Big Oil Dials Up Output Growth Just as OPEC Mulls Supply Boost

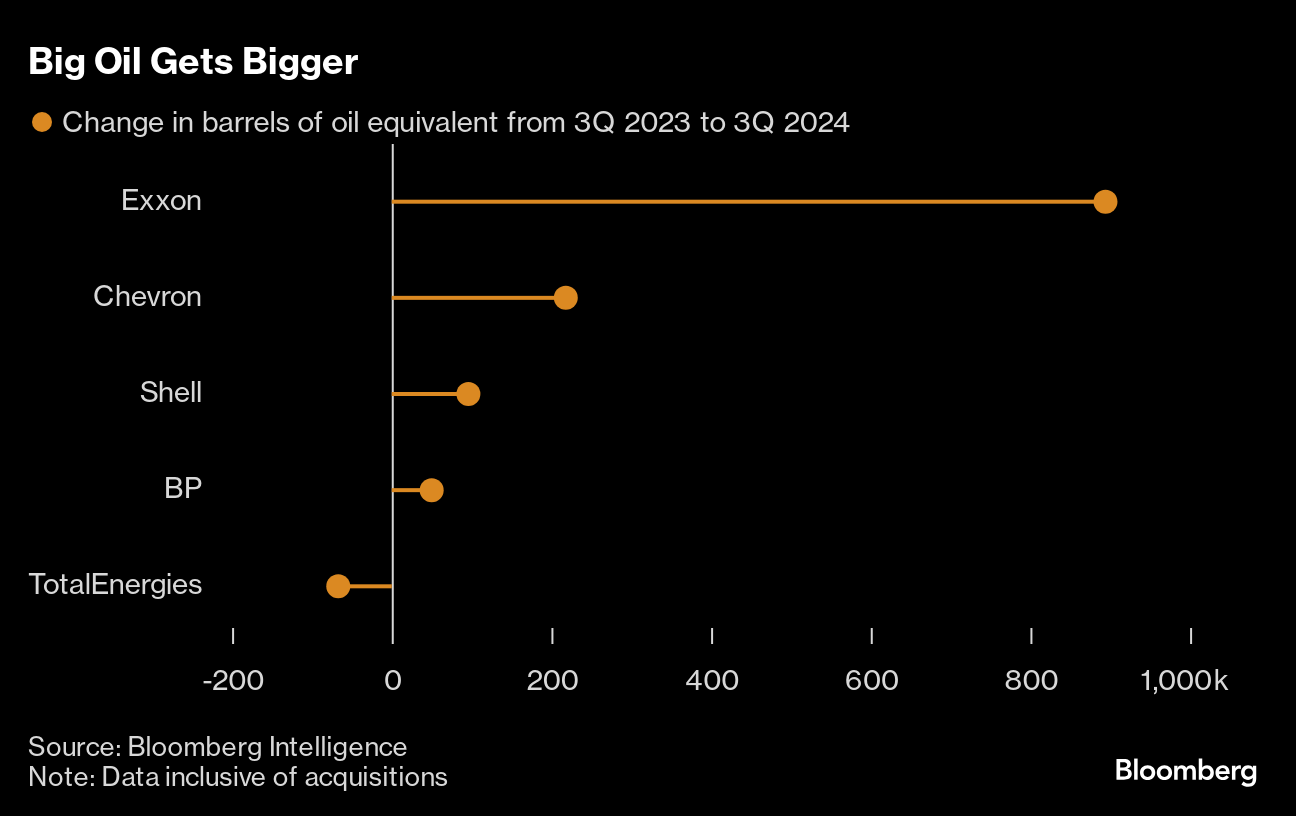

(Bloomberg) -- Exxon Mobil Corp. and Chevron Corp. capped Big Oil earnings season by revealing blockbuster increases in fossil fuel production — just as OPEC and its allies are preparing to increase the supply of crude into the global market.

The US oil majors’ increases were fueled by pumping record amounts of crude from the Permian Basin, which continues to surprise analysts with year-over-year growth and efficiency gains. Exxon’s oil and gas production, boosted by the $60 billion acquisition Pioneer Natural Resources Co., increased 24% from a year earlier while Chevron grew output by 7%.

The US companies weren’t alone. Shell Plc and BP Plc hiked production 4% and 2% respectively, even despite net zero targets that are more aggressive than their American rivals.

It all combines to a weakening outlook for oil prices, which have already dropped roughly 12% in the past six months due to lackluster demand from China, the world’s biggest importer of crude. They may drop even further if the Organization of the Petroleum Exporting Countries follows through with its plan to bring back previously curtailed production.

The moment also stands in stark contrast to just a few years ago, when executives were working to rein in capital spending during the pandemic and as they faced pressure from the environmental, social and governance movement to invest in low-carbon alternatives to fossil fuels. Success in the former and failure at the latter has led the industry to coalesce around a common strategy: oil and gas that’s cheap enough to withstand any energy transition scenario.

“Exxon and Chevron are sticking to their core oil and gas strategy while getting bigger in some of the best assets globally,” said Nick Hummel, a St. Louis-based analyst at Edward D. Jones & Co. “The near-term outlook for oil and gas feels soft, especially with OPEC poised to move more barrels onto the market.”

Exxon, which lost an activist battle to ESG-leaning Engine No. 1 in 2021, is the prime example of the change in strategy.

Acquisitions, divestments, cost cutting and efficiency gains have “doubled” the oil giant’s profit margins per barrel since 2019, even at constant oil prices, Chief Financial Officer Kathy Mikells said in an interview.

And meanwhile, Chevron is pumping 27% more oil and gas than a decade ago despite cutting capital expenditure in half. Much of that is because the company was spending heavily on Australian gas projects that are now operational, but it’s also down to efficiency gains and a pivot toward the Permian. Chevron has doubled its production in the basin in the last five years and is now returning records amounts of cash to shareholders.

“We’re getting more efficient in everything we’re doing,” Chevron CEO Mike Wirth said in an interview. “We’re getting more for every dollar we spend.”

The growth in US production — currently about 50% higher than Saudi Arabia — is helping to keep millions of OPEC barrels off the market. These barrels, combined with fresh supply from Guyana, Brazil and elsewhere, could mean that 5 million barrels a day of productive capacity “will be available in 2025 that is not currently producing today,” Macquarie analysts said in a report. That’s agains the backdrop of “relatively weak” demand growth, they said.

The bank sees Brent crude declining below $70 a barrel, from about $73 currently, barring any major geopolitical events.

Falling prices puts pressure on Big Oil’s ability to pay dividends and buy back shares. BP plunged this week after signaling it may reduce its buyback next year amid lower oil prices. But Exxon, Chevron and Shell remain confident they can weather the storm.

Exxon projects in Guyana and the Permian, which now make up about a quarter of overall production, can pump crude for less than $35 a barrel, meaning they should remain profitable during a potential downturn.

“The fundamental transformation of our business has put us on really good footing in any market environment, but especially a softening market environment,” Mikells said.

©2024 Bloomberg L.P.