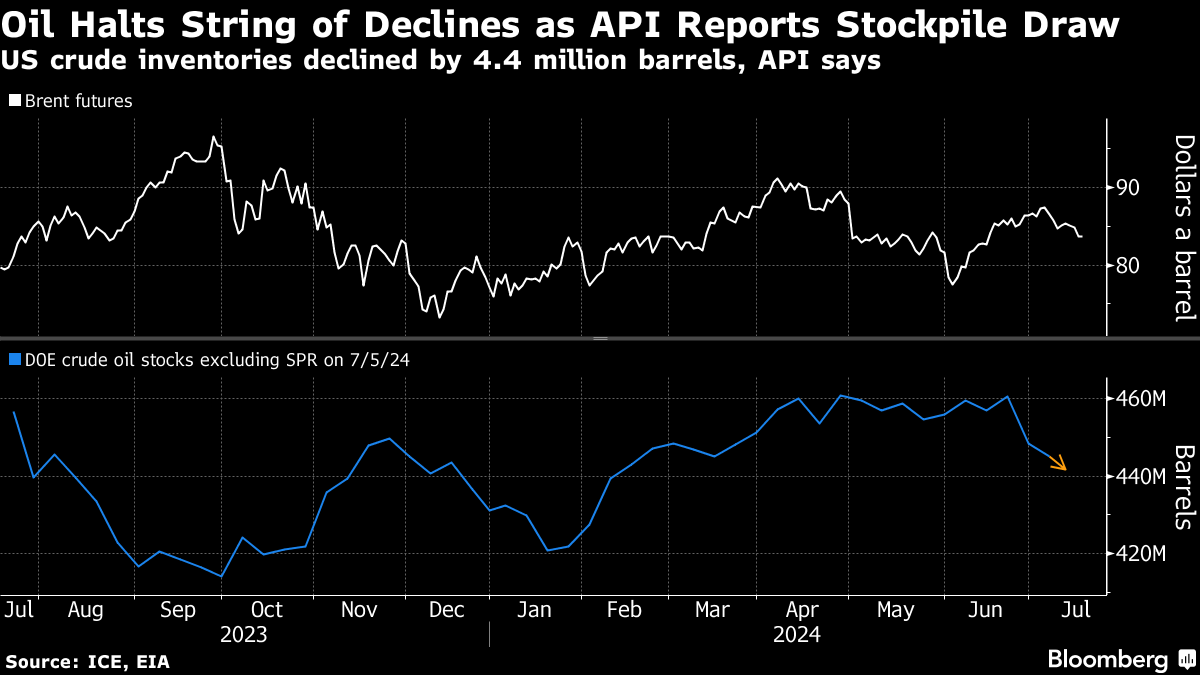

Oil Halts Run of Losses on Estimate for US Crude Inventory Draw

(Bloomberg) -- Oil steadied after a three-day drop as an industry estimate pointed to another decline in US crude stockpiles, countering concerns about a lackluster demand outlook in China.

Brent traded just below $84 a barrel while West Texas Intermediate was near $81. US crude stockpiles shrank by 4.4 million barrels last week, the American Petroleum Institute reported, according to people familiar with the figures. Official inventory data comes later Wednesday, and if confirmed, that would be a third straight drop, the longest run of draws since last September.

Crude remains higher for the year after OPEC+ curbed supplies, although prices have declined from a peak earlier this month on signs of poor demand in top importer China. The country recorded its slowest growth in five quarters in the three months to June, and the International Energy Agency has pinned its expectations for weaker oil demand growth on the Asian nation’s slowdown.

China’s “weaker growth data cast some doubts on whether market participants are being overly optimistic around the Chinese oil demand outlook,” said Yeap Jun Rong, market strategist at IG Asia Pte. “Hopes for stronger stimulus measures at the Third Plenum has also somewhat fizzled,” he said, referring to a policymakers’ gathering that’s taking place this week.

Russia, meanwhile, plans to make extra crude production cuts in the warm seasons of this year and next to make up for pumping above its OPEC+ quota, according to people familiar with the matter. Moscow missed a deadline to present the compensation schedule to the cartel’s secretariat by June 30, but aimed to publish it soon, the people said.

©2024 Bloomberg L.P.

KEEPING THE ENERGY INDUSTRY CONNECTED

Subscribe to our newsletter and get the best of Energy Connects directly to your inbox each week.

By subscribing, you agree to the processing of your personal data by dmg events as described in the Privacy Policy.

More oil news

Philippines’ Marcos Seeks to Import LNG From Alaska, Envoy Says

Oil Falls After Weak Technicals Accelerate Supply-Driven Losses

Buffett’s Annual Letter May Give Much Needed Support to Japanese Stocks

Oil Edges Lower With Focus on US Stockpiles, Supply Uncertainty

Oil Climbs With Focus on OPEC+ Output Plans and Ukraine Talks

Diamondback Energy announces $4.08 billion acquisition to expand Permian presence

Oil Holds Declines on Prospect of Higher Russia, Iraq Supplies

Canada’s Conservative Leader Pitches Major Natural-Resource Revamp to Counter Trump

EPA Terminates Nearly 400 Workers Amid US Government Purge