Oil Extends Advance as Shrinking US Crude Stockpiles Buoy Mood

(Bloomberg) -- Oil climbed for a second day as signs of growing demand and a risk-on tone across broader markets combined to aid sentiment.

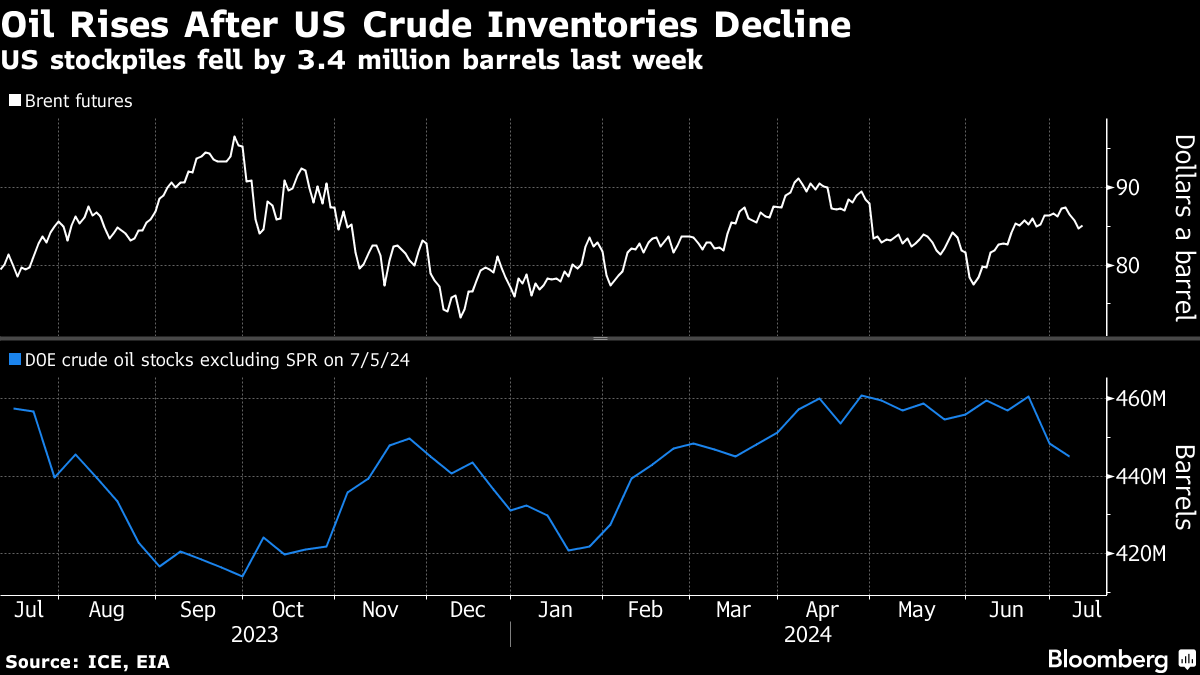

Global crude benchmark Brent advanced toward $86 a barrel after posting a 0.5% gain on Wednesday, with West Texas Intermediate near $83. Nationwide US stockpiles fell by 3.4 million barrels last week, with gauges of jet fuel and gasoline consumption both rising as the summer travel season continues.

Oil’s push higher came as global equities rallied, with US shares at a new high ahead of inflation data later Thursday that may fan investors’ expectations for interest-rate cuts from the Federal Reserve.

Crude has rallied this year, supported by OPEC+ supply cutbacks, although relatively muted moves have caused volatility to decline to six-year lows this month. While some members of the cartel are continuing to pump above agreed limits, key producer Russia made noticeable reductions in June.

“The inventory drawdown was a reflection of strong summer demand, coming partly from the surge in air travel,” and that’s driving prices for now, said Charu Chanana, market strategist for Saxo Capital Markets Pte. While hopes of an imminent Fed pivot were also fueling optimism, much still depended on the state of the US labor market as Powell has pointed to, she said.

Widely watched timespreads show signs of underlying strength. The gap between the two nearest Brent contracts, or prompt spread, was 88 cents a barrel in a bullish, backwardated structure, with the front-month contract at a premium to the subsequent month. That compares with 38 cents a month ago.

Traders will be watching for a monthly market snapshot from the International Energy Agency later on Thursday for its assessment of global crude balances in this half of the year.

©2024 Bloomberg L.P.

KEEPING THE ENERGY INDUSTRY CONNECTED

Subscribe to our newsletter and get the best of Energy Connects directly to your inbox each week.

By subscribing, you agree to the processing of your personal data by dmg events as described in the Privacy Policy.

More oil news

Philippines’ Marcos Seeks to Import LNG From Alaska, Envoy Says

Oil Falls After Weak Technicals Accelerate Supply-Driven Losses

Buffett’s Annual Letter May Give Much Needed Support to Japanese Stocks

Oil Edges Lower With Focus on US Stockpiles, Supply Uncertainty

Oil Climbs With Focus on OPEC+ Output Plans and Ukraine Talks

Diamondback Energy announces $4.08 billion acquisition to expand Permian presence

Oil Holds Declines on Prospect of Higher Russia, Iraq Supplies

Canada’s Conservative Leader Pitches Major Natural-Resource Revamp to Counter Trump

EPA Terminates Nearly 400 Workers Amid US Government Purge