China’s Solar Industry Looks to OPEC for Guide to Survival

(Bloomberg) -- China’s solar equipment manufacturers are learning they need to exercise restraint to survive.

More than 30 of the top companies signed up to a program of self-discipline at the China Photovoltaic Industry Association’s annual meeting last week, in an agreement fashioned after the way the Organization of Petroleum Exporting Countries manages its oil supply. The firms will receive quotas for how much they can produce next year, based on their existing market share and capacity as well as expected demand, according to local media.

The CPIA declined to comment on the agreement.

The accord comes as China’s solar industry contends with overcapacity, heightened geopolitical tensions and slowing demand. Companies are focused on riding out the storm in the belief that it could be at least another year or more before profits begin to recover.

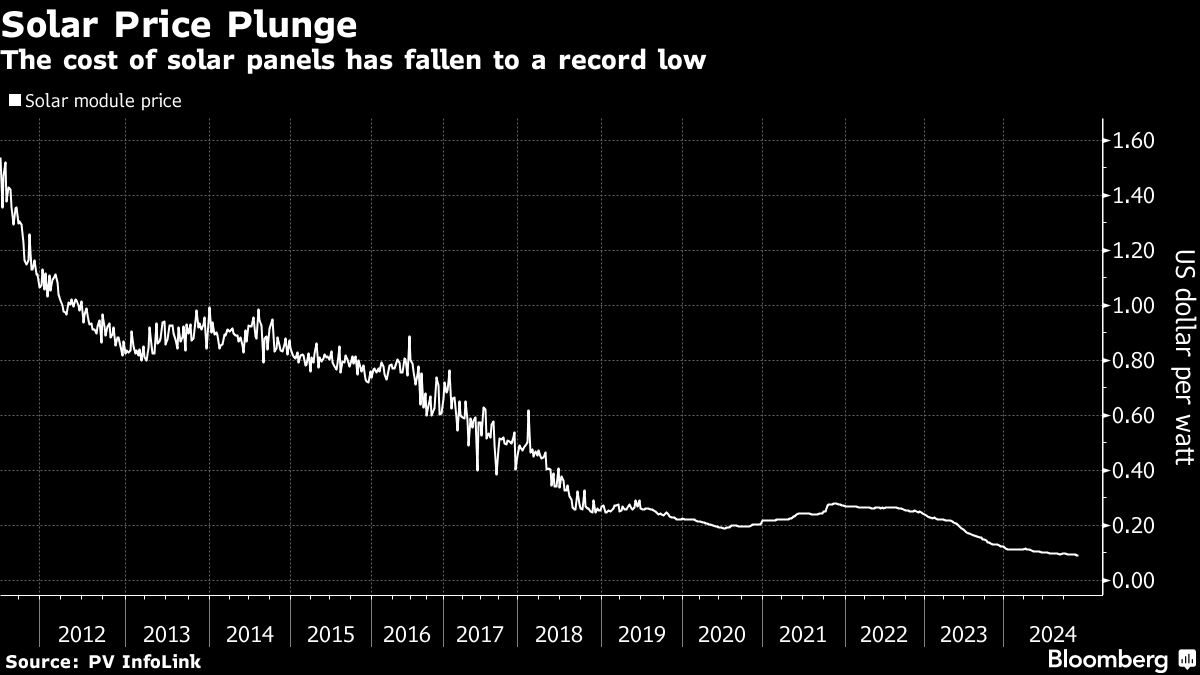

The agreement represents a sharp turnaround from years of stiff competition that have brought the industry to its knees, while at the same time slashing prices and raising quality to the point that solar power is the cheapest and fastest growing form of energy.

It’s too early to tell whether quotas can succeed in such a fragmented and competitive industry. But what’s clear from comments made by solar executives at two high-profile events last week — the BloombergNEF Summit in Shanghai and the China Photovoltaic Industry Association’s gathering in Yibin, Sichuan — is the desperation behind the move.

“The keyword for next year is surviving,” Xing Guoqiang, chief technology officer at Tongwei Co., said at the Shanghai event. “2025 will be very important for many companies to survive this cycle.”

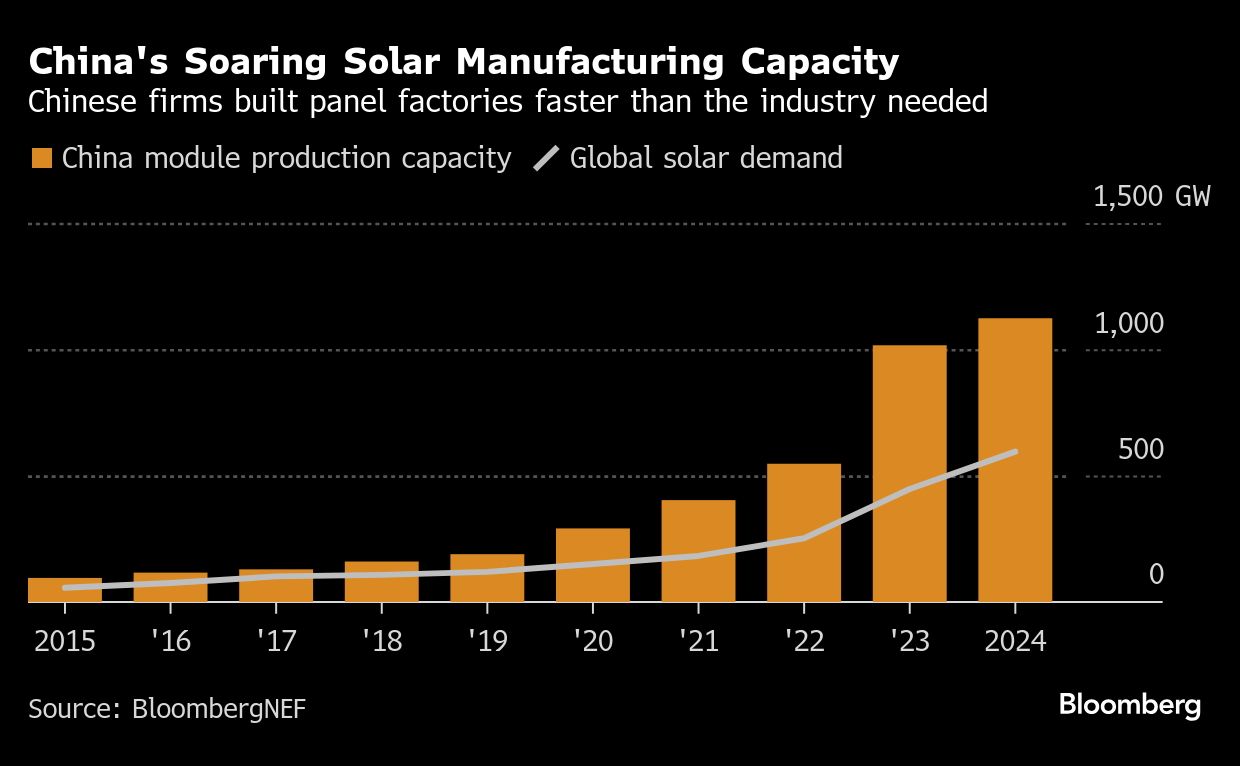

The root of the sector’s woes was a factory build-out that started in 2021, which led to massive overcapacity, especially in China, where more than 80% of global manufacturing takes place. There’s currently enough capacity to build more than 1,100 gigawatts of panels a year. That’s not only nearly double what the world is expected to have installed in 2024, it’s more than it’s going to need as far out as 2035, according to BloombergNEF forecasts.

Solar isn’t alone when it comes to battling overcapacity in China, where breakneck growth in recent decades led to excessive investment that’s now running ahead of a slowing economy. From copper smelters to steelmakers and oil refiners, industries throughout the country are dealing with the problem of everyone agreeing that plants need to be shut, and no one willing to be the first to take the plunge.

The solar industry’s saving grace was soaring demand for its products, but that’s fading. Global installations surged 76% in 2023 and are expected to increase by another 34% this year, but growth will slow to just 8% in 2025, according to BloombergNEF. Trade tensions are also a factor, pushing Chinese companies to set up plants in countries like the US, India and Indonesia to try and avoid rising tariffs.

Excess capacity has forced companies to slash their prices, in many cases below production costs. Longi Green Energy Technology Co., until recently the biggest solar manufacturer, is expected to post a net loss of nearly $1 billion this year, after making a profit of over $1.7 billion in 2023. Most executives said they didn’t expect the situation to improve until the second half of 2025, although some were even more pessimistic.

“Considering the current capacity level, it might take at least three years for the wafer and module sectors to bottom out,” Zhang Longgen, chairman of United Solar Polysilicon, said in Shanghai.

The strains were apparent in Yibin, a city in southwest China known for its spicy cuisine and fiery baijiu liquor. The CPIA hosted a meeting there with Chinese media in which it scolded reporters for focusing on negative news and implored them to help promote the sector.

Solar companies are used to more positive coverage. In addition to producing the clean energy that’s vital to winning the fight against climate change, they’re also known for their technical prowess, which has helped cut costs by more than 90% over the past decade. That’s led to truly remarkable growth. In 2014 there were less than 200 gigawatts of solar panels installed in the world. By the end of this year, there’ll be more than 2,200 gigawatts, according to BloombergNEF.

Such rapid development has created multi-billion dollar manufacturing giants, but it’s also left a trail of corporate failures in its wake. Suntech Power Holdings Co. and Yingli Green Energy Holding Co. were the world’s biggest panel makers in the early 2010s. Neither has survived.

So, the lesson in Yibin was how to avoid a repeat. Executives spoke about the need to show restraint and avoid vicious competition, citing OPEC as a model for managing prices. At the same time, some were ambivalent about whether companies will adhere to the new rules.

“If you make a promise, how do you actually follow through?” asked Lu Chuan, chairman of Chint New Energy Technology Co. “How do you reach consensus and take punitive measures in the absence of self-discipline? I think these issues will continue to be discussed in the future.”

Still, the agreement should at the very least help staunch the bleeding in the sector and could help boost prices. Now, it’s just a question of how well the companies carry out the plan.

“We are entering the new OPEC era where the traditional supply-demand analysis might be less relevant if execution is right,” Jefferies Financial Group Inc. analyst Alan Lau said in a note.

On the Wire

Chinese state media said the country has room to increase its borrowing and fiscal deficit in 2025 as investors closely watch to see whether Beijing would use its fiscal firepower to increase stimulus in its key economic meeting next week.

China’s central bank expanded its gold reserves in November, ending a six-month pause in purchases after prices for the precious metal rose to a record.

Critical details, particularly on fiscal steps, are missing in China’s stimulus push. So too is a clear indication of how forceful policy will be next year to spur growth and shield the economy from higher US tariffs. The Central Economic Work Conference, said to be scheduled for Dec. 11-12, will set the policy direction, says Bloomberg Economics.

This Week’s Diary

(All times Beijing unless noted.)

Monday, Dec. 9:

- China’s inflation data for November, 09:30

- China to release Nov. aggregate finance & money supply by Dec. 15

- Intl Energy Executive Forum on the energy transition, Beijing, day 1

Tuesday, Dec. 10:

- China’s 1st batch of Nov. trade data, including steel, iron ore & copper imports; steel, aluminum & rare earth exports; oil, gas & coal imports; oil products imports & exports; soybean, edible oil, rubber and meat & offal imports ~11:00

- China’s monthly CASDE crop supply-demand report

- Intl Energy Executive Forum on the energy transition, Beijing, day 2

Wednesday, Dec. 11:

- Chinese govt’s Central Economic Work Conference in Beijing, day 1

- CCTD’s weekly online briefing on Chinese coal, 15:00

Thursday, Dec. 12:

- Chinese govt’s Central Economic Work Conference in Beijing, day 2

Friday, Dec. 13:

- China’s weekly iron ore port stockpiles

- Shanghai exchange weekly commodities inventory, ~15:00

©2024 Bloomberg L.P.

KEEPING THE ENERGY INDUSTRY CONNECTED

Subscribe to our newsletter and get the best of Energy Connects directly to your inbox each week.

By subscribing, you agree to the processing of your personal data by dmg events as described in the Privacy Policy.

More oil news

Oil Pushes Higher as Trump Signals No Intention to Ax Powell

Oil Climbs After Plunging Monday on Trump’s Criticism of Powell

TotalEnergies announces first oil from Ballymore offshore field

China’s Cosco Says US Levies Risk Upsetting Global Shipping

Turkey Plans Oil and Gas Exploration in Bulgaria, Libya and Iraq

Oil Fell With Ukraine-Russia Truce, US-Iran Talks in Focus

Oil Traders Lurch From Praying for Volatility to Drowning in It

Abu Dhabi Defies Oil Price Plunge to Keep Building Big at Home

Oil Rises a Second Day After US Cracks Down on Iranian Supply