Oil Steadies in Thin Trading as Investors Focus on 2025 Outlook

(Bloomberg) -- Oil was steady as traders focused on 2025 risks, from ample supply to the unpredictability of the incoming Trump administration.

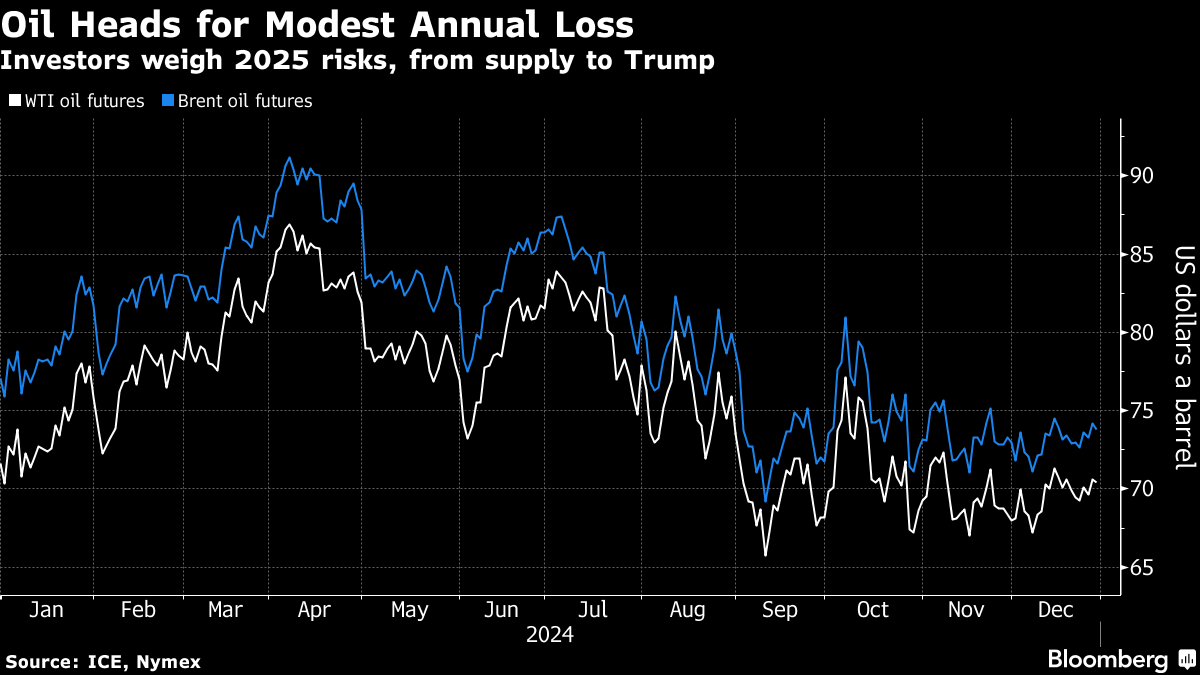

West Texas Intermediate held near $71 a barrel in thin trading after advancing 1.6% last week, and Brent was above $74. There are widespread expectations that the market will be oversupplied next year, which is likely to make it harder for OPEC and its allies to revive idled production.

Crude is heading for a loss this year, with trading confined to a narrow range since mid-October. The market has been buffeted by bullish and bearish signals, including persistent hostilities in the Middle East and concerns around Chinese demand, the world’s biggest oil importer.

The actions of President-elect Donald Trump after he takes office next month will keep the market on edge. He has already threatened tariffs on oil producers Canada and Mexico, while his pick for national security adviser vowed “maximum pressure” on Iran.

“The biggest topic in the market will be the policy direction of Trump’s second term,” said Kim Kwangrae, a commodities analyst at Samsung Futures Inc. OPEC+ may have missed its timing to restore idled production, given the outlook for ample supply and slowing demand, he added.

©2024 Bloomberg L.P.