Oil Holds Biggest Drop in a Month on Signs of Softening Market

(Bloomberg) -- Oil held the largest drop in about a month on signs of a weaker physical market, including a deep pricing cut by OPEC+ leader Saudi Arabia.

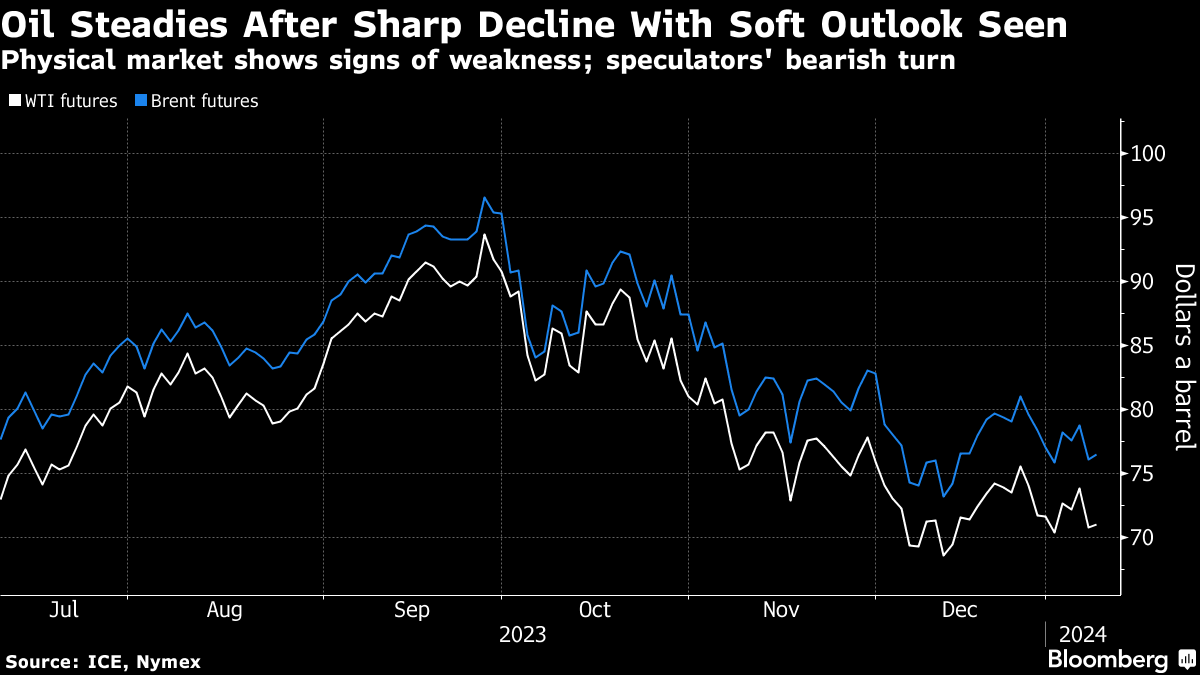

Global benchmark Brent traded above $76 a barrel after tumbling by 3.4% on Monday to unwind all of the previous week’s gains, with US marker West Texas Intermediate near $71. Riyadh reduced its prices more than had been expected, with prices of other Middle Eastern crudes also declining.

Underscoring the weakness were speculators starting 2024 by making one of their biggest bearish shifts on oil prices in years. Investors added about 61,000 combined shorts in Brent and WTI in the week to Jan. 2, according to Intercontinental Exchange Inc. and Commodity Futures Trading Commission data. That was the most since March, and the second-largest increase since 2017.

Crude is coming off the back of its first annual drop since 2020, with losses driven by rising supplies from outside OPEC+ and concerns that demand will slow this year including in top importer China. Still, the Israel-Hamas war, related attacks on shipping in the Red Sea by Houthi rebels, and recent supply outages in Libya have combined to provide some support.

Despite recent supply issues, the “oil market has come back to focus on demand concerns after the Saudi price cuts,” said Charu Chanana, market strategist for Saxo Capital Markets Pte. “We expect oil prices to remain range-bound as demand worries and rising non-OPEC+ supply are offset by OPEC+ cuts and Middle Eastern tensions.”

In the Middle East, Hezbollah said a senior commander was killed in south Lebanon, amid rising concerns the war in Gaza will escalate. The death came as US Secretary of State Antony Blinken toured the region in a bid to ease tensions, warning that the war could turn into a wider conflict.

Traders will later Tuesday get further insight into crude’s prospects over the coming quarters when the Energy Information Administration releases its Short-Term Energy Outlook. The forecasts for US oil production will be among the key takeaways after supply swelled to a record last year.

©2024 Bloomberg L.P.

KEEPING THE ENERGY INDUSTRY CONNECTED

Subscribe to our newsletter and get the best of Energy Connects directly to your inbox each week.

By subscribing, you agree to the processing of your personal data by dmg events as described in the Privacy Policy.

More oil news

Oil Extends Drop as Trump’s Trade War Hurts Outlook for Demand

Oil Slumps as Traders Await Next Moves in China, Economic Data

Oil Edges Up as Traders Eye Next Moves in US-China Trade Tumult

Ambani’s Reliance Posts Profit Beat as Energy Unit Recovers

As Elliott Moves In, BP Investment Case Splits ESG Fund Market

Oil Holds Decline With Focus on OPEC+ Supply and Tariff Outlook

Oil Pushes Higher as Trump Signals No Intention to Ax Powell

Oil Climbs After Plunging Monday on Trump’s Criticism of Powell

TotalEnergies announces first oil from Ballymore offshore field