Maduro Clings to Power, Crushing Bondholder Hopes in Venezuela

(Bloomberg) -- In less than a week, Venezuela creditors have gone from speculating how high a political transition could push bond prices to weighing how far they will fall.

A worst-case scenario has emerged since Sunday’s presidential election: A questionable vote count, deadly protests, a crackdown on dissent and signs Nicolas Maduro’s government will be relegated back to international isolation.

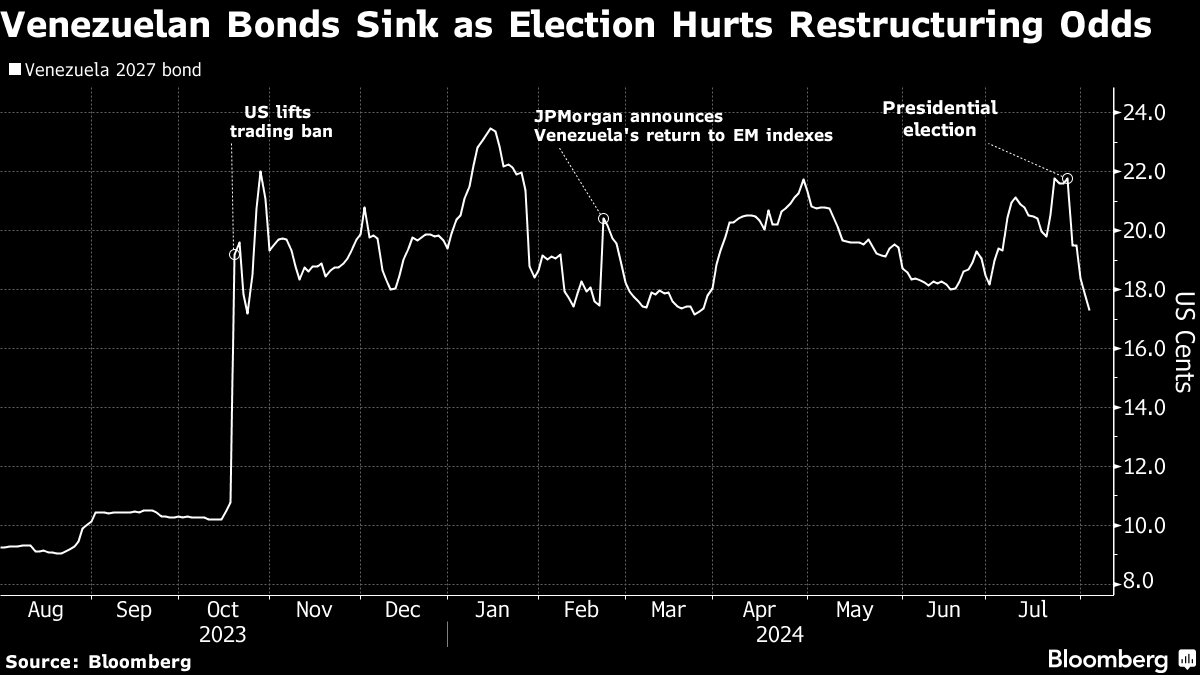

Government bonds — in default for most of the last seven years and already trading deeply in distressed territory — have fallen as much as 5 cents on the dollar to about 17 cents, the lowest since March, since the vote. For bondholders who have stuck with the debt because of its enormous potential upside, the question has now become how far can they drop.

“It is becoming increasingly difficult to see the Maduro regime willingly concede power,” strategist Jason Keene at Barclays Plc wrote in a note Friday. “Maduro’s disregard for the outcome of last week’s election could further isolate the regime, turning Venezuela into a fully-fledged autocracy like Nicaragua.”

Barclays Plc, which had preached the rising odds of a political transition in the lead up to the vote, is now recommending clients sell the notes, saying the democratic path toward such change is “seemingly closed.”

Maduro says the regime has arrested over 1,200 people since protests erupted after the vote and has accused opposition leaders of being responsible for the violence, including the presidential candidate Edmundo Gonzalez.

A report by election observers at the Carter Center said the vote “cannot be considered democratic.”

Finding a Floor

Bleak as the outlook is, the most traded sovereign bonds, due 2027, are unlikely to slump below 10 cents a dollar, where they traded for much of 2022 and part of 2023, investors say. That calculation is based on bets that the White House won’t bring back a ban on US investors buying the notes, which was lifted in October along with sanctions on the oil industry.

The removal of the ban led JPMorgan Chase & Co. to re-introduce the debt to its indexes, which most emerging-market investors follow as a benchmark to build their portfolios.

Bruno Rovai, a sovereign strategist for Latin America at Macquarie Investment Management in New York, said the balance of risk is skewed toward the negative, but that prices are already near the bottom.

“We’re closer to what we think is the floor with the caveat that sanctions are not re-imposed, especially for the oil industry,” he said.

Others are less optimistic.

“If this period of uncertainty continues for a long time, bonds will drift lower,” said Francesco Marani, head of trading at Spanish boutique investment firm Auriga. “If it becomes a dead negotiation and we have no solution in next six months, it can become dead money.”

Election Hopes

Money managers had warmed to the idea of negotiating with Maduro ahead of the vote, assuming he’d gain US recognition from a fair election. The government recently hired Rothschild & Co. to map out its roughly $150 billion of defaulted debt, which includes overseas bonds and other obligations, like bilateral loans.

Still, it’d be much easier to deal with an opposition government, bondholders say. For starters the US would recognize it and almost certainly lift sanctions that prevent Venezuela and its state-oil company from issuing new bonds, a necessary step toward overhauling the debt.

Now, creditors are closely watching the military, which experts say hold the key to Maduro’s future in power.

“No one knows what the outcome is going to be yet,” Graham Stock, a sovereign analyst at RBC Bluebay in London said on Monday. “It’s clear that the popular will wants a change and Maduro doesn’t want to recognize that.”

©2024 Bloomberg L.P.