Most Asian Stocks Rise as Traders Mull Trump, Fed: Markets Wrap

(Bloomberg) -- Most Asian shares gained, following their US peers higher, as investors positioned for a second Donald Trump presidency and an expected Federal Reserve interest-rate cut.

Equity gauges rallied in Hong Kong and China on expectations that Beijing will roll out more stimulus. That was after the S&P 500 surged 2.5% Wednesday, its best post-election day in history and the Nasdaq 100 advanced 2.7%. The Federal Reserve is forecast to cut its benchmark rate on Thursday.

The gains for US stocks reflected expectations that a Trump policy agenda favoring lower taxes and less regulation may support corporate profits. At the same time, Treasury 10-year yields surged 16 basis points on Wednesday on expectations his fiscal plans and proposal to hike tariffs will drive inflation higher and erode the ability of the Fed to trim borrowing costs.

“It’s very likely that we will see significantly more fiscal and monetary stimulus from Beijing, which could offset some of the trade headwinds,” said David Chao, global market strategist at Invesco in Singapore. “All eyes are on what may emerge from China’s policy toolkit after the conclusion of the NPC standing committee meeting on 8th November.”

Chinese stocks opened lower but then swung to a gain. Consumer and property shares rallied as traders bet Beijing would shift its focus to boosting domestic demand to offset any negative impact from Trump’s return to the White House.

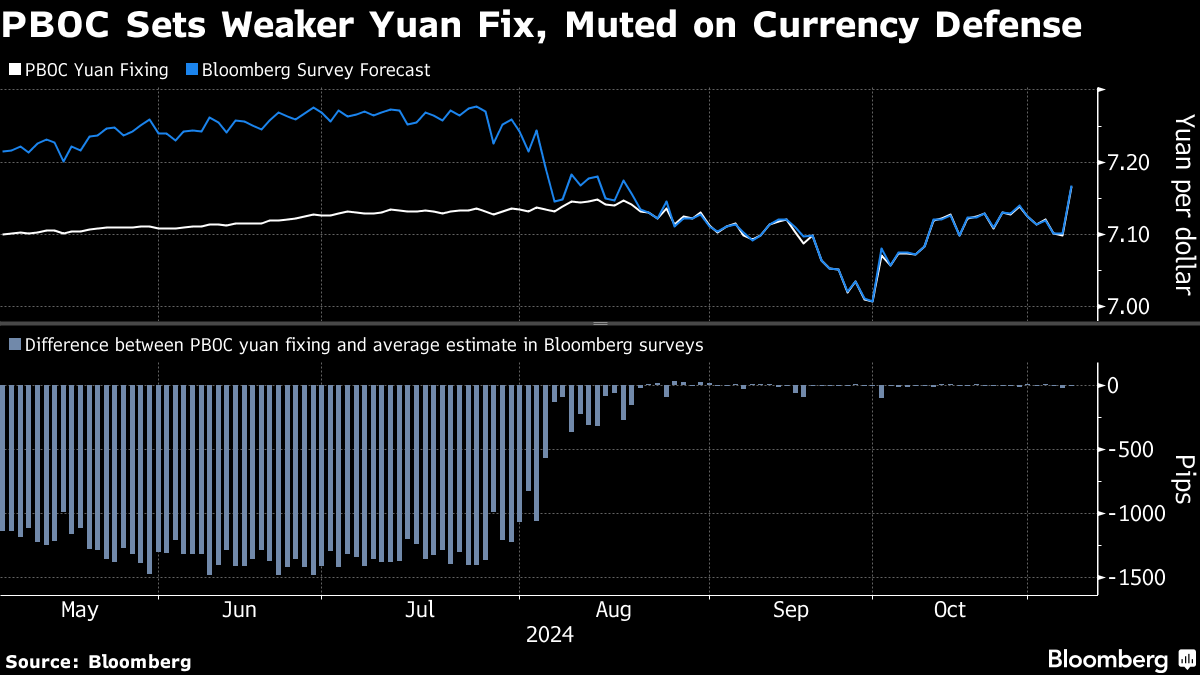

Chinese policymakers lowered their daily reference rate for the yuan to the lowest since late 2023, a sign the central bank is allowing depreciation after a surge in the dollar pummeled the currency.

China’s export growth surged in October to the fastest in more than two years, extending a months-long run of resilience that helped sustain the economy before a barrage of stimulus measures aimed at shoring up domestic demand.

The yen edged higher after Japan’s chief currency official Atsushi Mimura said the authorities will take appropriate action against excessive currency moves. The currency had tumbled about 2% on Wednesday following Trump’s victory.

Bloomberg’s dollar index stabilized in Asia after jumping about 1.3% on Wednesday. Treasury 10-year yields slipped one basis point to 4.42%.

“I think now the world has to be seen through the kind of lens of Trump effectively and the kind of zero sum game and the bilateral way that he approaches foreign relations,” Kyle Rodda, a senior market analyst at Capital.Com Inc., said on Bloomberg Television.

Spreads on Asian investment-grade dollar bonds tightened to a record low on Thursday, with yield premiums on the notes declining by at least one basis point, according to credit traders. Spreads had narrowed to 73 basis points the previous day, then the lowest based on Bloomberg data stretching back to 2009.

Fed Decision

Fed officials are widely expected to lower their benchmark rate by a quarter percentage point late Thursday, a move that will come on the heels of the half-point cut in September. They have projected one more quarter-point reduction this year, in December, and an additional full point of reductions in 2025, according to the median estimate released in September.

“The Fed is still likely to cut by 25 basis points at Thursday’s meeting and likely to cut again in December,” said Yung-Yu Ma at BMO Wealth Management. “As we move into 2025, we believe it’s possible that we only see two or three cuts for the year depending on the mix of policy and growth that plays out.”

Central bankers the world over are gauging whether their worst fears over Trump will come to pass following his resounding return to the US presidency.

Wall Street’s “fear gauge” — the VIX — tumbled Wednesday by the most since August. Almost 19 billion shares changed hands on US exchanges, 63% above the daily average in the past three months.

Bitcoin, viewed by many as a so-called Trump trade after he embraced digital assets during his campaign, slipped early Thursday after hitting a record high the day before. In commodities, oil and coal steadied after a roller-coaster session on Wednesday. Copper and other base metals ticked higher.

Key events this week:

- China trade, forex reserves, Thursday

- UK BOE rate decision, Thursday

- Fed rate decision, Thursday

- US University of Michigan consumer sentiment, Friday

Some of the main moves in markets:

Stocks

- S&P 500 futures rose 0.1% as of 12:50 p.m. Tokyo time

- Nikkei 225 futures (OSE) fell 0.8%

- Japan’s Topix rose 1%

- Australia’s S&P/ASX 200 rose 0.1%

- Hong Kong’s Hang Seng rose 1%

- The Shanghai Composite rose 0.9%

- Euro Stoxx 50 futures were little changed

Currencies

- The Bloomberg Dollar Spot Index fell 0.1%

- The euro rose 0.1% to $1.0740

- The Japanese yen rose 0.2% to 154.32 per dollar

- The offshore yuan rose 0.2% to 7.1884 per dollar

Cryptocurrencies

- Bitcoin fell 1% to $75,186.26

- Ether rose 6.4% to $2,860.98

Bonds

- The yield on 10-year Treasuries was little changed at 4.43%

- Japan’s 10-year yield advanced two basis points to 1.000%

- Australia’s 10-year yield advanced two basis points to 4.64%

Commodities

- West Texas Intermediate crude rose 0.8% to $72.25 a barrel

- Spot gold was little changed

This story was produced with the assistance of Bloomberg Automation.

©2024 Bloomberg L.P.

KEEPING THE ENERGY INDUSTRY CONNECTED

Subscribe to our newsletter and get the best of Energy Connects directly to your inbox each week.

By subscribing, you agree to the processing of your personal data by dmg events as described in the Privacy Policy.

More oil news

Philippines’ Marcos Seeks to Import LNG From Alaska, Envoy Says

Oil Falls After Weak Technicals Accelerate Supply-Driven Losses

Buffett’s Annual Letter May Give Much Needed Support to Japanese Stocks

Oil Edges Lower With Focus on US Stockpiles, Supply Uncertainty

Oil Climbs With Focus on OPEC+ Output Plans and Ukraine Talks

Diamondback Energy announces $4.08 billion acquisition to expand Permian presence

Oil Holds Declines on Prospect of Higher Russia, Iraq Supplies

Canada’s Conservative Leader Pitches Major Natural-Resource Revamp to Counter Trump

EPA Terminates Nearly 400 Workers Amid US Government Purge