Oil Wavers With Dollar Strength in Focus After Trump Shooting

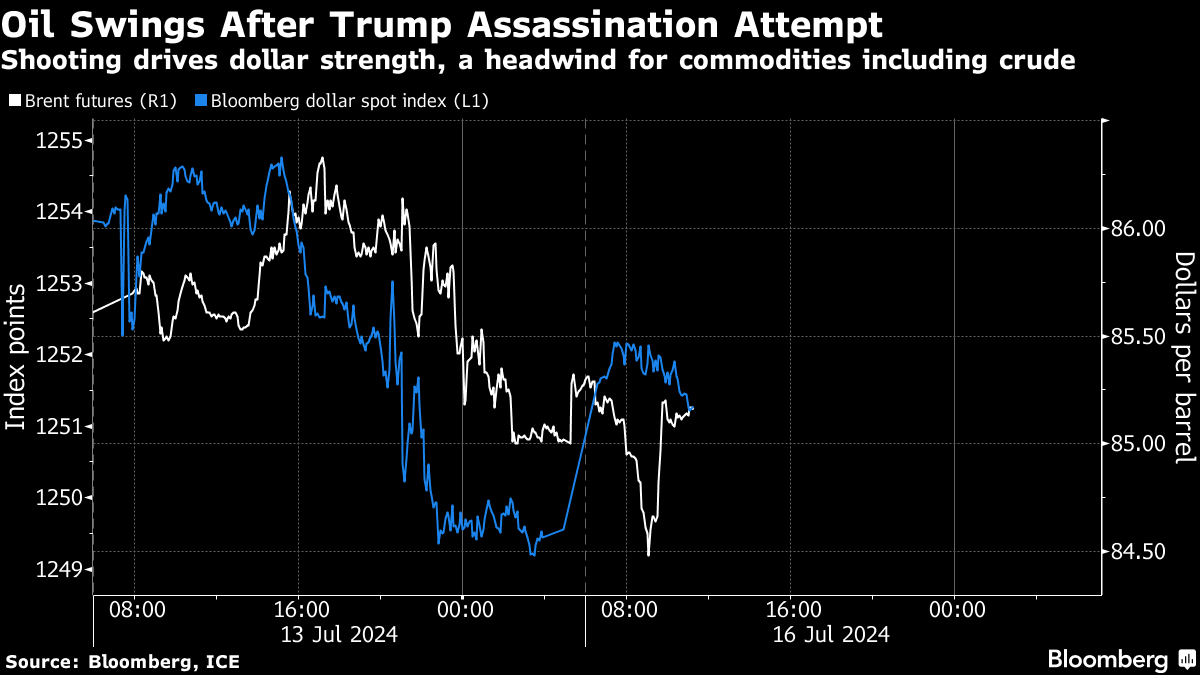

(Bloomberg) -- Oil swung as an assassination attempt on Republican presidential contender Donald Trump brought political risk into focus, with China’s Third Plenum also kicking off on Monday.

Brent rose to around $85 a barrel after paring a loss, while West Texas Intermediate was above $82. The attack on the former president injected a fresh dose of uncertainty into the US election race. The dollar moved modestly higher, making commodities including oil that are priced off the currency more expensive for most buyers.

Oil remains solidly higher for the year, helped by OPEC+’s output curbs and stronger fuel demand over the Northern Hemisphere summer. The Chinese Communist Party’s Third Plenum this week, which will set the nation’s broad economic and political priorities, will be closely watched for clues on the growth trajectory in the world’s largest crude importer.

China’s appetite for crude oil to soybeans has shrunk over the first six months of the year, raising concerns over demand. The nation’s GDP growth fell to the worst pace in five quarters. The International Energy Agency said China’s slowdown would likely weigh on global oil consumption growth.

“It’s not surprising following the attempted assassination of former President Donald Trump over the weekend that we are seeing a stronger US dollar, and that strength is weighing on oil,” said Warren Patterson, head of commodities strategy for ING Groep NV. “In addition, the market is also coming around to the idea that Chinese oil demand could very well disappoint this year.”

Even so, timespreads signal robust near-term demand, as the gap between Brent’s two nearest contracts stayed in a bullish, backwardated structure, with the nearest contract at a premium over the later-dated one. At 97 cents a barrel, it’s about double what it was a month ago.

©2024 Bloomberg L.P.

KEEPING THE ENERGY INDUSTRY CONNECTED

Subscribe to our newsletter and get the best of Energy Connects directly to your inbox each week.

By subscribing, you agree to the processing of your personal data by dmg events as described in the Privacy Policy.

More oil news

Oil Steadies With Glut Expectations, Trade War Souring Outlook

Oil Edges Higher With Focus on Tariff Moves, US-Iran Discussions

Oil Steadies as Progress on Iran Talks Undercuts Tariff Reprieve

Goldman Sachs Warns Oil Faces ‘Large Surpluses’ Through 2026

Chevron Ordered to U-Turn Venezuela Oil Ahead of Sanctions

Shale Drillers Idle US Rigs at Fastest Pace in Almost Two Years

Oil Heads for Weekly Decline as Trade War Roils Global Markets

US Crude Flows to China Trickle to Near Zero After Tariff Blitz

Aramco announces discovery of 14 new oil and gas fields in Eastern Region