Hedge Funds Boost Bullish WTI Bets Most in a Year on Sanctions

(Bloomberg) -- Hedge funds increased their bullish positioning on US crude by the most in more than a year on the prospect of sanctions on Iranian and Russian oil and the potential for additional Chinese economic stimulus.

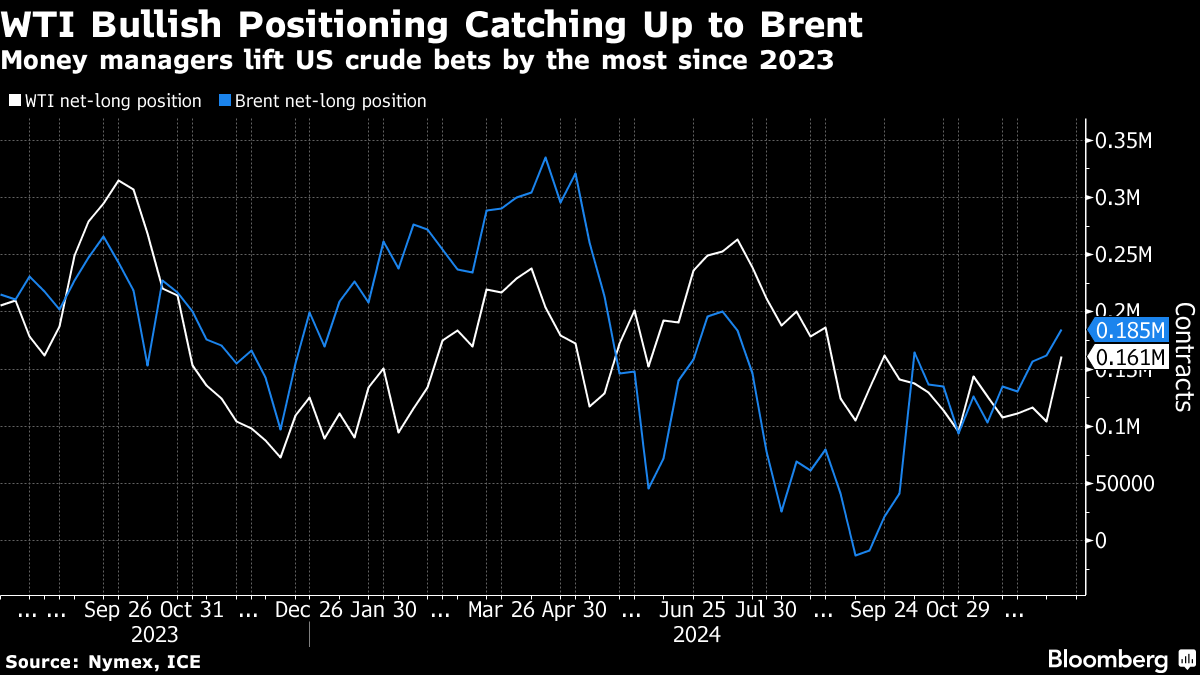

Money managers boosted their net-long position on West Texas Intermediate by 57,215 lots to 161,201 lots during the week ended Dec. 17, according to the Commodities Futures Trading Commission. That’s the biggest gain since September 2023.

The change came after oil prices rallied on the prospect of sanctions that would reduce supplies of Russian and Iranian oil, countering projections for a supply glut in 2025. On the demand side, bolder stimulus plans in China bolstered the outlook for the world’s biggest crude importer.

An increase in WTI long-only contracts to the highest in about four months pushed hedge funds’ stance on the US benchmark closer to Brent’s bullish positioning, which increased to 184,841 lots.

©2024 Bloomberg L.P.

KEEPING THE ENERGY INDUSTRY CONNECTED

Subscribe to our newsletter and get the best of Energy Connects directly to your inbox each week.

By subscribing, you agree to the processing of your personal data by dmg events as described in the Privacy Policy.

More oil news

Philippines’ Marcos Seeks to Import LNG From Alaska, Envoy Says

Oil Falls After Weak Technicals Accelerate Supply-Driven Losses

Buffett’s Annual Letter May Give Much Needed Support to Japanese Stocks

Oil Edges Lower With Focus on US Stockpiles, Supply Uncertainty

Oil Climbs With Focus on OPEC+ Output Plans and Ukraine Talks

Diamondback Energy announces $4.08 billion acquisition to expand Permian presence

Oil Holds Declines on Prospect of Higher Russia, Iraq Supplies

Canada’s Conservative Leader Pitches Major Natural-Resource Revamp to Counter Trump

EPA Terminates Nearly 400 Workers Amid US Government Purge