Asian Stocks Lose Momentum as China Rally Fades: Markets Wrap

(Bloomberg) -- Asian shares struggled for direction after a policy-induced intraday rally in China lost steam, offsetting strong gains in heavyweight Samsung Electronics Co. Ltd.

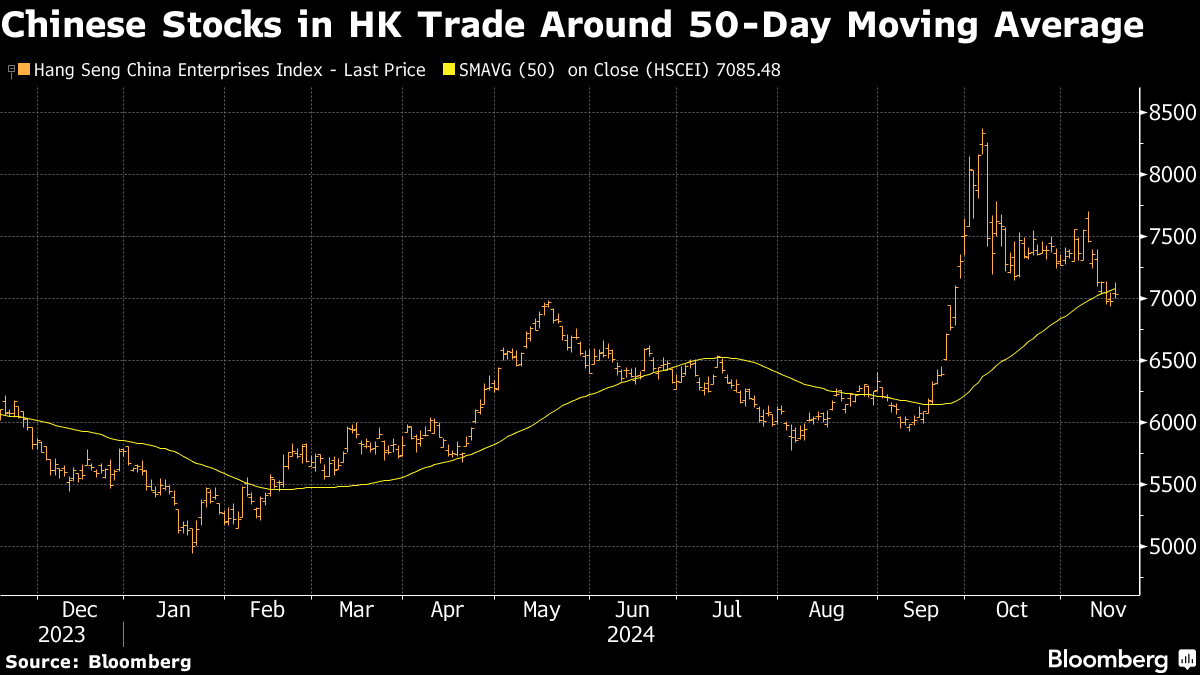

A key gauge of the region’s equities turned flat after rising as much as 0.4%. China’s CSI 300 Index closed 0.5% down, following a 1.6% gain earlier that was inspired by news that the country’s securities regulator urged listed companies to boost returns on their stocks. Chinese stocks listed in Hong Kong also slowed their advancement.

Samsung Electronics was another focus in Asia, rallying after South Korea’s biggest firm announced a surprise stock buyback plan.

European stock futures pointed to mild gains at the open, with their US peers edging higher.

Weighing on broader investor sentiment are lingering concerns about Donald Trump’s potentially inflationary economic policies and Friday’s upbeat US retail sales data that reduced expectations for the Federal Reserve to cut interest rates. The resumed selling in Chinese stocks offers another reminder of the difficulties faced by Beijing to prop up the market in the absence of potent fiscal stimulus.

“We think that the Trump trade, as it’s called, is kind of faltering a little bit now,” Anita Gupta, head of equity strategy at Emirates NBD PJSC, told Bloomberg TV. As private consumption is not yet rebounding in China, “we would wait for further green shoots before we go back overweight” on the country’s equities, she added.

The Bloomberg dollar index was largely steady. The yen slipped after Bank of Japan Governor Kazuo Ueda said the timing of the central bank’s next policy adjustment will depend on the economy and prices. The BOJ is scheduled to meet on Dec. 18-19.

In corporate news, Alibaba Group Holding Ltd. is proposing to sell dollar and yuan bonds to pay back offshore debt and buy back shares, following the Chinese tech conglomerate’s issuance of a record convertible bond offering earlier this year. Meanwhile, Enel SpA raised its dividend on 2024 earnings and said it’s targeting up to €6.9 billion ($7.3 billion) in profit for 2025.

As for commodities, oil rebounded. Gold advanced after suffering its worst weekly drop since 2021, as the dollar eased and traders weighed the outlook for Fed rate cuts.

Elsewhere this week, China’s banks are expected to keep their loan prime rates unchanged after a cut in October. Bank Indonesia will deliver a policy decision as the rupiah neared 16,000 per dollar on Friday, a key psychological level for a central bank focused on currency stability.

UK and eurozone inflation readings are due which will help gauge the outlook for Bank of England and European Central Bank policy with a swath of officials from the respective institutions also due to speak. Nvidia’s results may test the sustainability of AI-led stock gains.

Key events this week:

- Group of 20 Summit in Brazil begins, Monday

- European Union foreign ministers meet in Brussels, Monday

- RBA meeting minutes, Tuesday

- Eurozone CPI, Tuesday

- Canada CPI, Tuesday

- China loan prime rates, Wednesday

- Indonesia rate decision, Wednesday

- South Africa retail sales, CPI, Wednesday

- UK CPI, Wednesday

- Nvidia earnings, Wednesday

- ECB President Christine Lagarde and Vice President Luis De Guindos speak, Wednesday

- ECB issues financial stability review, Wednesday

- Fed Governor Lisa Cook, Fed Governor Michelle Bowman speak, Wednesday

- BOE Deputy Governor Dave Ramsden speaks, Wednesday

- RBA Governor Michele Bullock speaks, Thursday

- Japan CPI, Friday

- India HSBC Manufacturing & Services PMI, Friday

- Eurozone HCOB Manufacturing & Services PMI, Friday

- UK retail sales, S&P Global Manufacturing & Services PMI, Friday

- US University of Michigan consumer sentiment, S&P Global Manufacturing & Services PMI, Friday

Some of the main moves in markets:

Stocks

- S&P 500 futures rose 0.3% as of 6:25 a.m. London time

- Nasdaq 100 futures rose 0.7%

- Futures on the Dow Jones Industrial Average were little changed

- The MSCI Asia Pacific Index was little changed

- The MSCI Emerging Markets Index rose 0.2%

- S&P 500 futures rose 0.3%

- Nikkei 225 futures (OSE) fell 1.2%

- S&P/ASX 200 futures were little changed

- Japan’s Topix fell 0.6%

- Hong Kong’s Hang Seng rose 0.7%

- The Shanghai Composite rose 0.2%

- Euro Stoxx 50 futures were little changed

Currencies

- The Bloomberg Dollar Spot Index fell 0.1%

- The euro was little changed at $1.0545

- The Japanese yen was little changed at 154.35 per dollar

- The offshore yuan fell 0.1% to 7.2473 per dollar

- The British pound rose 0.1% to $1.2636

Cryptocurrencies

- Bitcoin rose 2% to $90,964.89

- Ether rose 2.2% to $3,130.21

Bonds

- The yield on 10-year Treasuries declined one basis point to 4.43%

- Germany’s 10-year yield advanced one basis point to 2.36%

- Britain’s 10-year yield declined one basis point to 4.47%

- Australia’s 10-year yield declined three basis points to 4.60%

Commodities

- Spot gold rose 0.8% to $2,584.29 an ounce

- West Texas Intermediate crude was little changed

- Spot gold rose 0.8% to $2,584.27 an ounce

This story was produced with the assistance of Bloomberg Automation.

©2024 Bloomberg L.P.

KEEPING THE ENERGY INDUSTRY CONNECTED

Subscribe to our newsletter and get the best of Energy Connects directly to your inbox each week.

By subscribing, you agree to the processing of your personal data by dmg events as described in the Privacy Policy.

More oil news

Oil Trader Faces Lawsuit Over Company Hit by US-Iran Sanctions

Oil Edges Higher as Market Tracks Risk-On Tone and China Demand

US Stocks Erase More Than Half Post-Election Gains: Market Wrap

Iran Loath to Be Drawn Into New Clash With US as Trump Returns

Oil Heads for Weekly Drop as Glut Concerns and Dollar Take Toll

Oil Steadies With Surging Dollar and Chinese Demand to the Fore

Oil Steadies Near November Lows With Outlook for Demand in Focus

Oil Holds Biggest Drop in Two Weeks on Demand Concern and Dollar

US Will Stay in Global Climate Fight Despite Trump, Podesta Says