Oil Holds Drop as Mideast Cease-Fire Talks Erode Risk Premium

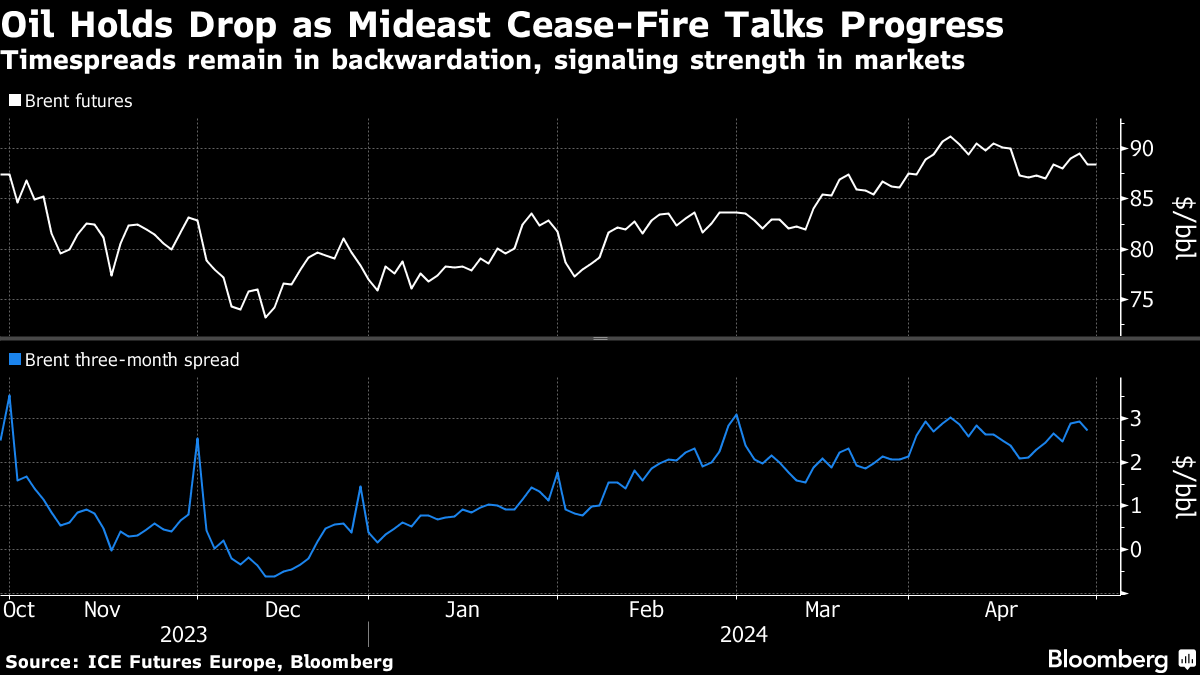

(Bloomberg) -- Oil held its biggest drop in almost two weeks as discussions on a possible cease-fire in the Middle East reduced the risk premium for crude.

Brent crude traded above $88 a barrel after closing 1.2% lower on Monday, with West Texas Intermediate under $83. The gap between Israel and Hamas on an agreement to release hostages has narrowed in recent weeks and a deal was close, according to two people familiar with the deliberations.

Crude is set to eke out a fourth monthly gain, after surging to its highest since October in mid-April following Iran’s unprecedented attack on Israel. Conflicts in the Middle East and Ukraine, as well as OPEC+ supply curbs, are bolstering prices, although uncertainty over US monetary policy and high inventories in product markets including diesel are weighing on the outlook for demand.

US Secretary of State Antony Blinken, on an ongoing visit to the Middle East, urged leaders of the Hamas militant group — designated a terrorist organization by the US and the European Union — to quickly reach a decision on Israeli conditions for a cease-fire.

“We’ve already seen crude ease a bit on anticipation of a rapprochement, but prices may now remain rangebound until the outcome of the latest push for a truce is known,” said Vandana Hari, founder of Vanda Insights in Singapore. “In the event of a deal, I expect crude to quickly slide toward $80.”

©2024 Bloomberg L.P.

KEEPING THE ENERGY INDUSTRY CONNECTED

Subscribe to our newsletter and get the best of Energy Connects directly to your inbox each week.

By subscribing, you agree to the processing of your personal data by dmg events as described in the Privacy Policy.

More oil news

China’s Weak Winter LNG Demand Provides Relief for Rival Buyers

Oil Edges Higher Ahead of US Inflation Figures and OPEC Report

Oil Slips as Glut Outlook Outweighs Optimism on China Stimulus

Oil Edges Higher as Traders Weigh Fallout From Syrian Upheaval

China’s Solar Industry Looks to OPEC for Guide to Survival

Five Key Charts to Watch in Global Commodity Markets This Week

Oil Steadies as OPEC+ Opts Again to Delay Plan to Restore Output

NMDC LTS to acquire 70% equity stake in Emdad

Oil Holds Drop as OPEC+ Decision on Supply Takes the Spotlight