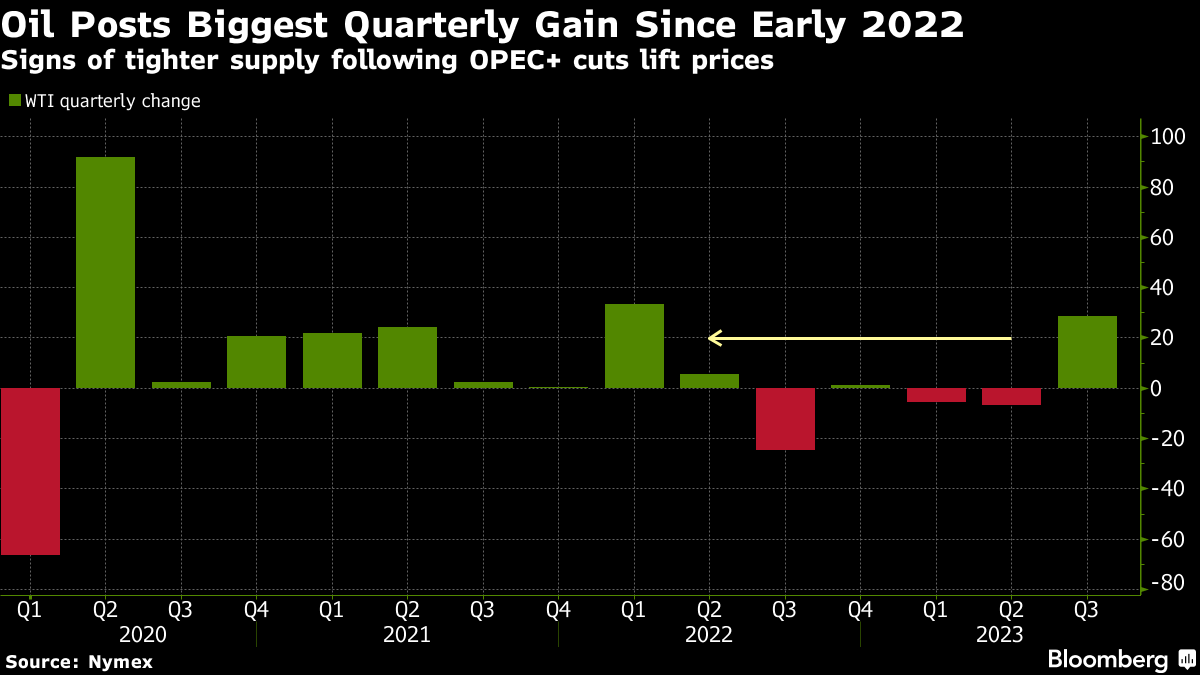

Oil Posts Strongest Quarter in More Than a Year Amid OPEC Cuts

(Bloomberg) -- Oil posted its largest quarterly rally since the initial jolt from the war in Ukraine as lower Russian fuel exports threaten to further tighten a market wrestling with OPEC+ production cuts.

Industry data released Friday show Moscow is planning almost no diesel exports next month in order to reduce domestic prices. The move sent European diesel futures rallying back above the psychologically key level of $1,000 a ton.

US benchmark crude futures cemented their biggest quarterly gain since the period ended in March 2022 on Saudi-led OPEC+ supply cuts and critically low stockpiles at the Cushing hub in the US. On Friday, West Texas Intermediate reversed its earlier gains and slipped to settle below $91, largely tracking the path of US equities.

Many of this week’s most significant oil-market moves have come away from headline prices. Key timespreads have exploded higher amid fears about the availability of US supplies. Meanwhile, gasoline’s premium over crude in the US has plunged in a potential sign that higher crude prices are starting to impinge on margins.

Even with traders casting a wary eye on the demand outlook, little remains to obstruct crude’s march toward $100 a barrel as OPEC forecasts a supply deficit at 3 million barrels a day next quarter.

“Oil for short-term delivery is being traded at a significant premium, which is an indication of tight supply,” Commerzbank AG analyst Barbara Lambrecht said in a report. “At the same time, demand for oil is continuing to grow. This is tightening the oil market, as evidenced by declining inventories.”

China’s Golden Week holidays, which run through next Friday, are expected to boost consumption as more people fly domestically and on international routes.

©2023 Bloomberg L.P.

KEEPING THE ENERGY INDUSTRY CONNECTED

Subscribe to our newsletter and get the best of Energy Connects directly to your inbox each week.

By subscribing, you agree to the processing of your personal data by dmg events as described in the Privacy Policy.

More oil news

US Steps Up Houthi Campaign With Deadly Strikes on Red Sea Oil Port

Iran's Space Program Is Growing Stronger Despite US Sanctions

Abu Dhabi Defies Oil Price Plunge to Keep Building Big at Home

Oil Rises a Second Day After US Cracks Down on Iranian Supply

Oil Steadies With Glut Expectations, Trade War Souring Outlook

Oil Edges Higher With Focus on Tariff Moves, US-Iran Discussions

Oil Steadies as Progress on Iran Talks Undercuts Tariff Reprieve

Goldman Sachs Warns Oil Faces ‘Large Surpluses’ Through 2026

Chevron Ordered to U-Turn Venezuela Oil Ahead of Sanctions