Oil Near Two-Month High on Hurricane Risks, US Stockpile Drop

(Bloomberg) -- Oil traded near a two-month high as Hurricane Beryl portended a potentially worse storm season, while shrinking US crude stockpiles hinted at improved demand.

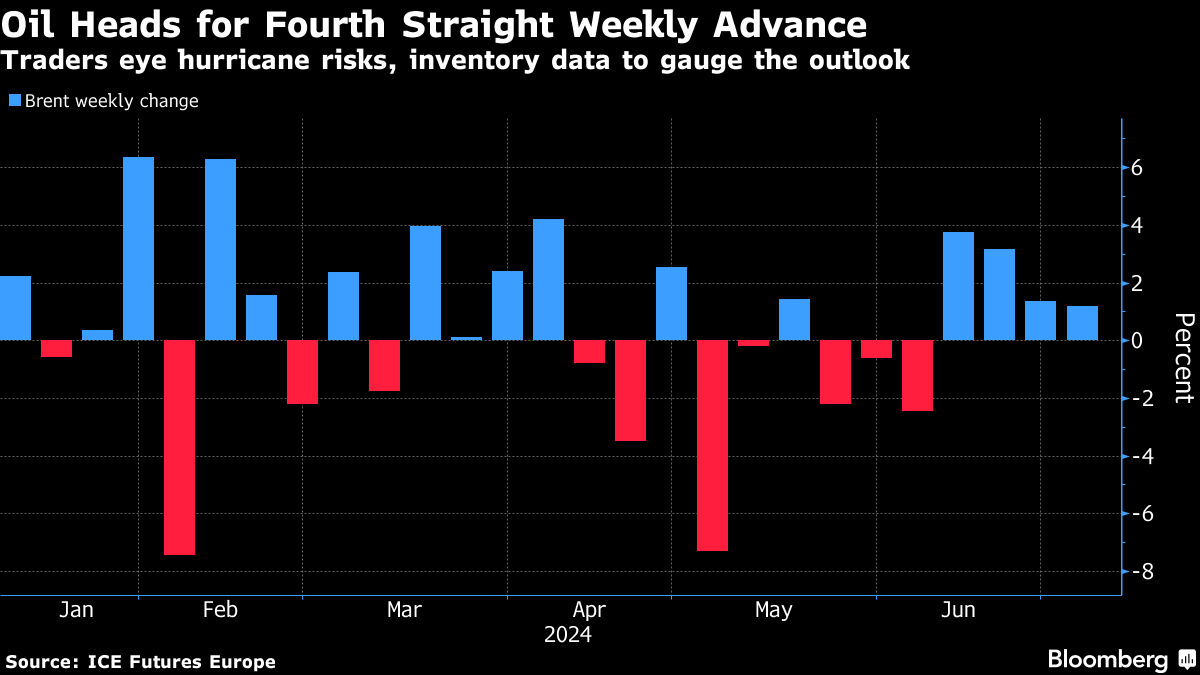

Brent crude traded above $87 a barrel and West Texas Intermediate was below $84, with both benchmarks headed for a fourth weekly advance. The risk of Hurricane Beryl to production in the Gulf of Mexico has tapered, but its early appearance highlighted concerns of a “supercharged” season. Meanwhile, the biggest drop in US stockpiles in almost a year signaled tightening supplies.

Crude has been on a slow and steady grind higher since the beginning of June partly due to a positive outlook for demand over the northern hemisphere summer, with bullish, backwardated timespreads signaling healthy near-term consumption. Signs of softer demand in Asia have tempered that optimism, and led Saudi Aramco to slash prices of its crude to the region for a second month.

Traders will be watching for data on US employment later on Friday, which may inform the outlook for monetary policy. That’ll also impact the dollar, which has weakened this week to make commodities priced in the currency cheaper for international investors.

Geopolitical risks are also salient, including elections in France and concerns over US President Joe Biden’s performance in his debate with Donald Trump. The situation in the Middle East also remains volatile, with signs of progress in truce talks between Hamas and Israel but a worsening of the conflict with Iran-backed Hezbollah.

“There are promising signs of a gradual increase in summer travel, boosting oil demand in the US,” said Priyanka Sachdeva, senior market analyst at brokerage Phillip Nova Pte. In the Middle East, “tensions show little signs of de-escalating,” so the current risk premium is likely to remain in place, she said.

©2024 Bloomberg L.P.

KEEPING THE ENERGY INDUSTRY CONNECTED

Subscribe to our newsletter and get the best of Energy Connects directly to your inbox each week.

By subscribing, you agree to the processing of your personal data by dmg events as described in the Privacy Policy.

More oil news

Oil Falls After Weak Technicals Accelerate Supply-Driven Losses

Buffett’s Annual Letter May Give Much Needed Support to Japanese Stocks

Oil Edges Lower With Focus on US Stockpiles, Supply Uncertainty

Oil Climbs With Focus on OPEC+ Output Plans and Ukraine Talks

Diamondback Energy announces $4.08 billion acquisition to expand Permian presence

Oil Holds Declines on Prospect of Higher Russia, Iraq Supplies

Canada’s Conservative Leader Pitches Major Natural-Resource Revamp to Counter Trump

EPA Terminates Nearly 400 Workers Amid US Government Purge

Trump to Create White House Council to Drive Energy Dominance