Oil Steady After Three-Day Streak of Losses as War Fears Ease

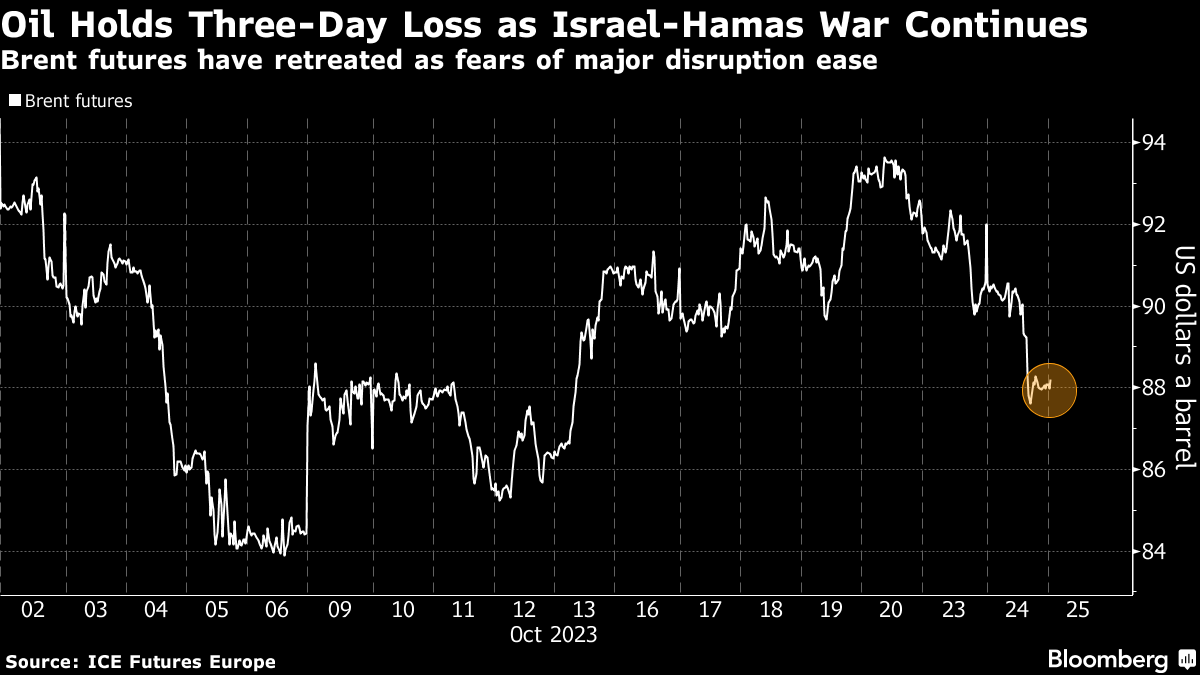

(Bloomberg) -- Oil steadied after falling over the previous three sessions on signs that the Israel-Hamas war will remain contained for the time being.

Global benchmark Brent was near $88 a barrel, erasing about half of the gains since Hamas’ attack on Oct. 7, while West Texas Intermediate traded below $84 a barrel. The US and Saudi Arabia agreed to pursue diplomatic efforts to maintain stability across the Middle East, the White House said Tuesday, helping to ease fears of major disruptions to the oil market.

Crude spiked in the initial stages of the war on concerns the conflict would escalate, potentially threatening exports from Iran and leading to attacks on tankers in key shipping routes. Those fears have ebbed in recent sessions, with growing calls within Israel to rethink the scope of a ground invasion of Gaza, although the risk of further disruption remains.

Crude’s string of declines “might reflect the hold back on a ground invasion in Gaza,” said Vishnu Varathan, Asia head of economics and strategy at Mizuho Bank Ltd. However, “live risks of a more uncontained conflict would be reflected in a heartbeat” if Iran, Lebanon or others were drawn in, he said.

Away from the Middle East, President Xi Jinping stepped up support for the Chinese economy, issuing additional sovereign bonds and raising the budget deficit ratio. The moves are spurring optimism in wider financial markets and could support demand in the world’s biggest crude importer.

The industry-funded American Petroleum Institute said Tuesday that nationwide crude inventories declined by 2.67 million barrels last week, according to people familiar with the data, a potentially bullish signal for oil. However, stockpiles at the Cushing, Oklahoma, storage hub, were seen rising modestly. Official figures are due later on Wednesday.

©2023 Bloomberg L.P.

KEEPING THE ENERGY INDUSTRY CONNECTED

Subscribe to our newsletter and get the best of Energy Connects directly to your inbox each week.

By subscribing, you agree to the processing of your personal data by dmg events as described in the Privacy Policy.

More oil news

Abu Dhabi Defies Oil Price Plunge to Keep Building Big at Home

Oil Rises a Second Day After US Cracks Down on Iranian Supply

Oil Steadies With Glut Expectations, Trade War Souring Outlook

Oil Edges Higher With Focus on Tariff Moves, US-Iran Discussions

Oil Steadies as Progress on Iran Talks Undercuts Tariff Reprieve

Goldman Sachs Warns Oil Faces ‘Large Surpluses’ Through 2026

Chevron Ordered to U-Turn Venezuela Oil Ahead of Sanctions

Shale Drillers Idle US Rigs at Fastest Pace in Almost Two Years

Oil Heads for Weekly Decline as Trade War Roils Global Markets