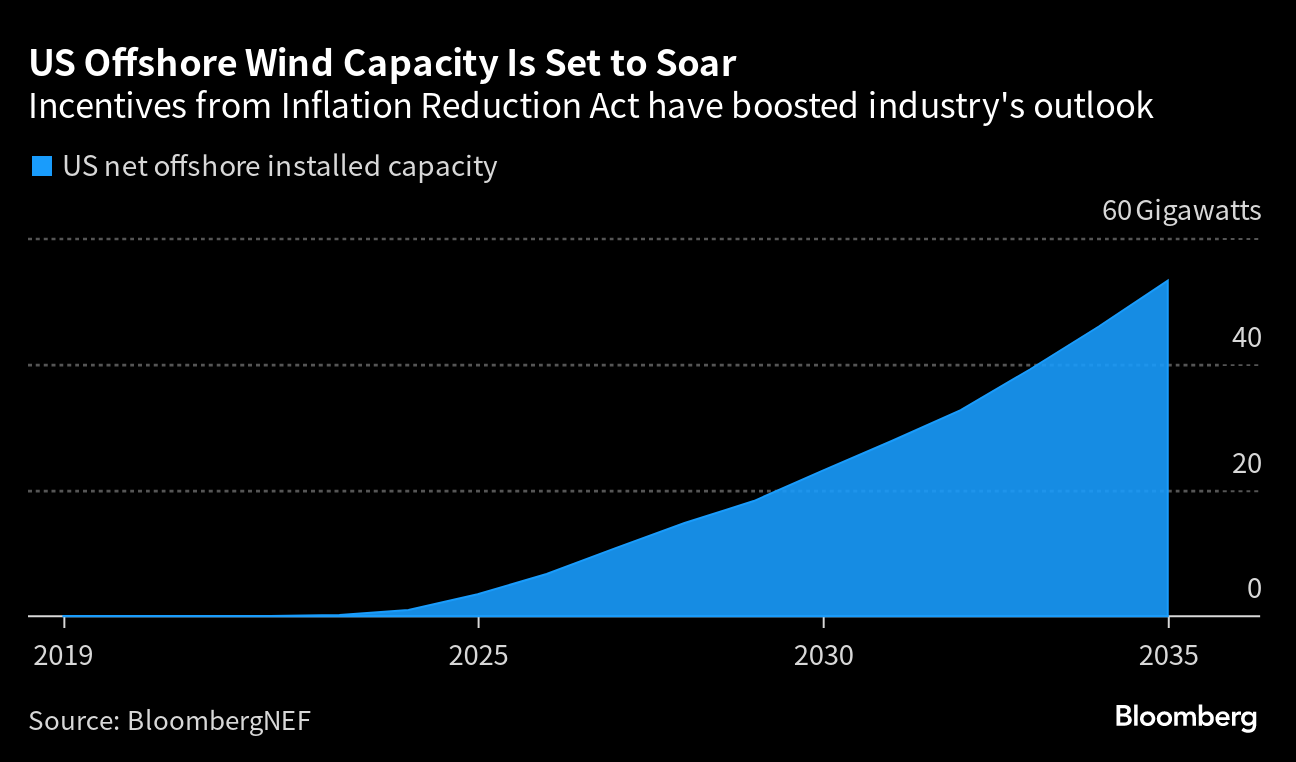

Offshore Wind

The future of US offshore wind is at a key inflection point, with construction impaired by soaring costs and ongoing supply-chain hurdles. The American Clean Power Association will host the Offshore Windpower Conference on Tuesday and Wednesday with major developers including Orsted A/S, Avangrid Inc. and Equinor ASA, as well as government officials, in attendance. Thanks to incentives provided by President Joe Biden’s landmark climate law — the Inflation Reduction Act — cumulative offshore wind installed capacity is set to soar to more than 53 gigawatts by 2035, according to BloombergNEF. That compares with just 42 megawatts at the end of 2022.

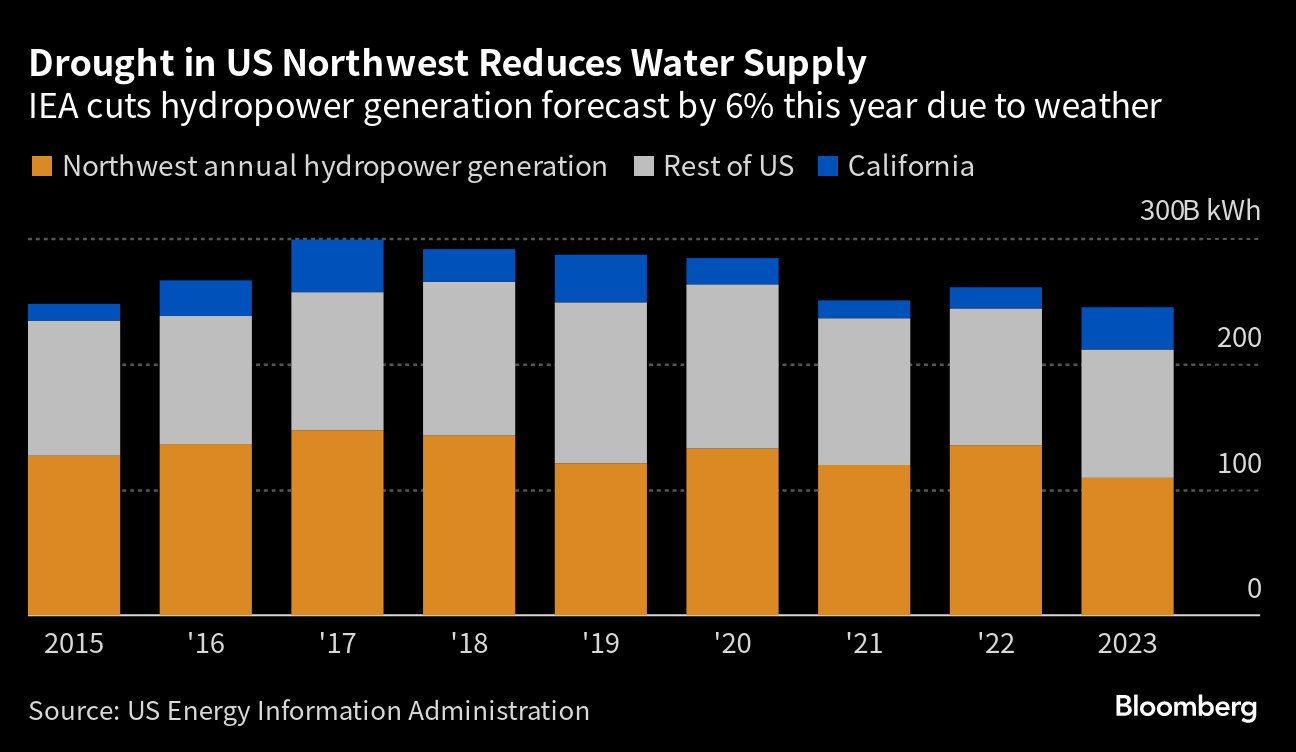

Hydropower

Above-normal temperatures in May and lingering drought in the Northwest have led the Energy Information Administration to cut its forecast for total US hydroelectric power generation this year by 6%. About one-half of the country’s hydropower comes from the Northwest, but less water in the first half of the year led to a 24% drop in output compared with the same period a year ago, prompting a reduced outlook for the full year. However, that’s partially offset by higher-than-expected generation in California, where record-breaking winter precipitation filled reservoirs and left a deep snowpack across the state’s Sierra Nevada.

(Updates with Monday’s oil settlement in third paragraph.)

©2023 Bloomberg L.P.

KEEPING THE ENERGY INDUSTRY CONNECTED

Subscribe to our newsletter and get the best of Energy Connects directly to your inbox each week.

By subscribing, you agree to the processing of your personal data by dmg events as described in the Privacy Policy.

More oil news

Philippines’ Marcos Seeks to Import LNG From Alaska, Envoy Says

Oil Falls After Weak Technicals Accelerate Supply-Driven Losses

Buffett’s Annual Letter May Give Much Needed Support to Japanese Stocks

Oil Edges Lower With Focus on US Stockpiles, Supply Uncertainty

Oil Climbs With Focus on OPEC+ Output Plans and Ukraine Talks

Diamondback Energy announces $4.08 billion acquisition to expand Permian presence

Oil Holds Declines on Prospect of Higher Russia, Iraq Supplies

Canada’s Conservative Leader Pitches Major Natural-Resource Revamp to Counter Trump

EPA Terminates Nearly 400 Workers Amid US Government Purge