Oil Declines for a Third Day as Rates and Geopolitics Dominate

(Bloomberg) -- Oil fell for a third day, with traders assessing the outlook for global interest rates and geopolitical tensions in the Middle East.

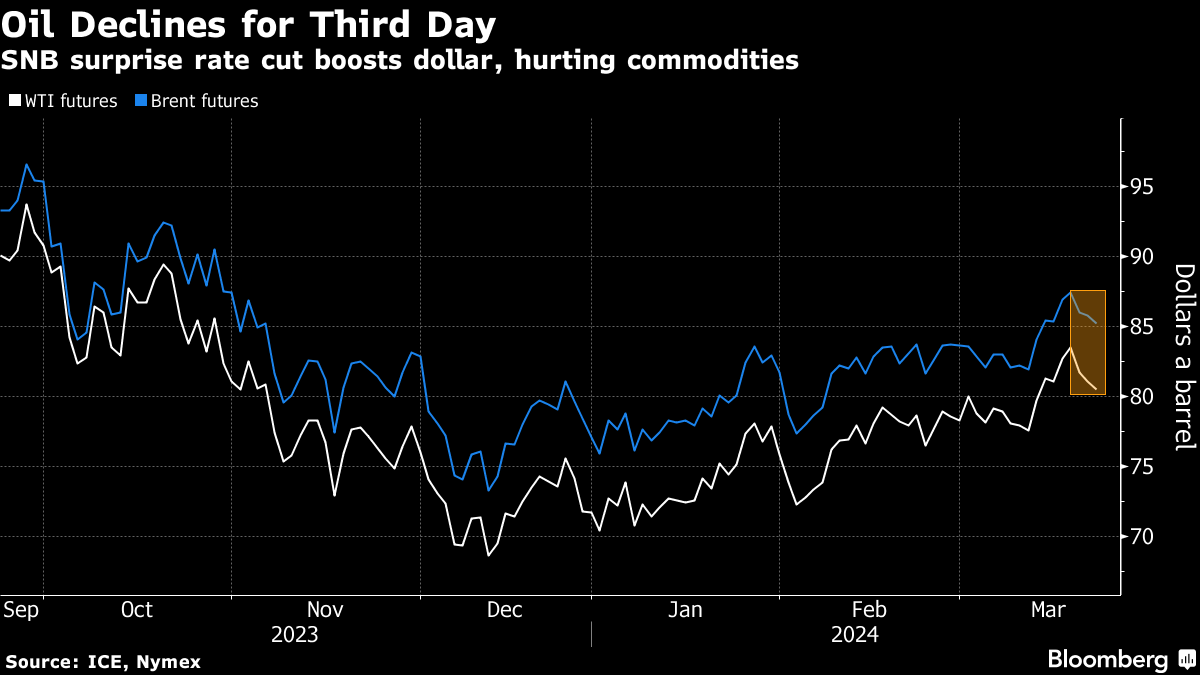

Brent crude dropped toward $85 a barrel after losing almost 2% over the previous two days, while West Texas Intermediate was below $81. A surprise rate cut from the Swiss National Bank boosted the dollar, a headwind for commodities priced in the greenback. That move followed the Federal Reserve signaling that a trio of US cuts remained on the cards this year.

Israel said it would invade Rafah no matter what the US says, potentially escalating tensions in the Middle East, as it battles Iran-backed Hamas in the Gaza Strip. The Houthis in Yemen, meanwhile, assured China and Russia that their vessels wouldn’t be targeted in the Red Sea.

Crude has still advanced in the first quarter, having broken out of a narrow range in recent weeks on US inventory drawdowns, OPEC+’s production cuts and as Ukrainian attacks on Russian territory, including against refineries, intensified. However, gains have been limited by surging supply from outside the group and a muddled economic outlook in top importer China.

Despite the divergent drivers, oil markets have been relatively calm, with a gauge of volatility for global benchmark Brent sinking to a four-year low. Gasoline, meanwhile, is showing signs of strength, with the profit margin for making the fuel from crude in the US near the widest since August.

“We expect oil markets to remain tight in the short term, while geopolitical risks are also likely to create some bouts of volatility” despite its recent decline, said Han Zhong Liang, investment strategist at Standard Chartered Plc. US crude inventory data would be one to watch, given the recent contractions in stockpiles, he said.

©2024 Bloomberg L.P.

KEEPING THE ENERGY INDUSTRY CONNECTED

Subscribe to our newsletter and get the best of Energy Connects directly to your inbox each week.

By subscribing, you agree to the processing of your personal data by dmg events as described in the Privacy Policy.

More oil news

Oil Rises a Second Day After US Cracks Down on Iranian Supply

Oil Steadies With Glut Expectations, Trade War Souring Outlook

Oil Edges Higher With Focus on Tariff Moves, US-Iran Discussions

Oil Steadies as Progress on Iran Talks Undercuts Tariff Reprieve

Goldman Sachs Warns Oil Faces ‘Large Surpluses’ Through 2026

Chevron Ordered to U-Turn Venezuela Oil Ahead of Sanctions

Shale Drillers Idle US Rigs at Fastest Pace in Almost Two Years

Oil Heads for Weekly Decline as Trade War Roils Global Markets

US Crude Flows to China Trickle to Near Zero After Tariff Blitz