Oil Drops as Saudi Pricing Cuts Counter Middle East Supply Risks

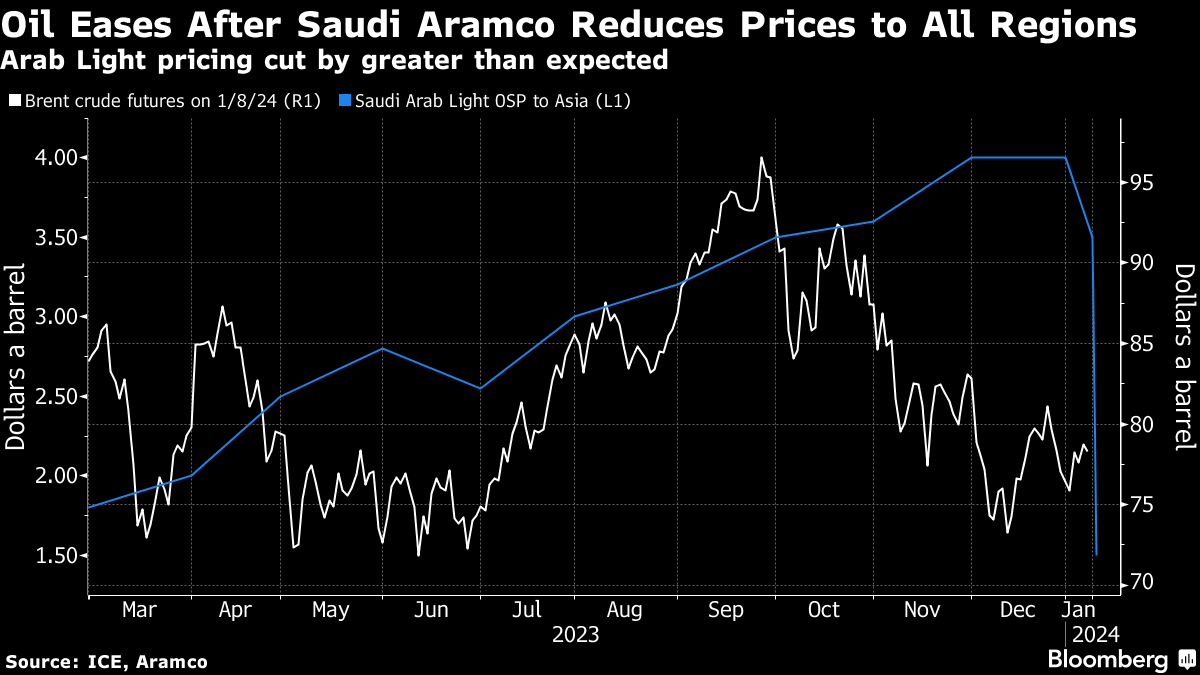

(Bloomberg) -- Oil dropped after Saudi Arabia cut official selling prices for all regions, underscoring a worsening outlook and outweighing concern over Red Sea tensions and supply disruptions in Libya.

Global benchmark Brent fell to below $78 a barrel after rising by 2.2% last week, with West Texas Intermediate around $73. State producer Saudi Aramco cut its flagship Arab Light price to Asia by a more-than-expected $2 a barrel amid persistent weakness in the global crude market.

Oil is coming off the back of the first annual decline since 2020, with losses driven by rising supplies from outside the OPEC+ cartel and concerns that demand growth will slow this year, including in leading importer China. With 2024 barely started, Wall Street is expecting more challenges ahead for crude, with major banks already cutting their outlooks for this year.

“Supply disruptions and Middle East tension continue to provide some support,” said Warren Patterson, head of commodities strategy at ING Groep NV. “However, in the absence of escalation in the Middle East, we suspect upside is limited, given a fairly comfortable balance over the first half of 2024.”

In the Middle East, container giant A.P. Moller-Maersk A/S will continue diverting ships away from the Red Sea after a string of vessel attacks by Houthi rebels. US Secretary of State Antony Blinken, meanwhile, warned that the Israel-Hamas war could spill over into a full-blown regional conflict.

In addition, Libya’s National Oil Corporation declared force majeure at the Sharara oil field after its shutdown by protesters. The closure of the nation’s largest field led has halted supplies to the Zawiya terminal, the NOC said.

The tensions in the Middle East have spurred a shift in Brent’s prompt spread — the difference between its two nearest contracts, and a widely watched metric of near-term conditions — in recent days. The differential was 22 cents a barrel in backwardation, a bullish pattern, compared with 16 cents in contango, the opposite structure, a month ago.

©2024 Bloomberg L.P.

KEEPING THE ENERGY INDUSTRY CONNECTED

Subscribe to our newsletter and get the best of Energy Connects directly to your inbox each week.

By subscribing, you agree to the processing of your personal data by dmg events as described in the Privacy Policy.

More oil news

Oil Rises a Second Day After US Cracks Down on Iranian Supply

Oil Steadies With Glut Expectations, Trade War Souring Outlook

Oil Edges Higher With Focus on Tariff Moves, US-Iran Discussions

Oil Steadies as Progress on Iran Talks Undercuts Tariff Reprieve

Goldman Sachs Warns Oil Faces ‘Large Surpluses’ Through 2026

Chevron Ordered to U-Turn Venezuela Oil Ahead of Sanctions

Shale Drillers Idle US Rigs at Fastest Pace in Almost Two Years

Oil Heads for Weekly Decline as Trade War Roils Global Markets

US Crude Flows to China Trickle to Near Zero After Tariff Blitz