Stocks, Bonds Decline for the Week After Fed Pivot: Markets Wrap

(Bloomberg) -- Major US stock indexes saw their worst week since mid-November after the Federal Reserve’s decision to be more cautious about cutting interest rates next year roiled markets. Treasuries sold off for a second consecutive week.

The S&P 500 and the Nasdaq 100 rose on Friday — paring what would have been a steeper weekly selloff — after fresh data calmed anxieties about inflation. Bloomberg’s dollar gauge saw its worst drop this month, but was still higher for the third straight week. While Treasury yields are lower across the curve on Friday, the 10-year rate has climbed more than 10 basis points this week.

The Fed shook markets on Wednesday when it scaled back the number of cuts it anticipates in 2025. A relentless stream of data showing how strong the economy is only validated the central bank’s view. With Fed Chair Jerome Powell focused on inflation progress, the muted personal consumption expenditures data for November that released Friday likely reassured policymakers — and investors — that the economy is cooling despite being robust.

“I don’t know why we always have to be reminded that the Fed not cutting rates — or not cutting rates as fast — is actually good news if it’s driven by stronger economic data, and that’s exactly what the Fed is telling us,” Art Hogan, chief market strategist at B. Riley Wealth, said in an interview, adding that the selloff after the Fed meeting was a “major overreaction.”

The Fed is now likely to wait and see how tariff and immigration policies unfold over the next coming months before implementing another cut, said Olu Sonola, Fitch Ratings’ head of US economic research. With the central bank facing these policy uncertainties from the incoming administration, odds still favor a pause on rate cuts in January, said Chris Larkin, managing director, trading and investing, E*Trade from Morgan Stanley.

Concerns also grew about a looming US government shutdown. House Republicans said they will vote Friday on funding to keep the government open through March 14, provide disaster relief and give billions of dollars in economic aid to farmers.

“The real problem is the shutdown, one wasn’t expecting this, it’s a surprise for the market, just as the Fed was a surprise,” said Jeanne Asseraf-Bitton, head of research and strategy at BFT IM in Paris. “All in all this week is a difficult one.”

Meanwhile, US consumer sentiment rose for a fifth month in December. The sentiment index continues to reflect an improving outlook among Republicans after November’s election, while Democrats grow more downbeat.

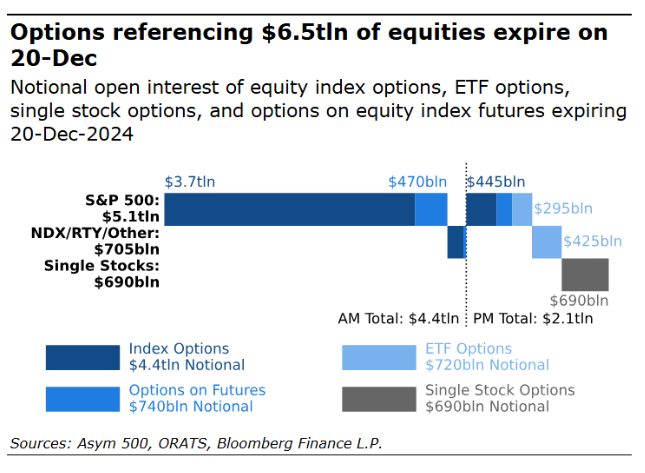

Friday’s US options expiration, which has historically stoked turbulence, offered a final hurdle to end-of-year calm. The quarterly “triple-witching” saw some $6.5 trillion worth of options tied to individual stocks, indexes and exchange-traded funds fall off the board, this year’s largest, according to an estimate from derivatives analytical firm Asym 500.

Elsewhere, Brazilian markets bounced at the end of the week amid extraordinary central bank moves to curb a selloff in the currency. The real was among the best performers in emerging markets Friday.

In the UK, long-term government borrowing costs are approaching the highest level since 1998 as investors struggle to work out how much the Bank of England will cut interest rates next year. In just one week, the market went from wagering on the possibility of four interest rate cuts next year to fewer than two, and then back to entertaining the chance of three.

In Asia, China’s one-year bond yield slumped to 1% for the first time since the global financial crisis, as traders ramped up bets on monetary easing.

The yen trimmed weekly losses after Japan’s key inflation gauge strengthened for the first time in three months and Finance Minister Katsunobu Kato warned against currency speculation.

Crude posted a weekly loss as traders mulled the Fed’s hawkish pivot and and President-elect Donald Trump’s threat to impose tariffs on EU countries unless they buy more US oil and gas.

Some of the main moves in markets:

Stocks

- The S&P 500 rose 1.1% as of 4:14 p.m. New York time

- The Nasdaq 100 rose 0.8%

- The Dow Jones Industrial Average rose 1.2%

- The MSCI World Index rose 0.8%

Currencies

- The Bloomberg Dollar Spot Index fell 0.5%

- The euro rose 0.6% to $1.0428

- The British pound rose 0.6% to $1.2575

- The Japanese yen rose 0.7% to 156.32 per dollar

Cryptocurrencies

- Bitcoin fell 2% to $95,420.2

- Ether fell 0.7% to $3,393.53

Bonds

- The yield on 10-year Treasuries declined four basis points to 4.53%

- Germany’s 10-year yield declined two basis points to 2.29%

- Britain’s 10-year yield declined seven basis points to 4.51%

Commodities

- West Texas Intermediate crude rose 0.2% to $69.51 a barrel

- Spot gold rose 1.2% to $2,623.86 an ounce

This story was produced with the assistance of Bloomberg Automation.

©2024 Bloomberg L.P.

KEEPING THE ENERGY INDUSTRY CONNECTED

Subscribe to our newsletter and get the best of Energy Connects directly to your inbox each week.

By subscribing, you agree to the processing of your personal data by dmg events as described in the Privacy Policy.

More oil news

Philippines’ Marcos Seeks to Import LNG From Alaska, Envoy Says

Oil Falls After Weak Technicals Accelerate Supply-Driven Losses

Buffett’s Annual Letter May Give Much Needed Support to Japanese Stocks

Oil Edges Lower With Focus on US Stockpiles, Supply Uncertainty

Oil Climbs With Focus on OPEC+ Output Plans and Ukraine Talks

Diamondback Energy announces $4.08 billion acquisition to expand Permian presence

Oil Holds Declines on Prospect of Higher Russia, Iraq Supplies

Canada’s Conservative Leader Pitches Major Natural-Resource Revamp to Counter Trump

EPA Terminates Nearly 400 Workers Amid US Government Purge