Oil Falls in Choppy Session as Supply Gains Blunt Red Sea Risks

(Bloomberg) -- Oil fell in a choppy session as traders weighed escalating military activity in the Middle East against expectations of rising supplies.

The US and UK launched more airstrikes against the Houthis on Monday to prevent the Iran-backed group from attacking commercial vessels in the Red Sea. Despite the increased geopolitical tensions, West Texas Intermediate fell 0.5% to settle near $74 a barrel after swinging in a range of less than $2.

“This range-bound trading regime is the ‘kryptonite’ of trend followers,” said Daniel Ghali, a commodity strategist at TD Securities. The narrow band of activity leads algorithms to buy high and sell low, causing with prices remaining largely unchanged, he said.

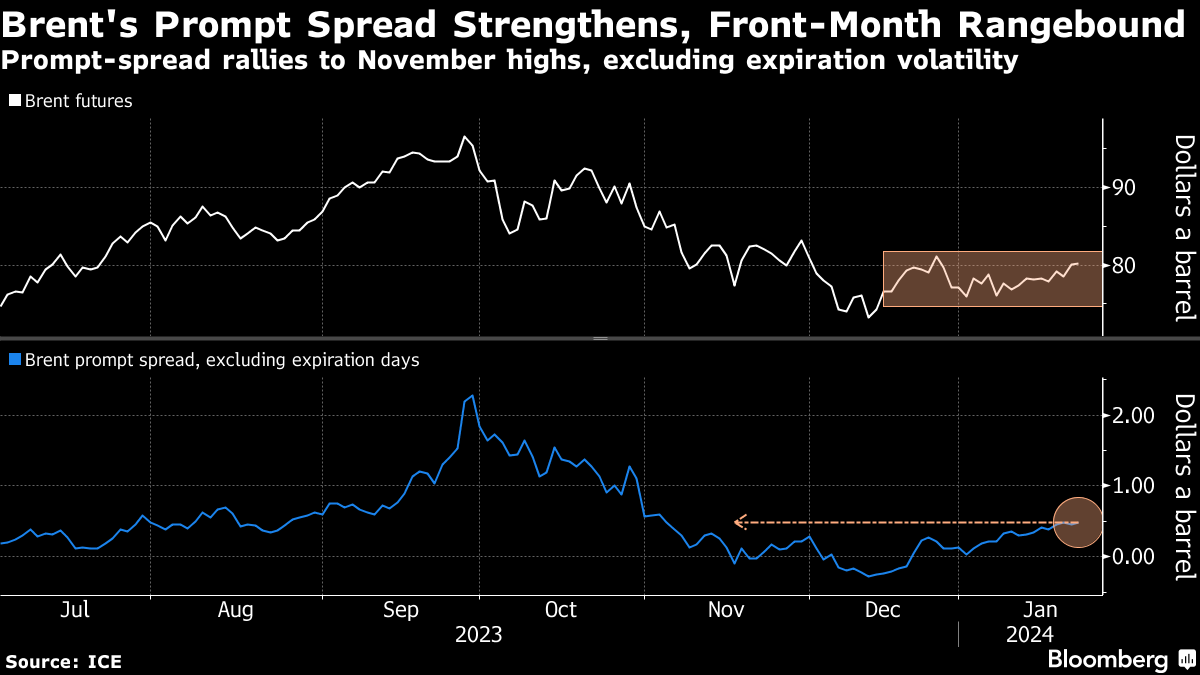

Still, a critical oil-market barometer for supply and demand known as the prompt-spread has been bolstered by the increased risks in the Red Sea. Global benchmark Brent crude’s front-month futures are trading at a 44-cent premium to the next contract, near the highest since November, excluding expiration days.

Crude has struggled to set a clear direction this year despite the Middle East conflict and a pledge by the Organization of Petroleum Exporting Countries to rein in production. Oil’s gains have been damped by indications of abundant non-OPEC output, with the International Energy Agency forecasting ample supply. In addition, Libya restarted flows from its largest field after a halt, and US drillers are recovering from a freeze that hurt operations.

In Russia, the country’s seaborne crude shipments fell to the lowest in almost two months after continuing bad weather in some ports and a Ukrainian drone strike that briefly halted flows from a key Baltic export terminal.

©2024 Bloomberg L.P.