Oil Dips as Rate Outlook Mutes Middle East Risks, US Cold Snap

(Bloomberg) -- Oil edged lower as fresh instability in the Red Sea and a US cold snap that’s disrupting output was countered by a softer tone in wider markets.

West Texas Intermediate fell as much as 2% before paring much of the loss. European equities dipped as markets watch for clues on interest rates ahead of a raft of speeches by policymakers at the World Economic Forum in Davos this week. In North America, extreme cold weather reduced oil production in some areas. US equity markets were closed for a holiday.

On Monday, a key trade group said it had been informed by the US Navy that shipping in the Red Sea remains too risky, and it advised merchant vessels to avoid the route. Underscoring the warnings, Houthi militants hit a US-owned commercial vessel with an anti-ship ballistic missile on Monday.

Temperatures of -22F (-8C) in North Dakota, home of the Bakken shale formation, reduced oil output by as much as 425,000 barrels a day. Extreme cold also descended on Alberta’s oil sands, where past cold snaps have resulted in production shut-ins.

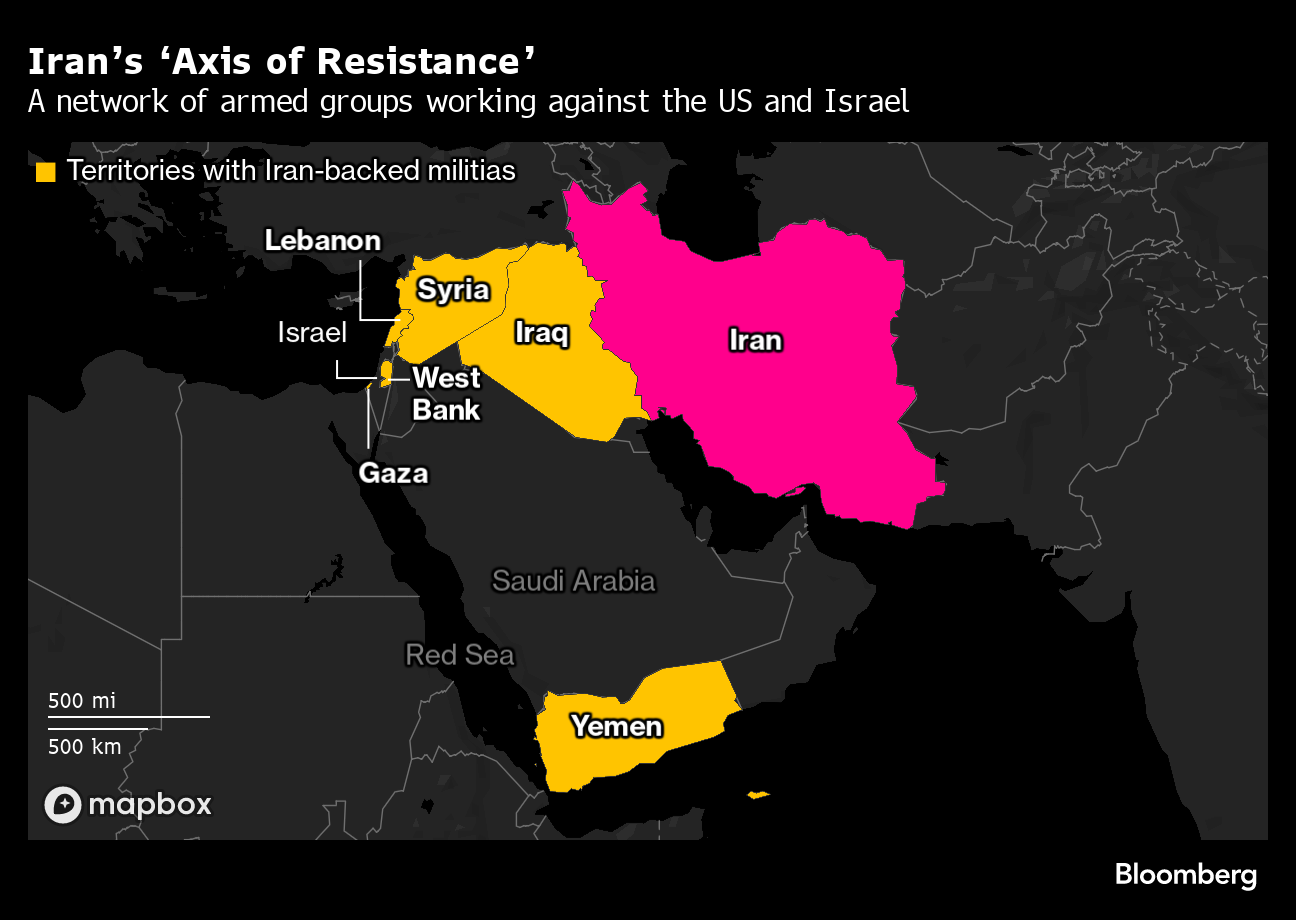

Global oil markets have been transfixed by the situation in the Middle East since the Hamas attack on Israel on Oct. 7. The strikes on the Houthis were in retaliation for the group’s harrying of ships in the Red Sea over the last couple of months. The Iran-backed militants have vowed not to let up until Israel ends its assault in the Gaza Strip.

The price reaction suggests the market doesn’t, at this point, see a high chance that the evolving conflict will endanger crude production and flows from the wider Middle East, which accounts for around a third of the world’s oil. Instead, the prospect of rising supply from non-OPEC countries and slowing demand growth are helping to keep prices range-bound.

“It is not our base case that US/UK strikes on Houthi targets in Yemen and issues in the Red Sea will lead to a substantive upside in oil prices over the coming weeks,” Citigroup Inc. analysts including Francesco Martoccia wrote in a note. “On the other hand, a possible escalation in tensions between Israel and Hezbollah and/or Iran, which the market believes may result in supply disruption, or actually results in supply disruption, is a larger concern in the near-term, though also not within our base case.”

©2024 Bloomberg L.P.

KEEPING THE ENERGY INDUSTRY CONNECTED

Subscribe to our newsletter and get the best of Energy Connects directly to your inbox each week.

By subscribing, you agree to the processing of your personal data by dmg events as described in the Privacy Policy.

More oil news

Trump Revokes Permits to US, Foreign Oil Firms in Venezuela

S&P 500 Sinks 2% as Economic Fears Spur Bond Rally: Markets Wrap

Oil Poised for Third Weekly Gain Ahead of More Trump Tariffs

Oil Holds Gain as US Posts Biggest Drop in Stockpiles This Year

Oil Holds Steady as Report Points to Big Drop in US Stockpiles

China Refiners Face Yet Another Blow as Trump Presses Venezuela

Billion-Dollar US Levies on Chinese Ships Risk ‘Trade Apocalypse’

Oil Steadies at Start of Week as Market Weighs Trump’s Tariffs

CATL’s Lithium Partner Lopal Sees Swings in Near-Term Prices