Oil Edges Higher With Global Equities and Middle East in Focus

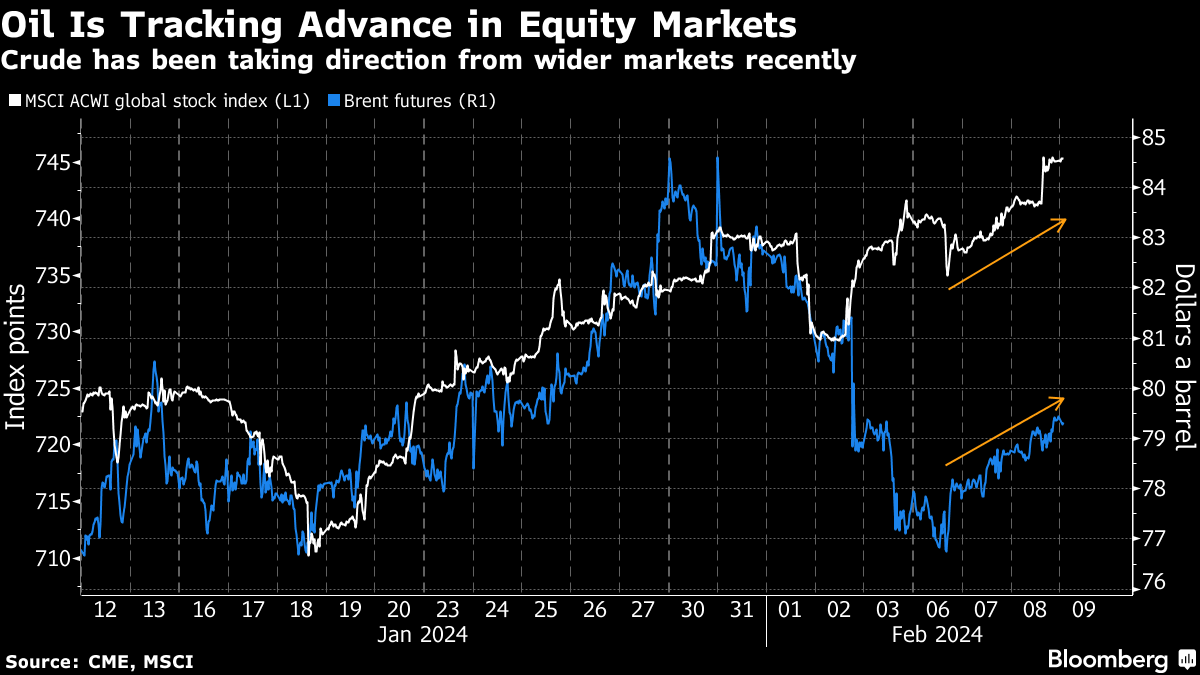

(Bloomberg) -- Oil extended a three-day climb, with prices supported by gains in wider financial markets and lingering Middle East risks.

Brent crude traded above $79 a barrel after rising 2.4% over the prior three sessions, with futures potentially set for longest winning run since September. West Texas Intermediate was near $74. A rally in global stocks is helping to support appetite for risk assets, including crude, even as the Federal Reserve plays down the chance of imminent interest-rate cuts.

In the Middle East, Houthi militants have continued to fire missiles at vessels off the coast of Yemen, forcing many tankers to make costly diversions. Elsewhere, the US killed the commander of an Iran-backed militia in Iraq with an airstrike in retaliation for the deaths of three soldiers.

Oil has been confined to a relatively narrow range since the start of the year. Prices have been supported by the tensions in the Middle East, as well as supply cuts implemented by the OPEC+ group of producers including Saudi Arabia and Russia. That’s been offset, however, by booming production and record exports from the US, as well as slowing global demand growth.

Oil is ignoring bearish signs “and sticking to the notion of a ‘soft landing’ and deficient supplies in the second half,” said Priyanka Sachdeva, senior market analyst at brokerage Phillip Nova Pte.

Crude market spreads still signal near-term strength in the global market, with the gap between Brent’s two nearest contracts holding in a bullish, backwardated structure. WTI’s prompt spread, however, is 7 cents a barrel in a opposite contango pattern, signaling looser conditions.

In Asia, the outlook in top importer China remains challenging. Consumer prices in January fell at the fastest pace since 2009, as the Asian nation struggles to shake off deflationary pressures. Producer prices, meanwhile, have been stuck in deflation for 16 consecutive months.

©2024 Bloomberg L.P.

KEEPING THE ENERGY INDUSTRY CONNECTED

Subscribe to our newsletter and get the best of Energy Connects directly to your inbox each week.

By subscribing, you agree to the processing of your personal data by dmg events as described in the Privacy Policy.

More oil news

Philippines’ Marcos Seeks to Import LNG From Alaska, Envoy Says

Oil Falls After Weak Technicals Accelerate Supply-Driven Losses

Buffett’s Annual Letter May Give Much Needed Support to Japanese Stocks

Oil Edges Lower With Focus on US Stockpiles, Supply Uncertainty

Oil Climbs With Focus on OPEC+ Output Plans and Ukraine Talks

Diamondback Energy announces $4.08 billion acquisition to expand Permian presence

Oil Holds Declines on Prospect of Higher Russia, Iraq Supplies

Canada’s Conservative Leader Pitches Major Natural-Resource Revamp to Counter Trump

EPA Terminates Nearly 400 Workers Amid US Government Purge