Oil Slips as Glut Outlook Outweighs Optimism on China Stimulus

(Bloomberg) -- Oil declined as persistent concerns of a looming supply glut overshadowed the outlook for bolder Chinese stimulus next year.

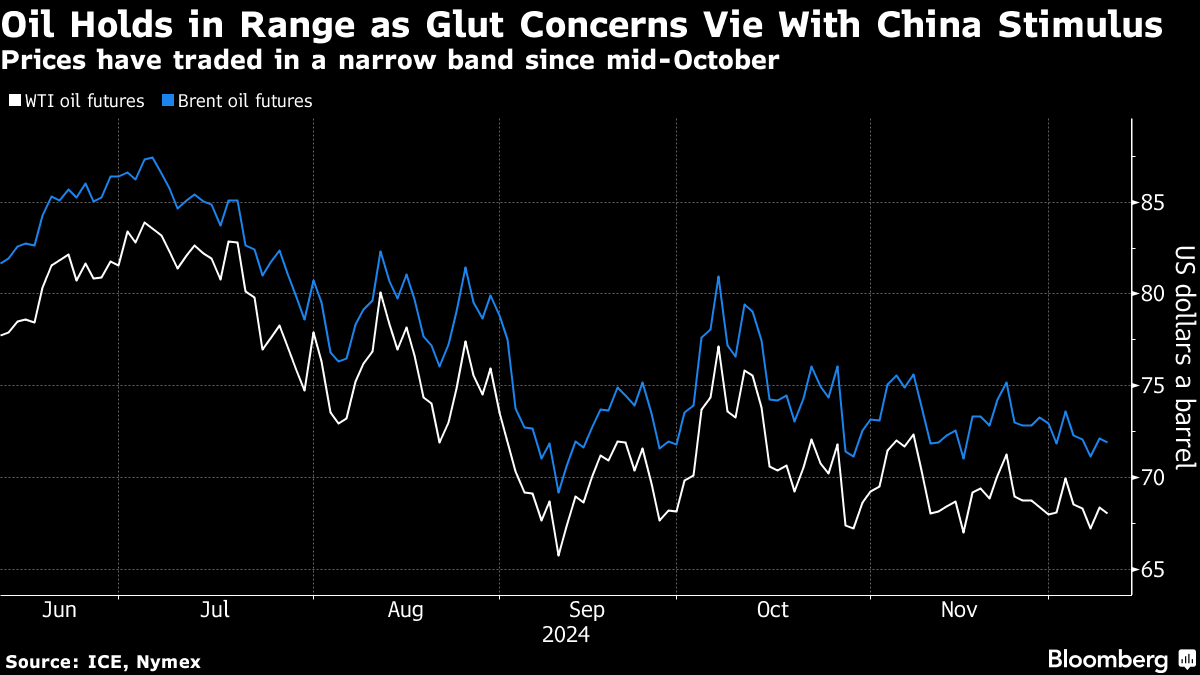

Brent futures traded below $72 a barrel, while holding most of the previous day’s gain. China’s decision-making Politburo vowed to embrace a “moderately loose” monetary policy, the most direct language on stimulus in years from the world’s biggest crude importer.

The oil market, however, is on track for a surplus next year, which has led to OPEC+ delaying the return of idled production. Crude futures have been stuck in a tight range since mid-October, buffeted by a series of bearish and bullish factors including Middle East tensions.

“Further strength cannot be ruled out in the immediate future,” said Tamas Varga, an analyst at brokerage PVM. “Still, without a discernible improvement in the underlying oil balance, it will be a strenuous process to sustain the current rally.”

The fall of Bashar al-Assad’s Syrian regime has left a power vacuum that could lead to more turmoil as factions fight for control. The market is watching for any spillover that could reverberate through the Middle East.

A report from China’s largest oil producer said the country’s consumption may peak next year — five years earlier than expected. Rapid adoption of new-energy vehicles and the use of liquefied natural gas to power trucks have chipped away at diesel and gasoline consumption, it said.

©2024 Bloomberg L.P.

KEEPING THE ENERGY INDUSTRY CONNECTED

Subscribe to our newsletter and get the best of Energy Connects directly to your inbox each week.

By subscribing, you agree to the processing of your personal data by dmg events as described in the Privacy Policy.

More oil news

US Steps Up Houthi Campaign With Deadly Strikes on Red Sea Oil Port

Iran's Space Program Is Growing Stronger Despite US Sanctions

Abu Dhabi Defies Oil Price Plunge to Keep Building Big at Home

Oil Rises a Second Day After US Cracks Down on Iranian Supply

Oil Steadies With Glut Expectations, Trade War Souring Outlook

Oil Edges Higher With Focus on Tariff Moves, US-Iran Discussions

Oil Steadies as Progress on Iran Talks Undercuts Tariff Reprieve

Goldman Sachs Warns Oil Faces ‘Large Surpluses’ Through 2026

Chevron Ordered to U-Turn Venezuela Oil Ahead of Sanctions