Oil Extends Drop on Mideast Cease-Fire Prospects, US Inflation

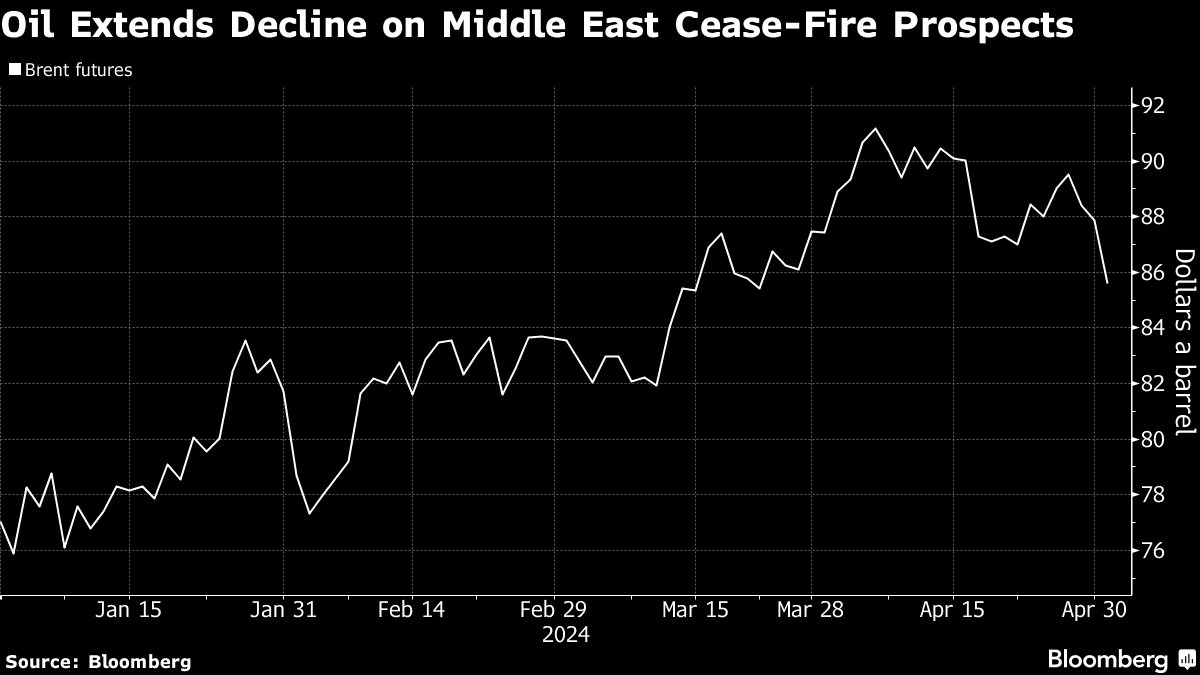

(Bloomberg) -- Oil extended a decline on the prospect a cease-fire in the Middle East will ease tensions and as signs of elevated inflation weigh on the outlook for US demand ahead of a Federal Reserve meeting.

Brent crude traded near $85 a barrel after losing 1% on Tuesday, while West Texas Intermediate was above $81. Volumes were thin in Asian trading, with public holidays in countries including China and Singapore.

Israel will consider joining cease-fire talks with Hamas when the militant group responds to the latest internationally mediated proposal for a temporary truce and hostage release, state-run Kan News reported.

Crude is starting May on the back foot after a rocky April that saw it surge to the highest since October following Iran’s unprecedented attack on Israel. While OPEC+ supply curbs are also bolstering prices, uncertainty over US monetary policy and softness in fuel markets including diesel are adding to headwinds.

“The potential for a cease-fire agreement between Israel and Hamas has eased concerns of an escalation of the conflict and any possible disruptions to supply,” ANZ Banking Group Ltd. analysts Brian Martin and Daniel Hynes said in a note. “Continued signs of inflation also raised concerns about demand for crude oil. This comes ahead of the US driving season, where demand for gasoline rises strongly.”

Meanwhile, in another sign of bearishness, US crude stockpiles increased 4.9 million barrels last week, according to the American Petroleum Institute. That would be the fifth expansion in six weeks if confirmed by official data later Wednesday.

©2024 Bloomberg L.P.

KEEPING THE ENERGY INDUSTRY CONNECTED

Subscribe to our newsletter and get the best of Energy Connects directly to your inbox each week.

By subscribing, you agree to the processing of your personal data by dmg events as described in the Privacy Policy.

More oil news

Oil Traders Lurch From Praying for Volatility to Drowning in It

US Steps Up Houthi Campaign With Deadly Strikes on Red Sea Oil Port

Iran's Space Program Is Growing Stronger Despite US Sanctions

Abu Dhabi Defies Oil Price Plunge to Keep Building Big at Home

Oil Rises a Second Day After US Cracks Down on Iranian Supply

Oil Steadies With Glut Expectations, Trade War Souring Outlook

Oil Edges Higher With Focus on Tariff Moves, US-Iran Discussions

Oil Steadies as Progress on Iran Talks Undercuts Tariff Reprieve

Goldman Sachs Warns Oil Faces ‘Large Surpluses’ Through 2026