Oil Resumes Gain Ahead of Promised US Response to Jordan Attack

(Bloomberg) -- Oil edged higher after the biggest decline in three weeks on Wednesday as investors weighed the risks from any US retaliation to a deadly attack in Jordan against signs of robust American supply.

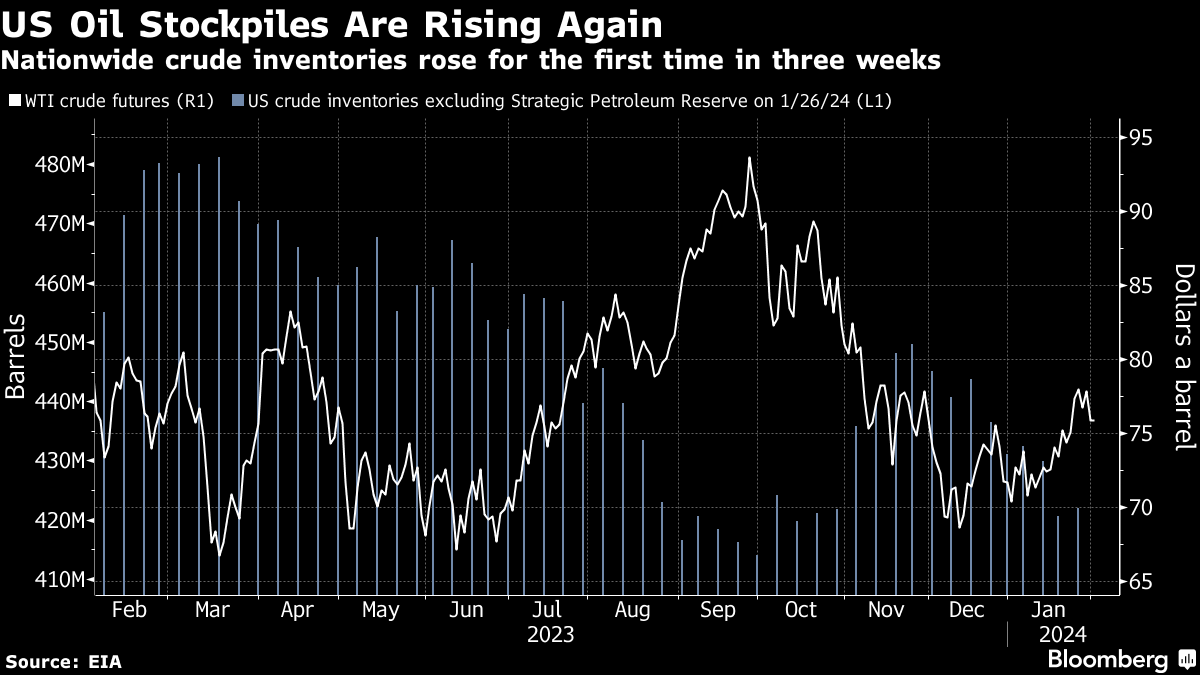

West Texas Intermediate climbed above $76 a barrel after losing 2.5% in the previous session, the biggest drop since early January. Brent crude gained to trade near $81. Data showing expanding US crude stockpiles and rising oil output put downward pressure on prices on Wednesday.

President Joe Biden said earlier this week that he had made a decision on how to respond to the attack over the weekend that killed American troops, without providing details. He said Iran was responsible for providing the weaponry used in the strike, but Tehran has denied involvement and vowed to hit back against any strike on its soil or assets abroad.

Oil capped its first monthly gain in four months in January after an escalation of attacks on commercial shipping in the Red Sea by Yemen-based Houthi rebels. However, concerns around demand in key consumers and strong supply from non-OPEC producers has kept a lid on price gains.

“The market will keep a watch on the Red Sea and the region at large, but we know crude won’t factor in supply disruptions until it has a good reason to,” said Vandana Hari, founder of Vanda Insights in Singapore. “The US weekly crude stock-build and its oil production figure took the steam out of prices.”

US oil output rose to 13.3 million barrels a day in November, surpassing a previous record in September, according to the Energy Information Administration. Data also showed weekly production back at 13 million barrels a day, while crude inventories gained for the first time in three weeks.

©2024 Bloomberg L.P.

KEEPING THE ENERGY INDUSTRY CONNECTED

Subscribe to our newsletter and get the best of Energy Connects directly to your inbox each week.

By subscribing, you agree to the processing of your personal data by dmg events as described in the Privacy Policy.

More oil news

US Steps Up Houthi Campaign With Deadly Strikes on Red Sea Oil Port

Iran's Space Program Is Growing Stronger Despite US Sanctions

Abu Dhabi Defies Oil Price Plunge to Keep Building Big at Home

Oil Rises a Second Day After US Cracks Down on Iranian Supply

Oil Steadies With Glut Expectations, Trade War Souring Outlook

Oil Edges Higher With Focus on Tariff Moves, US-Iran Discussions

Oil Steadies as Progress on Iran Talks Undercuts Tariff Reprieve

Goldman Sachs Warns Oil Faces ‘Large Surpluses’ Through 2026

Chevron Ordered to U-Turn Venezuela Oil Ahead of Sanctions