War Fears Drive Gold and Oil Higher; S&P 500 Drops: Markets Wrap

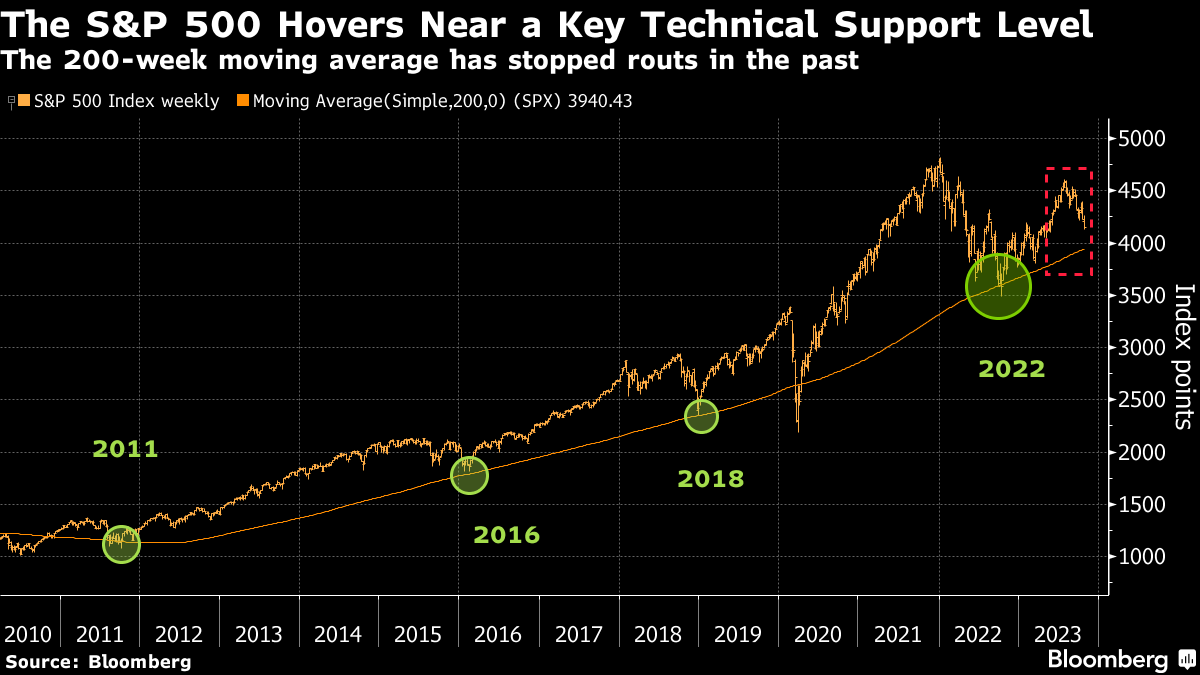

(Bloomberg) -- A rebound in stocks sputtered, with the S&P 500 extending a slide from its July peak to 10% — the threshold of a “correction.” Oil topped $85 and gold hit $2,000 amid the latest geopolitical developments.

Volatility resurfaced on news that Israeli forces are expanding their activity in Gaza. The benchmark stock gauge headed toward its worst week in a month. JPMorgan Chase & Co. dropped as Chief Executive Officer Jamie Dimon plans to sell shares currently worth about $141 million. Amazon.com Inc. and Intel Corp. rallied on earnings. Treasury two-year yields edged lower as traders took a hotter inflation measure in stride. The dollar fell.

US stocks are in their third month of declines after bond yields soared on worries about a persistently hawkish Federal Reserve. Concern about the war in the Middle East as well as an underwhelming corporate earnings season have dented risk appetite more recently.

“The aggressive market selloff has been driven largely by technical factors, as fundamentals remain solid,” said Mark Hackett, chief of investment research at Nationwide. “This is fitting, given the strong bounce since last October was also largely technical. Signs of oversold conditions and supportive seasonality should lead to a bounce, though sentiment will need to shift, which could take a catalyst or a period of capitulation.”

More than two-thirds of stocks for companies in the S&P 500 index are trading below their 200-day moving averages, according to an analysis by Bloomberg Intelligence. That’s a sign of widespread pain for stock prices, after many companies have posted lackluster earnings amid interest rates that are high and bond yields that keep creeping up.

In economic news, US near-term inflation expectations rose in October to a five-month high as they feared higher prices at the gas pump, reinforcing downbeat views on the economy. The Fed’s preferred measure of underlying inflation accelerated to a four-month high in September and consumer spending picked up, keeping the door open to another interest-rate hike in the months ahead.

Corporate Highlights:

- Tesla Inc. raised the price of its Model Y Performance sport-utility vehicle by around $2,000 in China on Friday, according to its local website, reversing a reduction made only in August.

- Ford Motor Co. said it fell short of third-quarter earnings expectations, citing higher costs and lower quality, a day after it won labor peace through a tentative contract with the United Auto Workers.

- Exxon Mobil Corp. and Chevron Corp. posted disappointing profits amid weak performances by their oil-refining and chemical businesses.

- Chipotle Mexican Grill Inc. jumped after the restaurant chain reported third-quarter comparable sales that beat estimates.

- AutoNation Inc., one of the biggest car dealership chains in the US, posted third-quarter profit and revenue that beat expectations on rising new car sales and growth in its aftermarket repair business.

- AbbVie Inc. raised its profit outlook for this year and next as demand for newer biologic drugs Skyrizi and Rinvoq helped fill the gap left by falling Humira sales.

- Sanofi shares plunged after a surprise forecast for lower profit next year overshadowed optimism about a plan to spin off the consumer health division.

- NatWest Group Plc’s shares plummeted after it cut its margin guidance, the latest UK lender to warn higher interest rates are stirring competition for deposits.

Some of the main moves in markets:

Stocks

- The S&P 500 fell 0.5% as of 2:35 p.m. New York time

- The Nasdaq 100 rose 0.4%

- The Dow Jones Industrial Average fell 1.1%

- The MSCI World index fell 0.2%

Currencies

- The Bloomberg Dollar Spot Index fell 0.1%

- The euro was little changed at $1.0566

- The British pound was little changed at $1.2117

- The Japanese yen rose 0.6% to 149.47 per dollar

Cryptocurrencies

- Bitcoin fell 2% to $33,496.71

- Ether fell 2.3% to $1,757.26

Bonds

- The yield on 10-year Treasuries was little changed at 4.85%

- Germany’s 10-year yield declined three basis points to 2.83%

- Britain’s 10-year yield declined five basis points to 4.54%

Commodities

- West Texas Intermediate crude rose 2.6% to $85.39 a barrel

- Gold futures rose 1% to $2,016.40 an ounce

This story was produced with the assistance of Bloomberg Automation.

©2023 Bloomberg L.P.

KEEPING THE ENERGY INDUSTRY CONNECTED

Subscribe to our newsletter and get the best of Energy Connects directly to your inbox each week.

By subscribing, you agree to the processing of your personal data by dmg events as described in the Privacy Policy.

More oil news

Abu Dhabi Defies Oil Price Plunge to Keep Building Big at Home

Oil Rises a Second Day After US Cracks Down on Iranian Supply

Oil Steadies With Glut Expectations, Trade War Souring Outlook

Oil Edges Higher With Focus on Tariff Moves, US-Iran Discussions

Oil Steadies as Progress on Iran Talks Undercuts Tariff Reprieve

Goldman Sachs Warns Oil Faces ‘Large Surpluses’ Through 2026

Chevron Ordered to U-Turn Venezuela Oil Ahead of Sanctions

Shale Drillers Idle US Rigs at Fastest Pace in Almost Two Years

Oil Heads for Weekly Decline as Trade War Roils Global Markets