July Fourth Travel Seen Hitting Record in Boost for Oil Bulls

(Bloomberg) -- A record of almost 71 million Americans are expected to travel over the Independence Day holiday period early next month, providing hope for oil bulls counting on rising demand during the crucial summer driving season.

About 60.6 million Americans are expected drive 50 miles (80 kilometers) or more from home from June 29 to July 7, representing a 4.8% increase from a year earlier, according to the American Automobile Association. Some 5.74 million are projected to fly over that period as well, up 6.9%. Another 4.62 million are forecast to travel by other means.

The anticipated travel boom would be a reassuring signal for crude traders who have been betting the US oil market will tighten this summer, driven by increased fuel demand. Rising US oil consumption also would help offset concerns about weak usage elsewhere, particularly in China.

Growth in travel has remained resilient in the US — even as wage growth loses steam and pandemic savings dwindle. Excursions that were once considered revenge spending have become the norm, according to AAA. Further encouraging road trips are retail gasoline prices that are currently below seasonal levels from the last two years.

“People may be willing to cut back on goods, but they’re not cutting back on experiences,” said Aixa Diaz, a spokesperson for AAA.

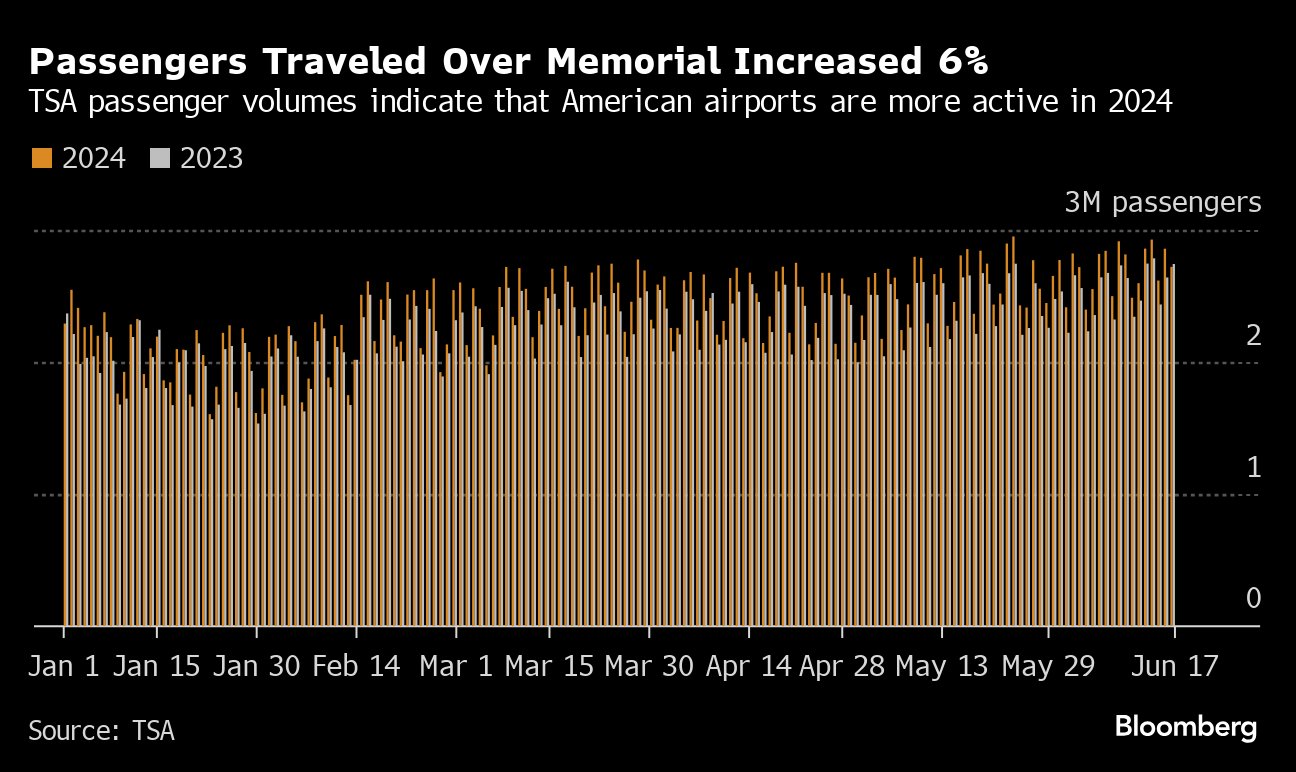

Rebounding air travel, in particular, has been a bright spot for fuel demand, with one measure of jet fuel consumption sitting at the highest since 2019. During the Memorial Day holiday long weekend in May, about 6% more passengers flew compared with 2023, according to JPMorgan Chase & Co. analysts, who cited Transportation Security Administration data.

Gasoline demand, by contrast, is projected to be softer, as greater vehicle efficiency caps consumption growth even as Americans travel more miles. During the May holiday, gas station spending was flat year over year, according to RBC Capital Markets.

Gasoline demand looks tepid so far this summer, with peak consumption coming in at come in about 10% lower than last year, said Patrick De Haan, head of petroleum analysis at GasBuddy.

“We usually see demand peak for gasoline sometime in late July, so there’s still some opportunity,” he said, “but it does look like we are running a little bit lower than last year.”

©2024 Bloomberg L.P.

KEEPING THE ENERGY INDUSTRY CONNECTED

Subscribe to our newsletter and get the best of Energy Connects directly to your inbox each week.

By subscribing, you agree to the processing of your personal data by dmg events as described in the Privacy Policy.

More oil news

Oil Rises a Second Day After US Cracks Down on Iranian Supply

Oil Steadies With Glut Expectations, Trade War Souring Outlook

Oil Edges Higher With Focus on Tariff Moves, US-Iran Discussions

Oil Steadies as Progress on Iran Talks Undercuts Tariff Reprieve

Goldman Sachs Warns Oil Faces ‘Large Surpluses’ Through 2026

Chevron Ordered to U-Turn Venezuela Oil Ahead of Sanctions

Shale Drillers Idle US Rigs at Fastest Pace in Almost Two Years

Oil Heads for Weekly Decline as Trade War Roils Global Markets

US Crude Flows to China Trickle to Near Zero After Tariff Blitz