Oil Extends Drop as US Push for Gaza Cease-Fire Gains Momentum

(Bloomberg) -- Oil extended the biggest drop in two weeks as the US said Israel accepted a cease-fire proposal in Gaza, potentially easing supply risks as concerns about the global demand outlook mount.

Brent crude fell toward $77 a barrel after shedding 2.5% on Monday, while US marker West Texas Intermediate was below $74. Secretary of State Antony Blinken said the next step was for Hamas to agree to the proposal aimed at de-escalating the 10-month old conflict in the Middle East.

China’s worsening economic malaise is keeping the market subdued. Recent data has shown shrinking factory activity and a decline in oil demand in the world’s biggest importer.

“Lingering Chinese demand concerns have been the key driver weighing on sentiment,” said Warren Patterson, head of commodities strategy for ING Groep NV in Singapore. “Now the potential for an Israel-Hamas cease-fire has only provided further downward pressure.”

Oil has given up most of its year-to date gains as the lift from OPEC+ supply curbs and expectations for lower US interest rates have been countered by the challenging outlook in China. The Organization of the Petroleum Exporting Countries is planning to restore some next quarter, although that could change if prices keep falling.

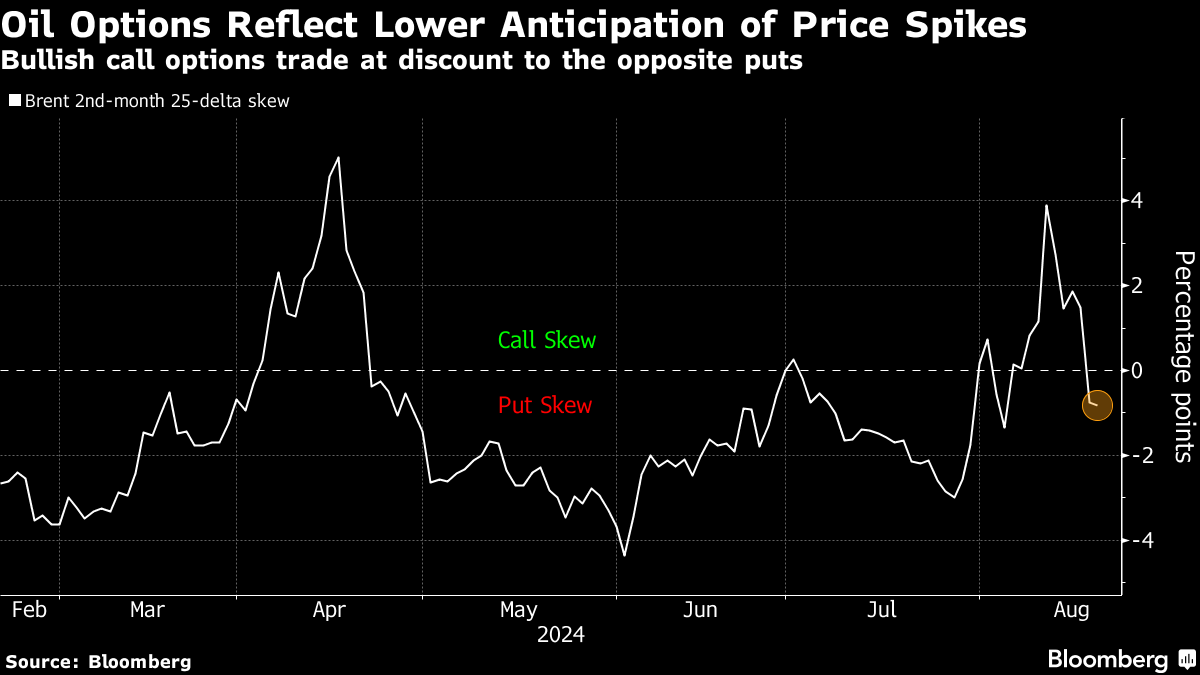

Options are signaling the market is now anticipating a lower risk of futures spiking. Brent option skews have returned to their usual bias toward puts — which profit from lower prices — for the first time in two weeks.

©2024 Bloomberg L.P.