Bullish Oil Bets at Four-Month High as Investors Eye 2025 Risks

(Bloomberg) -- Bullish oil bets reached a four-month high in the penultimate week of 2024 as investors position for a new year that will see Donald Trump’s return to the White House.

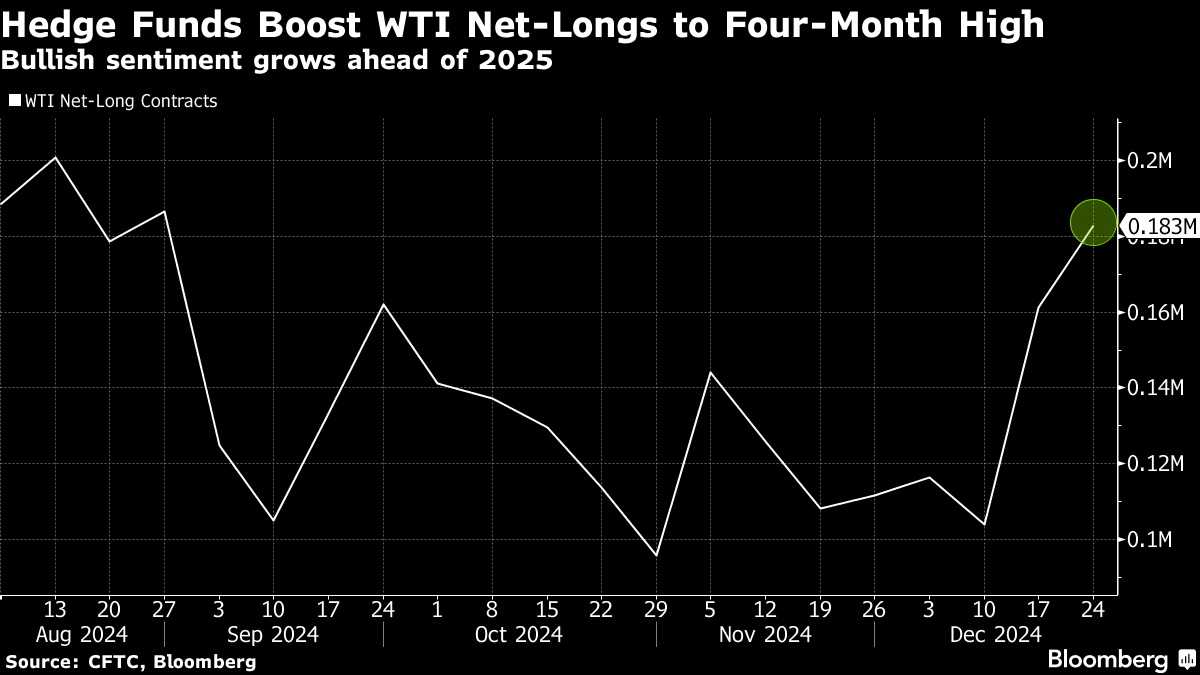

Money managers boosted net-long positions on West Texas Intermediate by 21,694 lots to 182,895 lots during the week ended Dec. 24, according to the Commodities Futures Trading Commission. Oil futures traded in a less-than $3 band during that week, suggesting the rise in bullish bets were due to longer-term positioning changes rather than short-term price reactions.

The increase comes a week after hedge funds boosted bets on rising prices by the most in a year. While a looming supply glut and tepid China demand are weighing on the market heading into 2025, investors are nevertheless positioning for upside risk as Donald Trump returns to the White House and conflicts in Ukraine and the Middle East continue to simmer. The US president’s position on major oil exporter Iran is a key wildcard for traders.

READ: Trafigura, Gunvor Weigh Trump Wildcard Against Oil Glut in 2025

Algorithmic traders flipped to net-long on both WTI and Brent crude earlier in the month and have continued to extend those positions, according to Bridgeton Research.

©2024 Bloomberg L.P.

KEEPING THE ENERGY INDUSTRY CONNECTED

Subscribe to our newsletter and get the best of Energy Connects directly to your inbox each week.

By subscribing, you agree to the processing of your personal data by dmg events as described in the Privacy Policy.

More oil news

Philippines’ Marcos Seeks to Import LNG From Alaska, Envoy Says

Oil Falls After Weak Technicals Accelerate Supply-Driven Losses

Buffett’s Annual Letter May Give Much Needed Support to Japanese Stocks

Oil Edges Lower With Focus on US Stockpiles, Supply Uncertainty

Oil Climbs With Focus on OPEC+ Output Plans and Ukraine Talks

Diamondback Energy announces $4.08 billion acquisition to expand Permian presence

Oil Holds Declines on Prospect of Higher Russia, Iraq Supplies

Canada’s Conservative Leader Pitches Major Natural-Resource Revamp to Counter Trump

EPA Terminates Nearly 400 Workers Amid US Government Purge