Oil Holds Near Six-Week Low With Chinese Demand, OPEC+ in Focus

(Bloomberg) -- Oil steadied near a six-week low as positive Chinese economic data helped ease concern over demand in the world’s biggest importer, before an OPEC+ monitoring meeting this week.

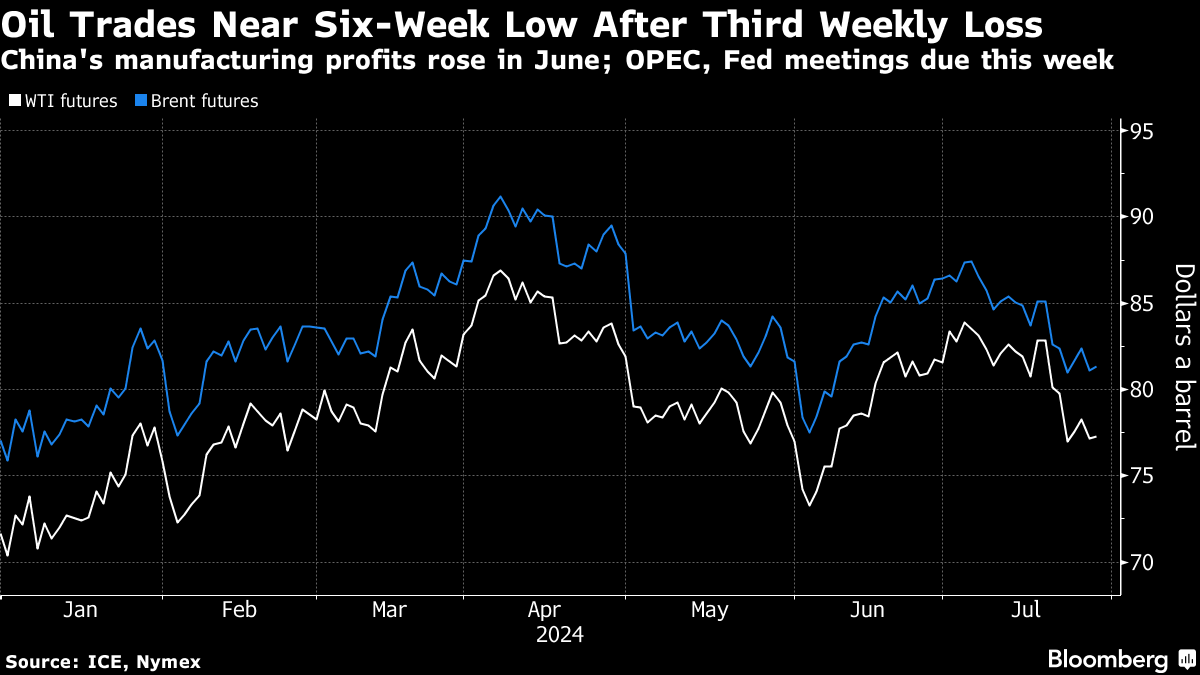

Brent crude traded above $81 a barrel after falling 1.5% on Friday to notch a third weekly drop, with West Texas Intermediate near $77. Industrial profits in Asia’s largest economy grew at a faster year-on-year pace in June than May, showing the resilience of manufacturing.

Crude remains modestly higher this year, helped by OPEC+ supply discipline and expectations the Federal Reserve is getting closer to lower borrowing costs. An interest-rate decision from the US central bank is due Wednesday. Key members of the Organization of the Petroleum Exporting Countries and its allies meet online a day later, with the market split on whether the group will alter production levels.

Traders will also be monitoring developments in the Middle East, after Israel attacked Hezbollah targets on Sunday and threatened further retaliation for an earlier rocket strike that killed 12 children, while continuing to signal it was open to a proposed Gaza truce.

“Concerns around China’s economy have broadly weighed on energy commodity prices,” said Vivek Dhar, an analyst at Commonwealth Bank of Australia in Melbourne. “Demand concerns, though, will likely give way to rising geopolitical risks in the Middle East early this week” as the conflict between Israel and Hezbollah worsens.

©2024 Bloomberg L.P.

KEEPING THE ENERGY INDUSTRY CONNECTED

Subscribe to our newsletter and get the best of Energy Connects directly to your inbox each week.

By subscribing, you agree to the processing of your personal data by dmg events as described in the Privacy Policy.

More oil news

Philippines’ Marcos Seeks to Import LNG From Alaska, Envoy Says

Oil Falls After Weak Technicals Accelerate Supply-Driven Losses

Buffett’s Annual Letter May Give Much Needed Support to Japanese Stocks

Oil Edges Lower With Focus on US Stockpiles, Supply Uncertainty

Oil Climbs With Focus on OPEC+ Output Plans and Ukraine Talks

Diamondback Energy announces $4.08 billion acquisition to expand Permian presence

Oil Holds Declines on Prospect of Higher Russia, Iraq Supplies

Canada’s Conservative Leader Pitches Major Natural-Resource Revamp to Counter Trump

EPA Terminates Nearly 400 Workers Amid US Government Purge