Oil Steadies as Traders Look to Dollar and China for Next Cues

(Bloomberg) -- Oil steadied after a two-day decline in quiet summer trading, with the outlook for the US dollar and monetary policy in focus.

Brent crude traded below $85 a barrel after losing 0.6% in the prior two sessions, with West Texas Intermediate near $82. The US currency rose for a second day on Tuesday after the attempted assassination US presidential contender Donald Trump, a headwind for commodities including oil.

Still, Federal Reserve Chair Jerome Powell said that recent US economic data gave policymakers more confidence that inflation was under control, which could herald lower borrowing costs and a weaker greenback.

Crude has advanced this year, aided by OPEC+ supply curbs and expectations of US interest rate cuts. China, however, remains a key risk for the crude market, with the country’s growth unexpectedly slowing to the worst pace in five quarters in the three months to June. The country’s Third Plenum, which sets broad economic and political policies, is taking place this week.

China’s “slowdown still paints a narrative of weak consumer confidence” that is likely to put downward pressure on oil prices, said Vivek Dhar, an analyst with Commonwealth Bank of Australia. “China’s Third Plenum is currently underway but is unlikely to yield any game‑changing policy reform given the current fragility of China’s economy.”

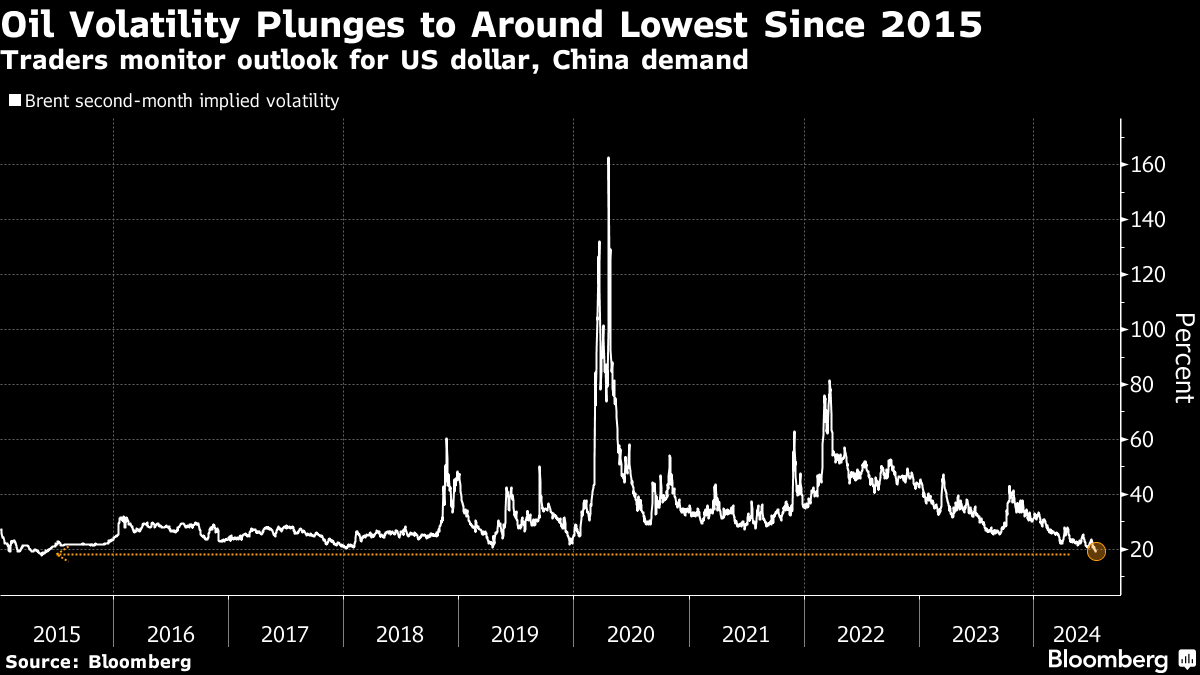

Oil’s listless trading has sent volatility to a multiyear lows, with Brent’s implied volatility — a forecast of the likely movement of crude that’s tied to options pricing — near the lowest since 2015.

©2024 Bloomberg L.P.

KEEPING THE ENERGY INDUSTRY CONNECTED

Subscribe to our newsletter and get the best of Energy Connects directly to your inbox each week.

By subscribing, you agree to the processing of your personal data by dmg events as described in the Privacy Policy.

More oil news

Oil Traders Lurch From Praying for Volatility to Drowning in It

US Steps Up Houthi Campaign With Deadly Strikes on Red Sea Oil Port

Iran's Space Program Is Growing Stronger Despite US Sanctions

Abu Dhabi Defies Oil Price Plunge to Keep Building Big at Home

Oil Rises a Second Day After US Cracks Down on Iranian Supply

Oil Steadies With Glut Expectations, Trade War Souring Outlook

Oil Edges Higher With Focus on Tariff Moves, US-Iran Discussions

Oil Steadies as Progress on Iran Talks Undercuts Tariff Reprieve

Goldman Sachs Warns Oil Faces ‘Large Surpluses’ Through 2026