Oil Holds Hefty Advance on OPEC+ Deal Progress, Iran Sanctions

(Bloomberg) -- Oil steadied after the biggest advance in more than two weeks as OPEC+ made progress toward a deal to delay further the restoration of shuttered supply, and the US imposed more sanctions on Iranian crude.

Brent crude traded below $74 a barrel after a 2.5% jump on Tuesday, while West Texas Intermediate was near $70. The producer group is edging closer to an agreement to push back a plan to revive output by a further three months, delegates said. Meanwhile, the US sanctioned 35 entities and ships that it said played a critical role in the transport of Iranian oil.

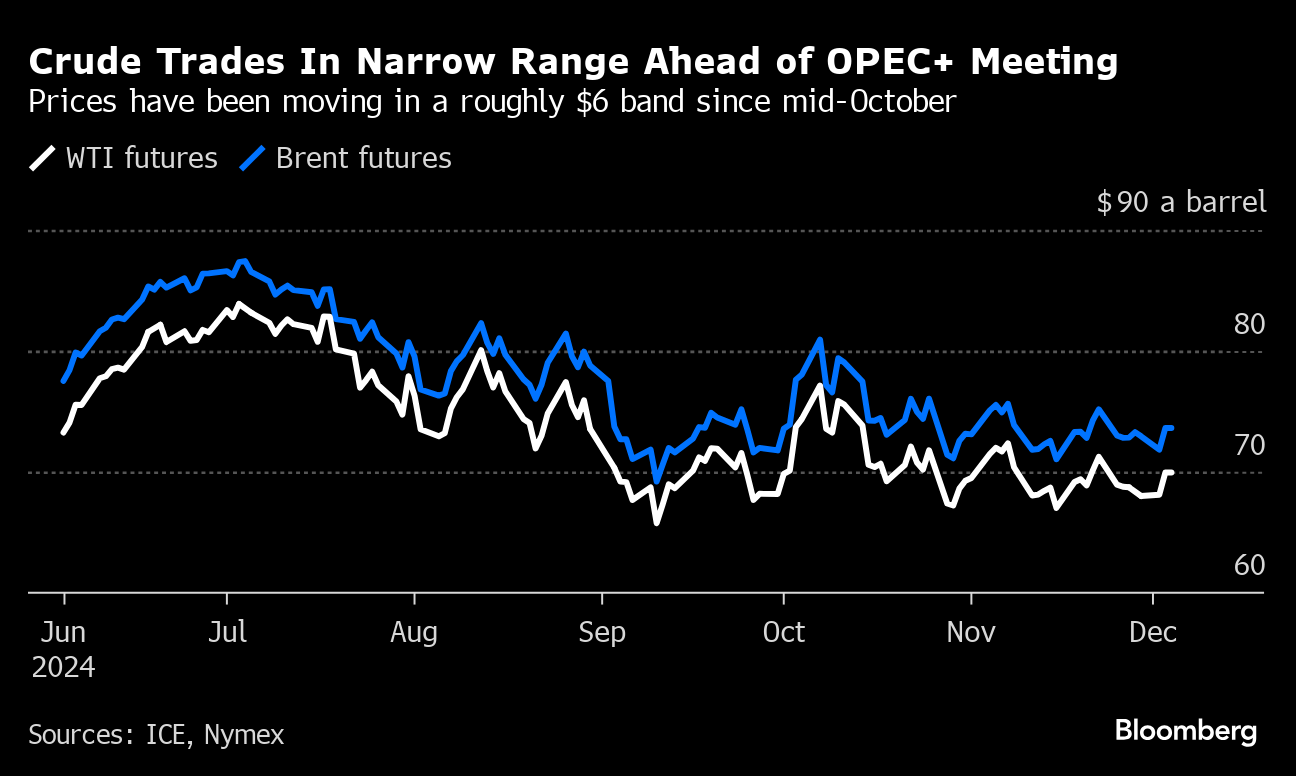

Crude remains caught in a tight range, trading within a roughly $6 band since the middle of October, buffeted by competing drivers including the imminent Donald Trump presidency, geopolitical tensions in the Middle East and Ukraine, and a lackluster demand outlook from top importer China. With widespread concern the global market faces a glut next year, OPEC+ members will meet on Thursday to review supply policy for 2025.

“Even with the prospect of lower Iranian oil exports, OPEC+ will likely face an uphill battle to justify adding back any supply,” said Vivek Dhar, an analyst at Commonwealth Bank of Australia. The main issue is the rise in non‑OPEC supply in 2025 is expected to eclipse growth in global demand, he said.

In the US, the American Petroleum Institute reported nationwide crude stockpiles rose by 1.2 million barrels last week, with large builds also seen in inventories of gasoline and distillates, a category that includes diesel.

©2024 Bloomberg L.P.

KEEPING THE ENERGY INDUSTRY CONNECTED

Subscribe to our newsletter and get the best of Energy Connects directly to your inbox each week.

By subscribing, you agree to the processing of your personal data by dmg events as described in the Privacy Policy.

More oil news

US Steps Up Houthi Campaign With Deadly Strikes on Red Sea Oil Port

Iran's Space Program Is Growing Stronger Despite US Sanctions

Abu Dhabi Defies Oil Price Plunge to Keep Building Big at Home

Oil Rises a Second Day After US Cracks Down on Iranian Supply

Oil Steadies With Glut Expectations, Trade War Souring Outlook

Oil Edges Higher With Focus on Tariff Moves, US-Iran Discussions

Oil Steadies as Progress on Iran Talks Undercuts Tariff Reprieve

Goldman Sachs Warns Oil Faces ‘Large Surpluses’ Through 2026

Chevron Ordered to U-Turn Venezuela Oil Ahead of Sanctions