Oil Swings Near $90 With Risk of Iran Strike on Israel in Focus

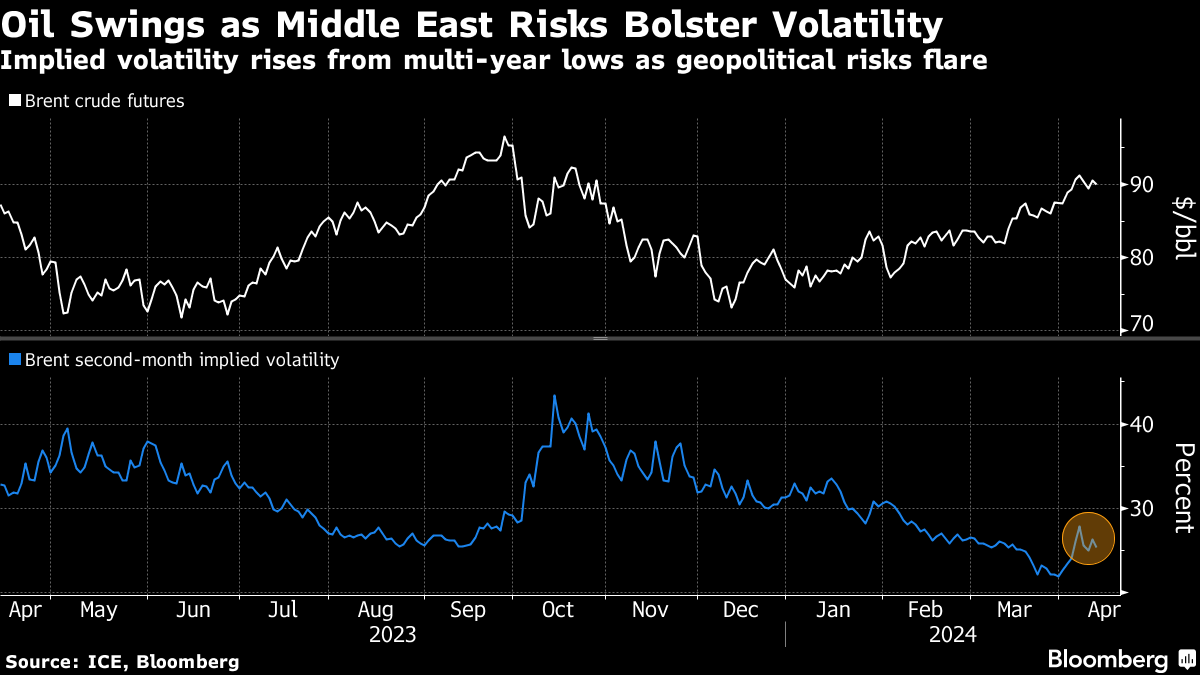

(Bloomberg) -- Oil cooled some of the previous day’s gains amid a choppy few days of activity as traders continue to watch for a potential attack on Israel by Iran or its proxies.

Brent futures erased an earlier gain to trade down 0.5% near $90. The dollar was firmer, making commodities priced in the currency less appealing.

The US and its allies believe a strike is imminent, according to people familiar with the matter, following a threat by Iran to hit Israel in retaliation for an attack on a diplomatic compound in Syria last week.

Oil is up about 18% this year as geopolitical tensions combine with OPEC+ supply cuts to drive prices higher. Still, there are headwinds in the form of swelling US crude stockpiles — now at the highest since July — and a hot US inflation print, which may delay rate cuts from the Federal Reserve.

Many of the world’s top traders and Wall Street banks are shifting toward a bullish tone on prices, with some seeing a possible return to $100 for the global benchmark. However, Macquarie Group said Brent will enter a bear market in the second half, with recent gains unlikely to hold if geopolitical events don’t lead to actual supply disruptions.

“Geopolitical risks continue to linger as the US warned Israel about an imminent Iran attack,” said Keshav Lohiya, founder of consultant Oilytics. “The question remains if the market loses patience with it in days if nothing materializes.”

On Wednesday, Iran’s Supreme Leader Ayatollah Ali Khamenei repeated a vow to retaliate against Israel for the Damascus strike. Even so, the head of the naval forces said recently that the country has chosen not to disrupt the Strait of Hormuz, a major trade route for Middle Eastern oil.

©2024 Bloomberg L.P.

KEEPING THE ENERGY INDUSTRY CONNECTED

Subscribe to our newsletter and get the best of Energy Connects directly to your inbox each week.

By subscribing, you agree to the processing of your personal data by dmg events as described in the Privacy Policy.

More oil news

US Steps Up Houthi Campaign With Deadly Strikes on Red Sea Oil Port

Iran's Space Program Is Growing Stronger Despite US Sanctions

Abu Dhabi Defies Oil Price Plunge to Keep Building Big at Home

Oil Rises a Second Day After US Cracks Down on Iranian Supply

Oil Steadies With Glut Expectations, Trade War Souring Outlook

Oil Edges Higher With Focus on Tariff Moves, US-Iran Discussions

Oil Steadies as Progress on Iran Talks Undercuts Tariff Reprieve

Goldman Sachs Warns Oil Faces ‘Large Surpluses’ Through 2026

Chevron Ordered to U-Turn Venezuela Oil Ahead of Sanctions