Oil Pushes Closer to $95 a Barrel as Global Market Tightens Up

(Bloomberg) -- Oil extended an upswing as OPEC+ supply cuts tightened the market, with Saudi Energy Minister Prince Abdulaziz bin Salman due to address a conference on the kingdom’s crude policy and view on net zero.

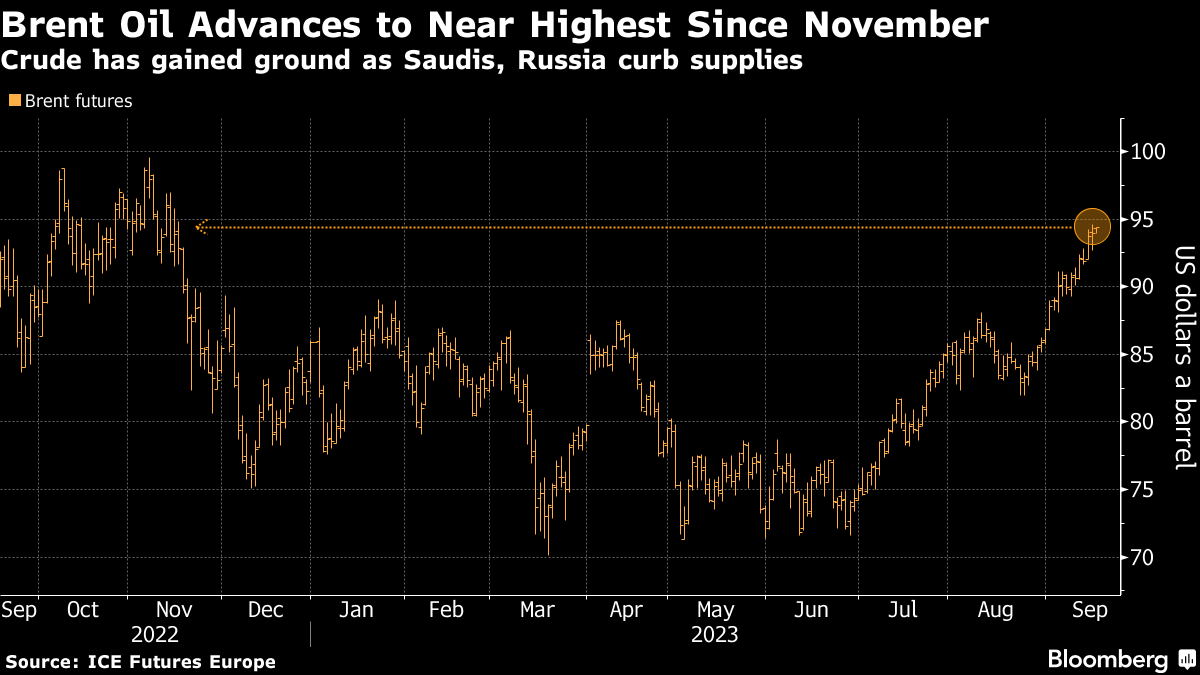

Global benchmark Brent advanced well above $94 a barrel after a three-week run of gains that boosted prices by 11%. With Saudi Arabia and Russia prolonging supply curbs to the year-end, Prince Abdulaziz is set to be among keynote speakers at the World Petroleum Congress in Calgary later on Monday.

Crude in London is nearly 10% higher year-to-date as the OPEC+ linchpins curb production and the demand outlook brightens, with the US potentially avoiding recession just as refiners in China go all-out. Against that backdrop, crude stockpiles have dropped, while speculators boosted net-bullish wagers on Brent and US benchmark West Texas Intermediate to a combined 15-month high.

Oil’s surge looks set to fan inflationary pressures around the globe just as central bankers, including those at the US Federal Reserve, try to determine whether they have already done enough to beat back the pace of price gains by hiking interest rates. It’ll be an important week for monetary policy, with decisions due from the Fed and the Bank of England, among others.

“Focus is likely to turn to the Fed meeting this week, but growing supply tightness and eroding inventories likely to continue underpinning bullish sentiment.’,”said Vandana Hari, founder of consultancy Vanda Insights.

In the physical market, refined products like diesel are increasingly showing warning signs, with the world’s refineries proving powerless to make enough of the industrial fuel. Prices have far outstripped those for crude.

Widely-watched crude timespreads are also signaling tightness, with the gap between Brent’s two nearest contracts at 92 cents a barrel in backwardation. That’s the widest since November and reflects scarce near-term supplies.

Still, other markers suggest a pullback could be in the offing after such a swift and marked move higher. Brent’s 14-day relative-strength index has been above 70 for nine of the past 10 sessions, pointing to the possibility that the rally could pause or retrace as traders digest gains.

©2023 Bloomberg L.P.

KEEPING THE ENERGY INDUSTRY CONNECTED

Subscribe to our newsletter and get the best of Energy Connects directly to your inbox each week.

By subscribing, you agree to the processing of your personal data by dmg events as described in the Privacy Policy.

More oil news

US Steps Up Houthi Campaign With Deadly Strikes on Red Sea Oil Port

Iran's Space Program Is Growing Stronger Despite US Sanctions

Abu Dhabi Defies Oil Price Plunge to Keep Building Big at Home

Oil Rises a Second Day After US Cracks Down on Iranian Supply

Oil Steadies With Glut Expectations, Trade War Souring Outlook

Oil Edges Higher With Focus on Tariff Moves, US-Iran Discussions

Oil Steadies as Progress on Iran Talks Undercuts Tariff Reprieve

Goldman Sachs Warns Oil Faces ‘Large Surpluses’ Through 2026

Chevron Ordered to U-Turn Venezuela Oil Ahead of Sanctions