Oil Extends Surge on Report Iran Orders Retaliatory Strike

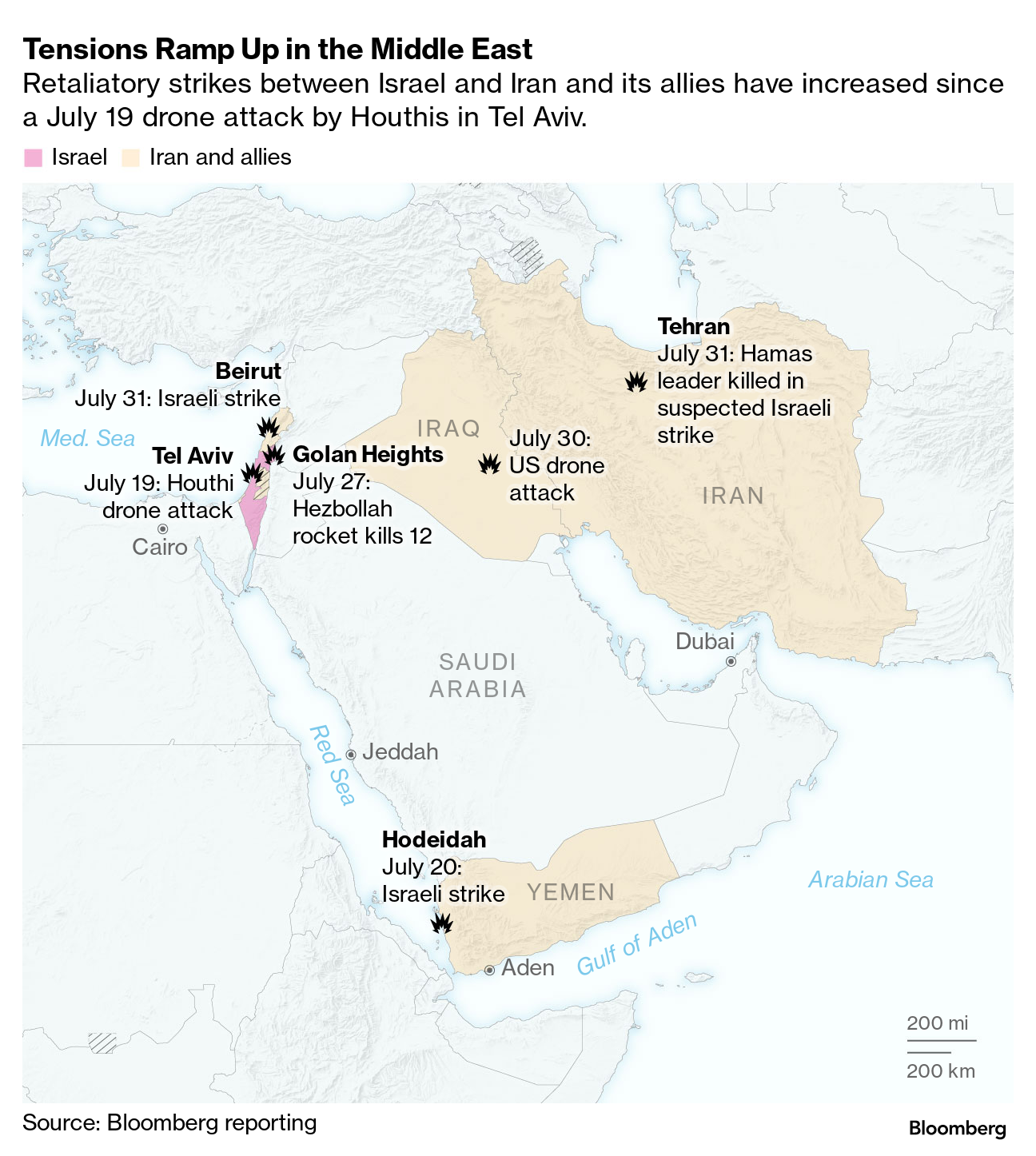

(Bloomberg) -- Oil rose after surging on Wednesday as Iran was reported to have ordered a retaliatory strike on Israel for killing a Hamas leader on its soil.

Brent crude broke through $81 a barrel after jumping 3.6% in the previous session, while West Texas Intermediate was above $78. Iran’s Ayatollah Ali Khamenei ordered a direct strike on Israel, the New York Times reported. That comes after Iran said Israel assassinated the political leader of Hamas in Tehran, shortly after killing a senior member of Hezbollah in Beirut.

Meanwhile, US officials are still pushing for a cease-fire in Gaza but concede it’s harder than ever after the death of Hamas’ political leader Ismail Haniyeh — a key representative during the negotiations. There’s also been more buying of call options, which benefit from price gains, after the attacks.

The escalation comes before a review meeting by key members of the Organization of the Petroleum Exporting Countries and its allies. Delegates expect the group’s session later Thursday to be routine, making no changes to plans to restore production starting in the fourth quarter.

“Oil markets are justifiably worried that the assassination of Haniyeh will bring Iran more directly into the war with Israel,” said Vivek Dhar, an analyst at Commonwealth Bank of Australia. “That could put at risk Iran’s oil supply and related infrastructure.”

Crude is still higher this year despite logging a monthly decline in July as concern increased over demand from top importer China. Bullishness has been driven by the tensions in the Middle East — the source of about a third of the world’s crude — as well as the OPEC+ curbs and expectations that monetary easing would boost US demand. Federal Reserve Chair Jerome Powell said Wednesday that an interest-rate cut could come as soon as September.

Away from the Middle East, US crude inventories shrank by 3.4 million barrels last week, official data showed. The fifth weekly decline in stockpiles was the longest losing streak since January 2022. Levels at the Cushing hub also fell.

©2024 Bloomberg L.P.

KEEPING THE ENERGY INDUSTRY CONNECTED

Subscribe to our newsletter and get the best of Energy Connects directly to your inbox each week.

By subscribing, you agree to the processing of your personal data by dmg events as described in the Privacy Policy.

More oil news

Asian Shares Rise After Selloff On Trump’s Tariffs: Markets Wrap

Sempra to Sell Assets as Utilities Raise Money for AI Boom

China Vanke Due as Chinese Developers See Signs of Recovery

Trump Revokes Permits to US, Foreign Oil Firms in Venezuela

S&P 500 Sinks 2% as Economic Fears Spur Bond Rally: Markets Wrap

Oil Poised for Third Weekly Gain Ahead of More Trump Tariffs

Oil Holds Gain as US Posts Biggest Drop in Stockpiles This Year

Oil Holds Steady as Report Points to Big Drop in US Stockpiles

China Refiners Face Yet Another Blow as Trump Presses Venezuela