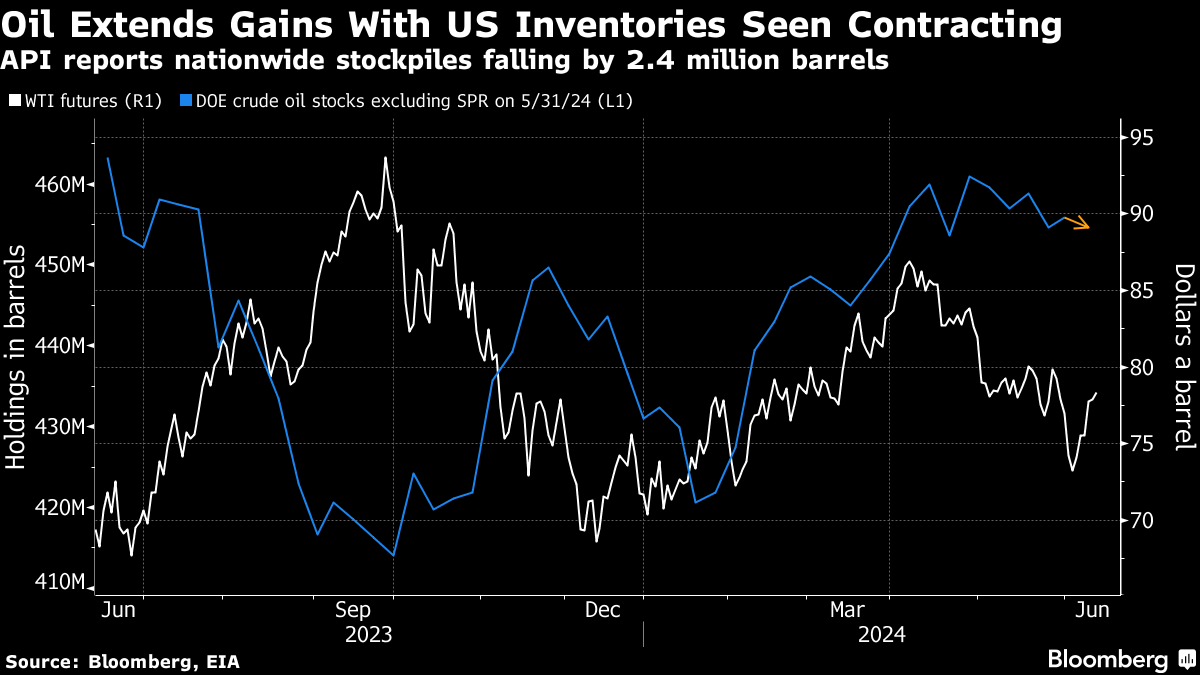

Oil Rises After Industry Report Points to Lower US Stockpiles

(Bloomberg) -- Oil extended gains after industry data pointed to shrinking US crude stockpiles ahead of a report from the IEA on the market outlook.

Brent futures climbed above $82 a barrel after rising almost 3% at the start of the week, while West Texas Intermediate traded near $78. The American Petroleum Institute reported that US crude inventories dropped by 2.4 million barrels last week, according to people familiar with the data.

Oil has rebounded this week following a selloff that was sparked by OPEC+’s plan to return some output this year, which would add to robust supply from outside of the group. The US on Tuesday forecast its production in 2024 will increase more than previously estimated to a fresh record.

The Organization of the Petroleum Exporting Countries remains positive on the outlook, however. The group maintained its forecast for strengthening demand in the second half of this year, according to a monthly report on Tuesday. The estimates are more bullish than others in the industry.

“We see a sizeable deficit in the third quarter, which suggests that prices still have room to run higher,” said Warren Patterson, head of commodities strategy for ING Groep NV in Singapore. “The oil balance will be tight in the short term.”

The International Energy Agency will provide its snapshot on the supply and demand outlook later Wednesday, which will be followed by an interest-rate decision from the Federal Reserve.

©2024 Bloomberg L.P.

KEEPING THE ENERGY INDUSTRY CONNECTED

Subscribe to our newsletter and get the best of Energy Connects directly to your inbox each week.

By subscribing, you agree to the processing of your personal data by dmg events as described in the Privacy Policy.

More oil news

Oil Edges Lower as Trade War Concerns Vie With Pressure on Iran

Oil Falls After Trump Delays Canada, Mexico Tariffs by a Month

Wright Confirmed to Lead Energy Agency Key to Trump’s Plans

Oil Rises as Trump Slaps Tariffs on Biggest Crude Supplier to US

UAE’s Adnoc Aims to Buy Nova Chemicals, Roll Into Deal With OMV

Ukrainian Drone Surge Highlights Russian Oil Refining Risk

South Korea Exports Resilient as Trump’s Tariff Threat Looms

Crude Oil Steadies With Traders in Limbo Over US Trade Policies

Oil Steadies as Traders Look to Tariff Fallout and Stockpiles