Oil Steadies as OPEC+ Opts Again to Delay Plan to Restore Output

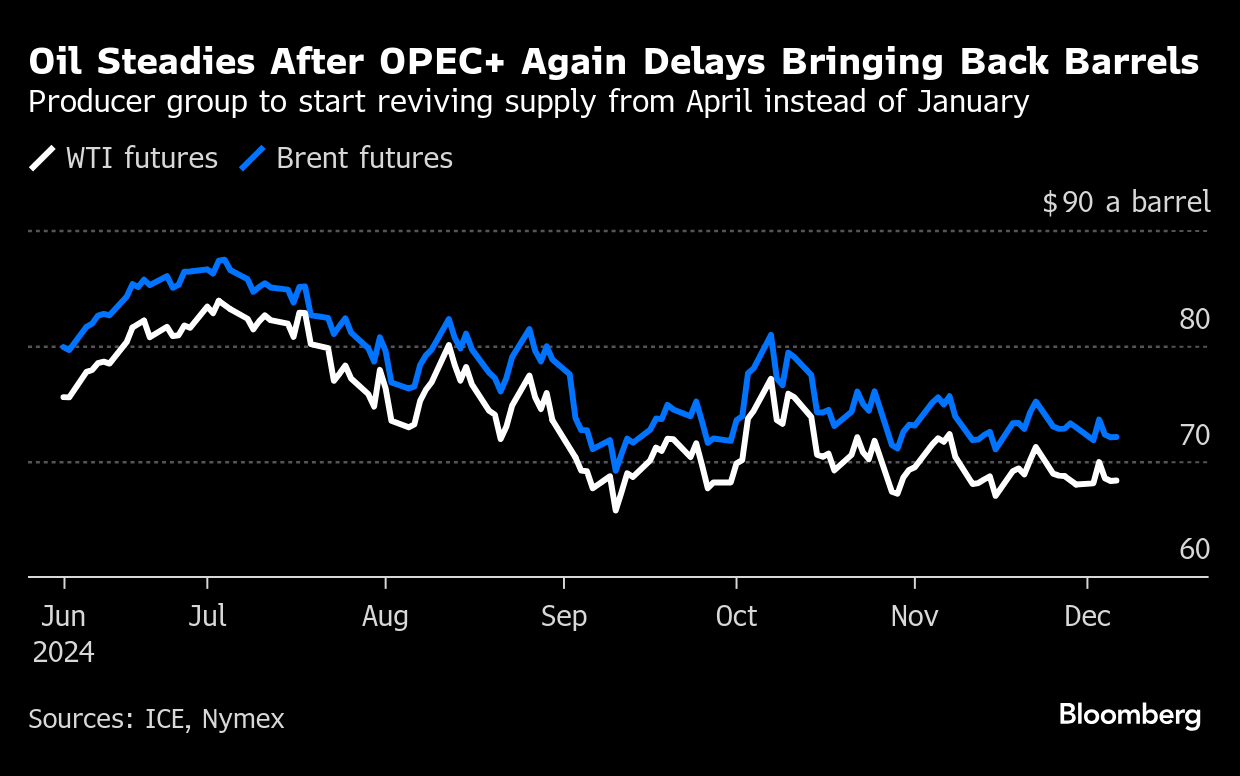

(Bloomberg) -- Oil steadied after OPEC+’s decision to push back the revival of shuttered production by another three months failed to lift sentiment in a market that’s expected to suffer from a glut next year.

Brent crude traded near $72 a barrel after closing 0.3% lower on Thursday, with West Texas Intermediate above $68. OPEC and its allies delayed increasing supplies for a third time, opting to start with a modest increase in April, and then unwind the cuts over 18 months, a slower pace than previously planned.

Crude has been confined to a tight range since mid-October, with bullishness from geopolitical developments in the Middle East and Ukraine countered by expectations for a glut in 2025 due to higher output from the Americas and lackluster Chinese demand. Weak global market balances mean there is little scope for the cartel to restore the output it’s been withholding since 2022.

“OPEC+ has given a robust indication that it continues to be willing to balance the oil market,” Morgan Stanley analysts including Martijn Rats said in a report. “We still estimate a surplus next year, but smaller than before,” they said, raising forecasts for the third and fourth quarters to $70, from $68 and $66.

The delayed start to the relaxation of curbs, the longer timeframe for the unwind, as well as an agreement from the United Arab Emirates to push back an increase in its base target would reduce by 61% the amount of oil that would be added by OPEC+ next year, according to Standard Chartered Plc.

“We do not think the market has priced in the full extent of how much oil has been removed,” StanChart analysts including Emily Ashford and Paul Horsnell said in a note, estimating the new plan would see a rise of 191.3 million barrels over 2025, down from 496.3 million under the prior approach.

©2024 Bloomberg L.P.

KEEPING THE ENERGY INDUSTRY CONNECTED

Subscribe to our newsletter and get the best of Energy Connects directly to your inbox each week.

By subscribing, you agree to the processing of your personal data by dmg events as described in the Privacy Policy.

More oil news

Oil Edges Lower as Trade War Concerns Vie With Pressure on Iran

Oil Falls After Trump Delays Canada, Mexico Tariffs by a Month

Wright Confirmed to Lead Energy Agency Key to Trump’s Plans

Oil Rises as Trump Slaps Tariffs on Biggest Crude Supplier to US

UAE’s Adnoc Aims to Buy Nova Chemicals, Roll Into Deal With OMV

Ukrainian Drone Surge Highlights Russian Oil Refining Risk

South Korea Exports Resilient as Trump’s Tariff Threat Looms

Crude Oil Steadies With Traders in Limbo Over US Trade Policies

Oil Steadies as Traders Look to Tariff Fallout and Stockpiles