Oil Extends Plunge as Brent Falls Below $85 on Demand Worries

(Bloomberg) -- Oil extended its sharp decline on concerns that a slowdown in global growth will erode consumption.

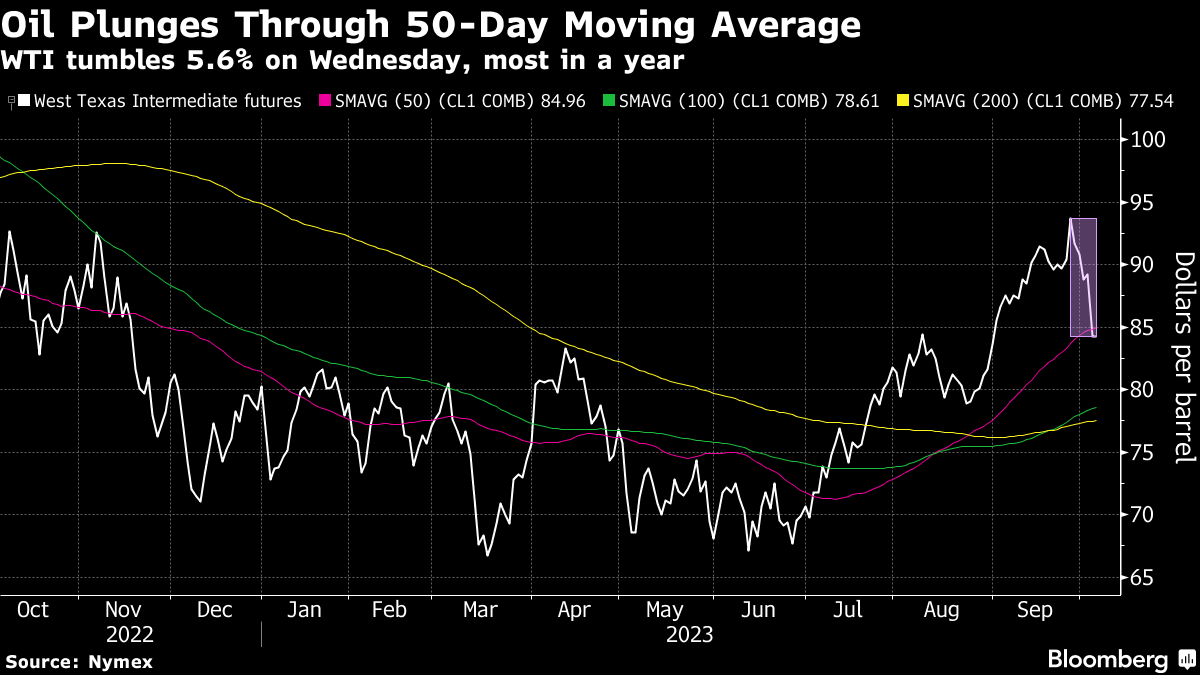

The global Brent benchmark fell below $85 for the first time since late August, while West Texas Intermediate slid below $84 after slumping the most since September last year on Wednesday. Crude’s drop followed a plunge in gasoline after US data showed stockpiles surged in the US and demand fell.

Oil also tumbled through key technical levels Wednesday with both Brent and WTI plunging below their 50-day moving average for the first time since July. Market volatility also surged during the rout, bolstering options trading.

After rallying strongly in the third quarter — with the US benchmark topping $95 a barrel near the end of September — crude’s upsurge has faltered. While the gains had fueled speculation that a return to $100 oil was on the cards, others remained skeptical, with notable bear Citigroup Inc. making the case that prices were on course to reverse as the market returned to a surplus.

Oil’s sharp retreat has come against a backdrop of rising worries about elevated interest rates and the global economy that has rattled equity and bond markets in recent weeks. If sustained, it will help to cool inflationary pressures as central bankers including those at the Federal Reserve debate whether they’ve hiked borrowing costs enough. Monthly US jobs data Friday will be scrutinized for clues on the economy’s health.

“The current rates environment along with the USD strength has only provided stronger headwinds to the market,” said Warren Patterson, head of commodities strategy at ING.

Crude’s tumble came despite announcements from Saudi Arabia and Russia that voluntary production cuts would remain in place through the end of the year. In addition, an OPEC+ committee recommended no change to collective curbs.

The rally in oil has reversed as “bond markets have been signaling economic weakness, and US gasoline demand continues to lag,” Citi analysts including Francesco Martoccia and Ed Morse said in a note. “Collapsing prices likely informed the OPEC+ decision to stay the course on output cuts to year-end.”

©2023 Bloomberg L.P.

KEEPING THE ENERGY INDUSTRY CONNECTED

Subscribe to our newsletter and get the best of Energy Connects directly to your inbox each week.

By subscribing, you agree to the processing of your personal data by dmg events as described in the Privacy Policy.

More oil news

Philippines’ Marcos Seeks to Import LNG From Alaska, Envoy Says

Oil Falls After Weak Technicals Accelerate Supply-Driven Losses

Buffett’s Annual Letter May Give Much Needed Support to Japanese Stocks

Oil Edges Lower With Focus on US Stockpiles, Supply Uncertainty

Oil Climbs With Focus on OPEC+ Output Plans and Ukraine Talks

Diamondback Energy announces $4.08 billion acquisition to expand Permian presence

Oil Holds Declines on Prospect of Higher Russia, Iraq Supplies

Canada’s Conservative Leader Pitches Major Natural-Resource Revamp to Counter Trump

EPA Terminates Nearly 400 Workers Amid US Government Purge