Oil Steadies After Technical Drop as US Stockpiles Seen Falling

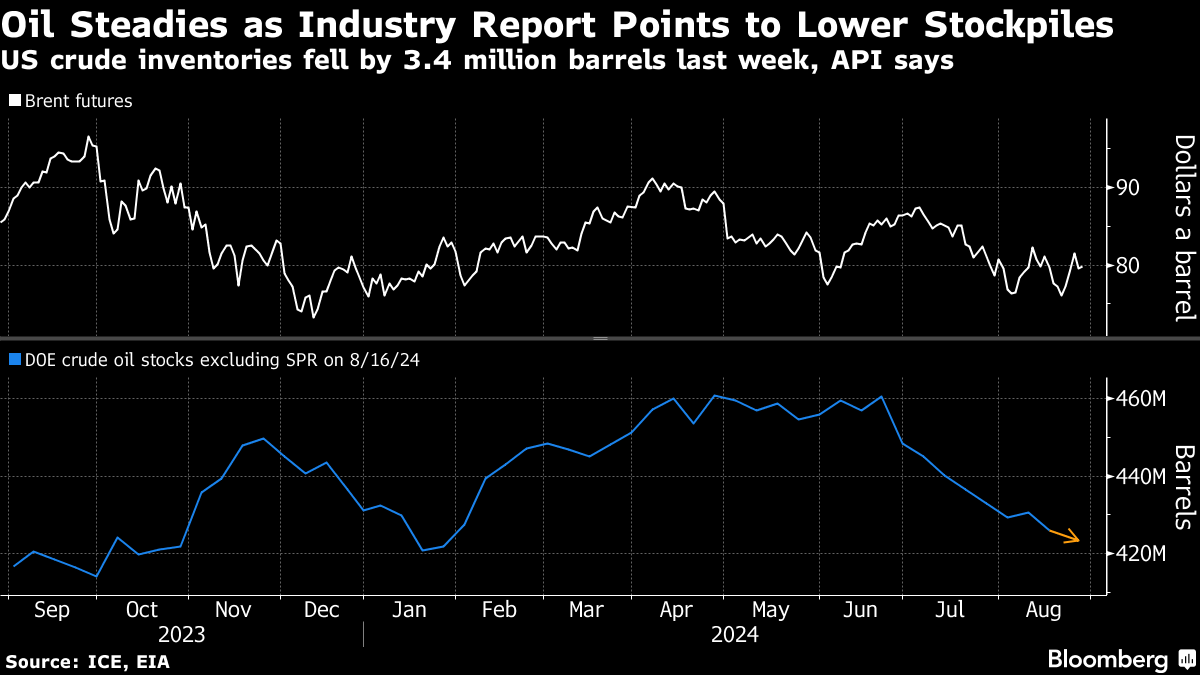

(Bloomberg) -- Oil steadied after dropping by more than 2% on Tuesday, as an industry report pointed to a further decline in US crude stockpiles.

Brent rose to near $80 a barrel, with West Texas Intermediate trading below $76. The industry-funded American Petroleum Institute forecast that nationwide inventories fell by 3.4 million barrels last week, which would mark the eighth decline in nine if confirmed by official data later Wednesday.

Crude has been buffeted in recent sessions, with the most recent decline coming after futures rallied to near their 200-day moving average. Political risk in the Middle East and a threat to supply from Libya supported recent gains, but have been countered by a broadly bearish undertone — leading top Wall Street banks including Goldman Sachs Group Inc. and Morgan Stanley to shave their price forecasts for next year.

The two banks also flagged a dour outlook in China for some of their pessimism, as wider economic malaise and a switch to electric vehicles dents fuel consumption in the biggest crude importer. In Europe, diesel demand is seen falling to below pandemic-era levels on weak manufacturing and structural shifts in the region’s car fleet.

Traders will be on the lookout for US economic data due later this week, including figures on growth and employment, which will offer more on the outlook for monetary policy. Federal Reserve Chair Jerome Powell earlier gave indications that lower interest rates were on the horizon.

“Oil field closures in Libya and ongoing geopolitical tensions in the Middle East may still keep prices afloat for now, but risk-taking on the broader scale will likely stay limited” as investors remain cautious ahead of key US data and earnings, said Yeap Jun Rong, market strategist for IG Asia Pte in Singapore. China’s shaky economic recovery and plans from OPEC+ to increase production from October should limit any significant price gains, he said.

©2024 Bloomberg L.P.