Oil Holds Decline as Risk-Off Tone Vies With Attacks on Ships

(Bloomberg) -- Oil held a loss as investors juggled a risk-off tone in broader markets with escalating attacks on ships near Yemen.

Brent traded above $85 a barrel and West Texas Intermediate was below $81. The drop came despite another two vessels being attacked, with one abandoned after flooding and another sustaining moderate damage. A coal-carrier sunk recently as Houthi militants ramped-up hostilities in the region.

In wider markets, Asian equities dipped ahead of a week that includes measures of inflation that will help guide bets on interest rates. The dollar held near the highest level since November, making commodities more expensive.

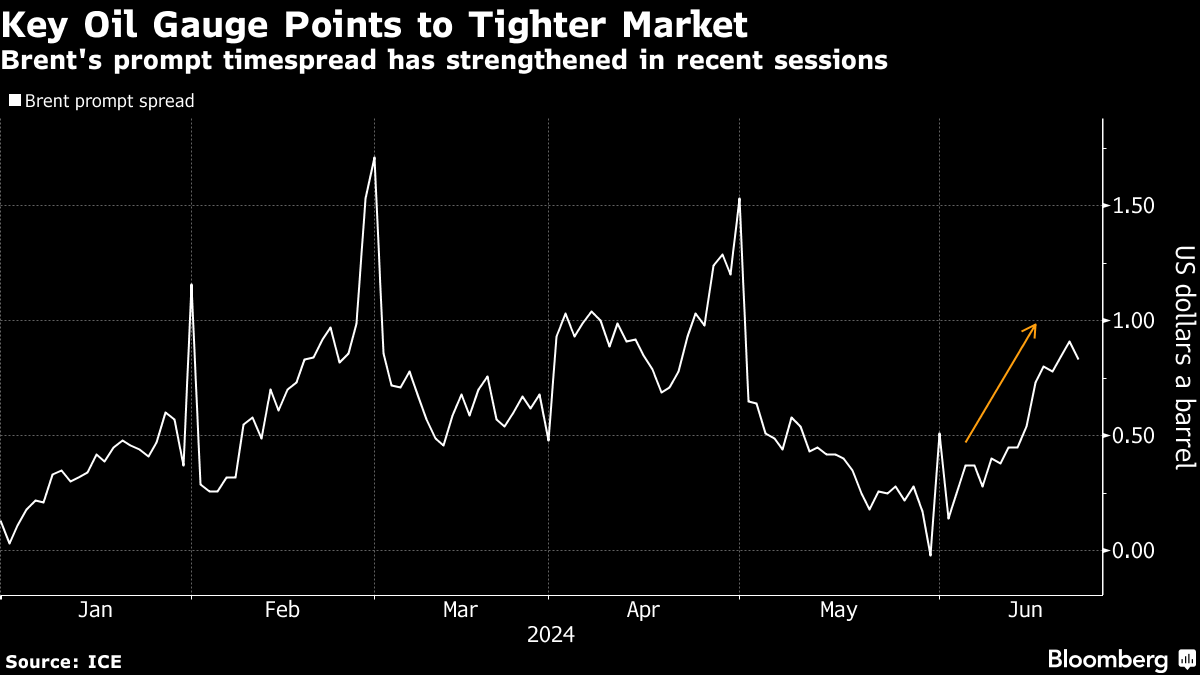

Crude still remains on track for a monthly gain, and there are signs of rising gasoline demand in the US and healthy demand for air travel, which is aiding the outlook. The prompt spread for Brent has strengthened this month in a bullish backwardation structure, signaling tightening supply.

“We remain supportive toward the oil market with a deficit over the third quarter set to tighten the oil balance,” said Warren Patterson, Singapore-based head of commodities strategy at ING Groep NV. “Speculators have also become more constructive toward oil as we move into summer.”

In Iran, snap elections will be held on Friday following the death of Ebrahim Raisi in a helicopter crash last month. The vote comes at a time of heightened tensions between Iran and the West, with Tehran mobilizing a regional network of proxy militias to target Israel.

©2024 Bloomberg L.P.