Oil Steady as Traders Assess Beryl’s Impact and Prepare for Fed

(Bloomberg) -- Oil steadied after a two-day drop with the worst of storm Beryl over, ahead of Federal Reserve Chair Jerome Powell’s report on monetary policy that’ll shape sentiment toward risk assets including commodities.

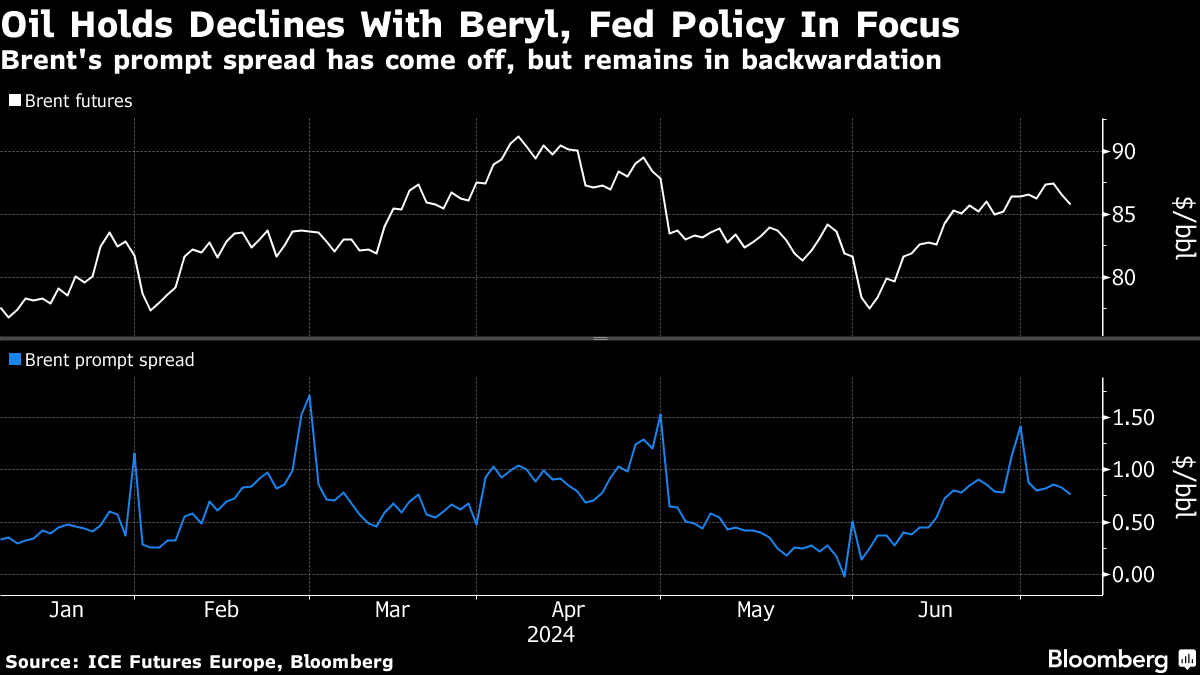

Brent crude traded below $86 a barrel after shedding almost 2% in the prior two sessions, while West Texas Intermediate was near $82. As storm Beryl continued its path through the US mainland, recovery efforts were in progress in Texas, with some infrastructure — like the Port of Houston and the Explorer Pipeline — remaining offline. About 85% of Houston lost power.

Crude remains solidly higher year-to-date, aided by OPEC+ supply cuts that have tightened the market, as well as expectations that the Fed is poised to lower interest rates. Powell will deliver the central bank’s semi-annual report on US monetary policy to the Senate Banking Committee later on Tuesday, offering investors hints on the path forward for borrowing costs.

Forecasts for higher fuel consumption through the northern hemisphere summer have been supportive of prices, although there are growing indications the optimism is fading. Money managers increased bearish bets against US gasoline to the highest in seven years, as inventories swell. Clues on the state of the market will come later Tuesday with the release of the Energy Information Administration’s Short-Term Energy Outlook.

Beryl’s impact on supply “has been more limited than what was initially expected,” which has helped prices unwind, said Yeap Jun Rong, market strategist at IG Asia Pte in Singapore. Investors are also likely to remain cautious in the lead-up to the Fed chair’s testimony, as well as key US inflation data this week, he said.

Timespreads present a mixed picture. While the gap between Brent’s two nearest contracts remains in a bullish, backwardated structure — when the nearest contract trades at a premium over the following month — levels have come off from last week. It was last 75 cents a barrel in backwardation compared with 88 cents at the start of last week.

©2024 Bloomberg L.P.

KEEPING THE ENERGY INDUSTRY CONNECTED

Subscribe to our newsletter and get the best of Energy Connects directly to your inbox each week.

By subscribing, you agree to the processing of your personal data by dmg events as described in the Privacy Policy.

More oil news

Oil Steadies With Glut Expectations, Trade War Souring Outlook

Oil Edges Higher With Focus on Tariff Moves, US-Iran Discussions

Oil Steadies as Progress on Iran Talks Undercuts Tariff Reprieve

Goldman Sachs Warns Oil Faces ‘Large Surpluses’ Through 2026

Chevron Ordered to U-Turn Venezuela Oil Ahead of Sanctions

Shale Drillers Idle US Rigs at Fastest Pace in Almost Two Years

Oil Heads for Weekly Decline as Trade War Roils Global Markets

US Crude Flows to China Trickle to Near Zero After Tariff Blitz

Aramco announces discovery of 14 new oil and gas fields in Eastern Region