Oil Poised for Weekly Gain on Heightened Middle East Tensions

(Bloomberg) -- Oil headed for a weekly advance after Prime Minister Benjamin Netanyahu’s dismissal of a potential cease-fire in the Israel-Hamas war heightened risks in the Middle East.

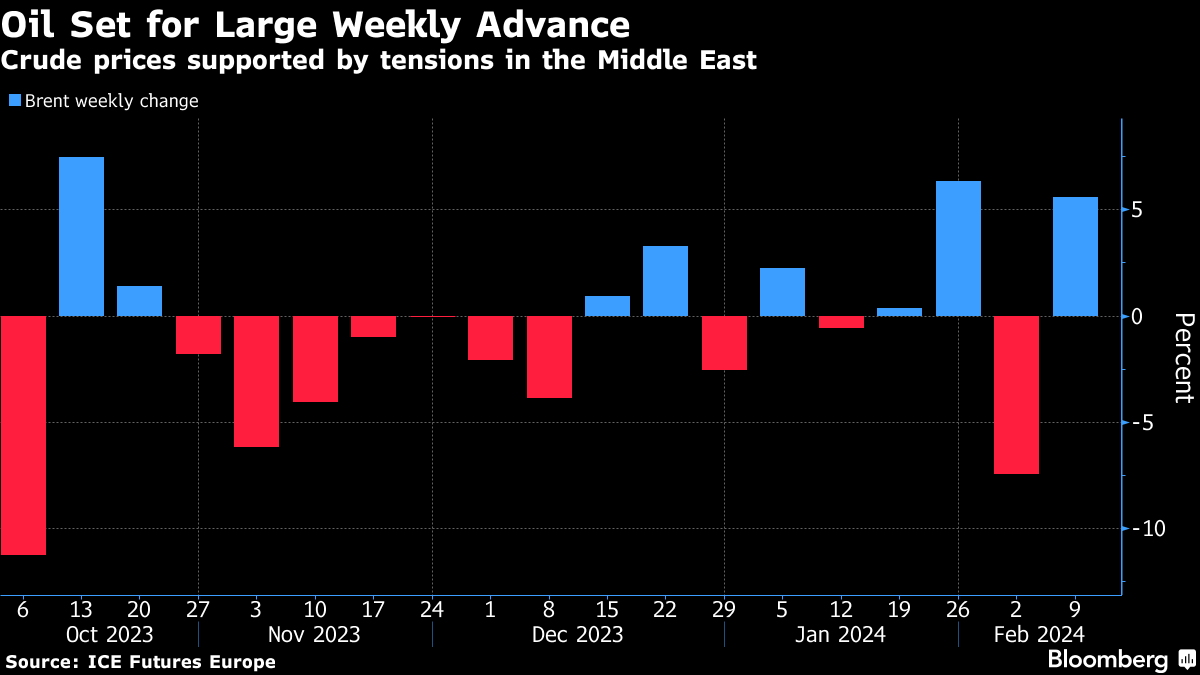

Brent crude traded below $82 a barrel, after climbing more than 3% on Thursday, the biggest daily jump in a month, as the Israeli leader’s comments spurred algorithmic buying. West Texas Intermediate was above $76. The move of almost 6% this week has undone most of last week’s slump, which was partially driven by optimism the two sides were moving closer to a pause in hostilities.

Netanyahu said he sees “no other solution than total victory,” and threats by Iraq to pull support for the American-led coalition added to tensions in the major oil-producing region. Shipping companies also warned that the security situation in the Red Sea continues to deteriorate.

“It’s been a bumper week for oil prices this week, as hopes of easing tensions in the Middle East failed to receive much-needed validation,” said Yeap Jun Rong, market strategist for IG Asia Pte. “Market participants are pricing for geopolitical risks to linger for longer.”

Crude is about 6% higher in the year to date, as nervousness over the Middle East was partially offset by ample global supply and shaky outlooks in the world’s two biggest consumers. There are expectations that the US Federal Reserve will leave interest rates elevated for longer, and China is still struggling to revive domestic demand and consumer confidence.

Oil’s implied volatility has also been declining in recent sessions even as open interest climbs. Trading volumes in Asia on Friday will likely be low as many markets close for the Lunar New Year holidays.

©2024 Bloomberg L.P.

KEEPING THE ENERGY INDUSTRY CONNECTED

Subscribe to our newsletter and get the best of Energy Connects directly to your inbox each week.

By subscribing, you agree to the processing of your personal data by dmg events as described in the Privacy Policy.

More oil news

US Steps Up Houthi Campaign With Deadly Strikes on Red Sea Oil Port

Abu Dhabi Defies Oil Price Plunge to Keep Building Big at Home

Oil Rises a Second Day After US Cracks Down on Iranian Supply

Oil Steadies With Glut Expectations, Trade War Souring Outlook

Oil Edges Higher With Focus on Tariff Moves, US-Iran Discussions

Oil Steadies as Progress on Iran Talks Undercuts Tariff Reprieve

Goldman Sachs Warns Oil Faces ‘Large Surpluses’ Through 2026

Chevron Ordered to U-Turn Venezuela Oil Ahead of Sanctions

Shale Drillers Idle US Rigs at Fastest Pace in Almost Two Years