Oil Falls as Dollar Surges on Fed Outlook for Fewer Rate Cuts

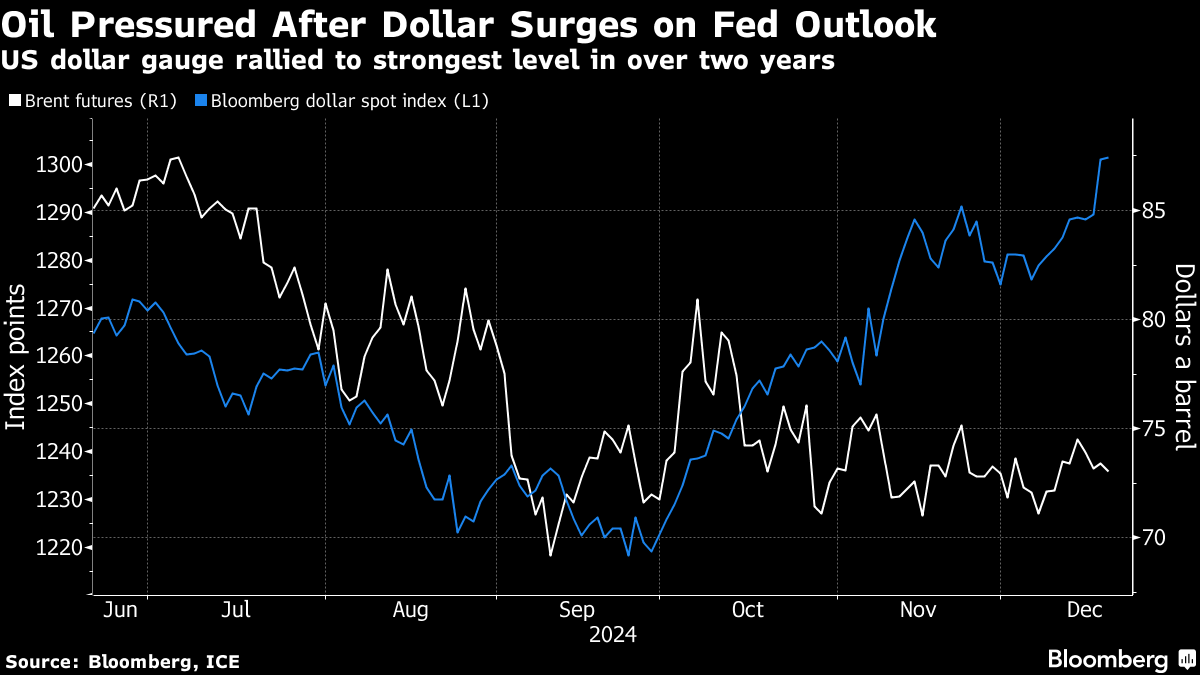

(Bloomberg) -- Oil edged lower as expectations for fewer interest-rate cuts by the Federal Reserve next year boosted the dollar.

Brent crude fell to near $73 a barrel while West Texas Intermediate traded around $70. Fed officials lowered borrowing costs as expected on Wednesday, but reined in the number of reductions they expect to make in 2025. The dollar rallied to its strongest level in more than two years, making commodities more expensive for most buyers.

Crude had risen on Wednesday after US nationwide inventories fell for a fourth week. Prices have been stuck in a fairly narrow range since the middle of October, with traders weighing a lackluster Chinese demand outlook and surging production from outside OPEC+ against geopolitical risks and the chance President-elect Donald Trump will move to restrict Iranian supply.

“The oil market is reviewing 2025 balances and becoming incrementally less bearish,” Macquarie analyst Vikas Dwivedi said in a note. Brent at $70 a barrel seems to be a “fundamental and technical support” level, he said.

The relative calm means crude futures are set for the narrowest annual price range since 2019, marking an abrupt halt to years of bumper swings following the global pandemic and the wars in Ukraine and the Middle East.

©2024 Bloomberg L.P.

KEEPING THE ENERGY INDUSTRY CONNECTED

Subscribe to our newsletter and get the best of Energy Connects directly to your inbox each week.

By subscribing, you agree to the processing of your personal data by dmg events as described in the Privacy Policy.

More oil news

US Steps Up Houthi Campaign With Deadly Strikes on Red Sea Oil Port

Iran's Space Program Is Growing Stronger Despite US Sanctions

Abu Dhabi Defies Oil Price Plunge to Keep Building Big at Home

Oil Rises a Second Day After US Cracks Down on Iranian Supply

Oil Steadies With Glut Expectations, Trade War Souring Outlook

Oil Edges Higher With Focus on Tariff Moves, US-Iran Discussions

Oil Steadies as Progress on Iran Talks Undercuts Tariff Reprieve

Goldman Sachs Warns Oil Faces ‘Large Surpluses’ Through 2026

Chevron Ordered to U-Turn Venezuela Oil Ahead of Sanctions