Oil Advances as Twin Middle East Strikes Raise Escalation Risks

(Bloomberg) -- Oil gained as twin incidents in the Middle East underlined the region’s rapidly escalating tensions, which have already snarled global shipping and carry the potential for interruptions to crude production.

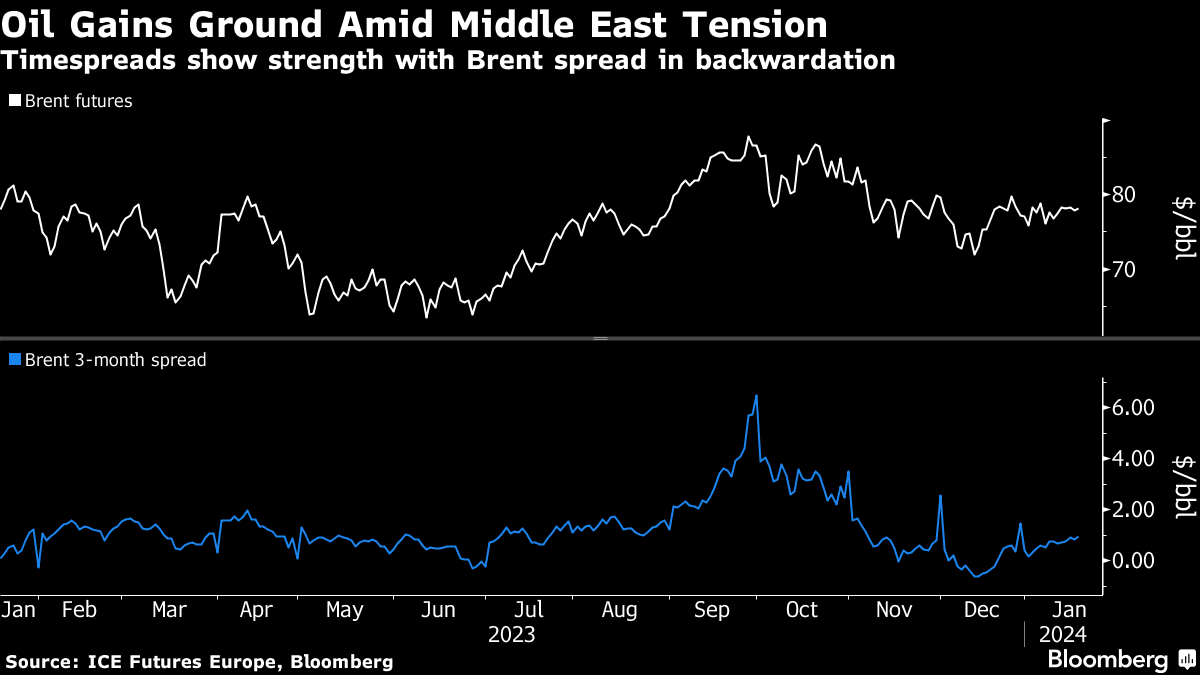

Brent crude rose above $78 a barrel, while West Texas Intermediate topped $73. In Yemen, the US struck more than a dozen Houthi missile launchers in its latest response to the Tehran-backed group’s repeated attacks on shipping. Elsewhere, Pakistan carried out retaliatory strikes in Iran.

Widely watched timespreads suggest conditions are tightening. Brent’s three-month spread widened to almost $1 a barrel in backwardation, a bullish pattern in which prompt prices command a premium to those further out. That compares with 33 cents in contango, the opposite structure, a month ago.

Crude oil has been buffeted in the opening weeks of the year by the escalating crisis in the Middle East, as well as concerns that demand growth will slow this year and the Federal Reserve will start cutting interest rates later than had been expected. Traders are also gauging the impact of supply cuts from the Organization of Petroleum Exporting Countries and its allies.

The crisis in Yemen has cut transits through the Red Sea and Suez Canal, snarling trade flows as ships avoid the area and take longer, alternative routes. The Biden administration will put Houthis back on a terrorism list. The group says it’s are acting in support of Hamas as it battles Israel.

The industry-backed American Petroleum Institute, meanwhile, reported a small increase in nationwide US crude inventories but a decline at the key Cushing, Oklahoma, hub. At the same time, it flagged increases in gasoline and distillate stockpiles. Official figures will be issued later on Thursday.

Ahead of that data, the International Energy Agency is scheduled to release its monthly market snapshot, giving insights into expected balances over the coming quarters. On Wednesday, OPEC forecast that global oil demand will continue to increase strongly next year and exceed growth in supplies.

©2024 Bloomberg L.P.

KEEPING THE ENERGY INDUSTRY CONNECTED

Subscribe to our newsletter and get the best of Energy Connects directly to your inbox each week.

By subscribing, you agree to the processing of your personal data by dmg events as described in the Privacy Policy.

More oil news

Oil Extends Drop as Trump’s Trade War Hurts Outlook for Demand

Oil Slumps as Traders Await Next Moves in China, Economic Data

Oil Edges Up as Traders Eye Next Moves in US-China Trade Tumult

Ambani’s Reliance Posts Profit Beat as Energy Unit Recovers

As Elliott Moves In, BP Investment Case Splits ESG Fund Market

Oil Holds Decline With Focus on OPEC+ Supply and Tariff Outlook

Oil Pushes Higher as Trump Signals No Intention to Ax Powell

Oil Climbs After Plunging Monday on Trump’s Criticism of Powell

TotalEnergies announces first oil from Ballymore offshore field