China’s Weak Winter LNG Demand Provides Relief for Rival Buyers

(Bloomberg) -- A rapid increase in liquefied natural gas prices has prompted China — the world’s biggest buyer — to cut back purchases and even resell some supply, providing relief to rival importers.

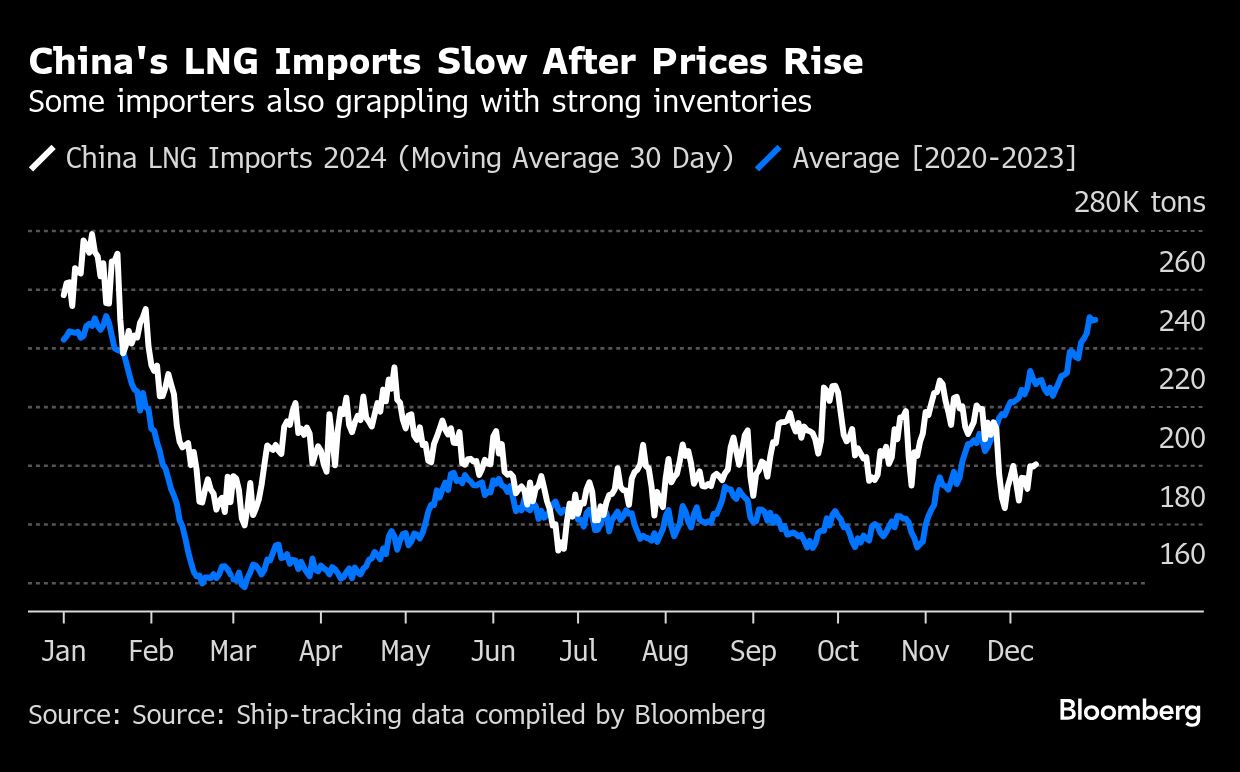

The 30-day moving average of Chinese LNG imports has slumped over the last few weeks, and is now 12% below the four-year average for this time of year, according to ship-tracking data compiled by Bloomberg. Imports had been above the seasonal norm for most of the year.

The Asian LNG benchmark price is at about $14.50 per million British thermal units, roughly 30% higher than at the start of the year. That’s too expensive for it to be economically viable to import spot shipments into China’s cheaper domestic market.

China also isn’t in dire need of additional LNG. Import terminals — particularly those in southern parts of the country — are grappling with high inventories due to tepid demand for the super-chilled fuel, as customers are choosing cheaper alternatives, according to traders. The government hasn’t given any strong orders to buy more, they said.

Global natural gas supply has remained tight since Russia’s invasion of Ukraine in early 2022 upended the market and forced Europe to depend more on LNG rather than piped supply. Bouts of cold, windless weather boosted prices in Europe in November, in turn lifting rates in Asia, which competes with the region for shipments.

Some Chinese LNG buyers are reselling shipments to take advantage of more attractive prices abroad. State-owned Cnooc Ltd. is offering to sell a shipment for February from an Australian project, while traders said PetroChina Co. has sold some cargoes in the last month.

This could help boost supply for other buyers in other parts of Asia, and farther afield. Russian pipeline deliveries are set to fall further at the end of the year as a transit deal in Ukraine expires, likely increasing demand for LNG in Europe.

On the Wire

US President-elect Donald Trump has invited Chinese President Xi Jinping to attend his inauguration next month, CBS reported, citing multiple sources.

The US will raise import tariffs on Chinese solar wafers, polysilicon and some tungsten products from the beginning of next year, following a four-year review by the Biden administration.

Jewelry stores across China have been receiving mysterious, unusually large orders for gold bars from customers who ask for the precious metal to be posted to faraway addresses in the nation. The scams have been highlighted by police and security bureaus who warn that fraudsters are increasingly using bullion to transfer assets and launder money.

This Week’s Diary

(All times Beijing unless noted.)

Thursday, Dec. 12:

- Chinese govt’s Central Economic Work Conference in Beijing, day 2

Friday, Dec. 13:

- China’s weekly iron ore port stockpiles

- Shanghai exchange weekly commodities inventory, ~15:00

©2024 Bloomberg L.P.

KEEPING THE ENERGY INDUSTRY CONNECTED

Subscribe to our newsletter and get the best of Energy Connects directly to your inbox each week.

By subscribing, you agree to the processing of your personal data by dmg events as described in the Privacy Policy.

More oil news

Philippines’ Marcos Seeks to Import LNG From Alaska, Envoy Says

Oil Falls After Weak Technicals Accelerate Supply-Driven Losses

Buffett’s Annual Letter May Give Much Needed Support to Japanese Stocks

Oil Edges Lower With Focus on US Stockpiles, Supply Uncertainty

Oil Climbs With Focus on OPEC+ Output Plans and Ukraine Talks

Diamondback Energy announces $4.08 billion acquisition to expand Permian presence

Oil Holds Declines on Prospect of Higher Russia, Iraq Supplies

Canada’s Conservative Leader Pitches Major Natural-Resource Revamp to Counter Trump

EPA Terminates Nearly 400 Workers Amid US Government Purge