Oil Holds Weekly Drop on Glut Concerns, China’s Demand Outlook

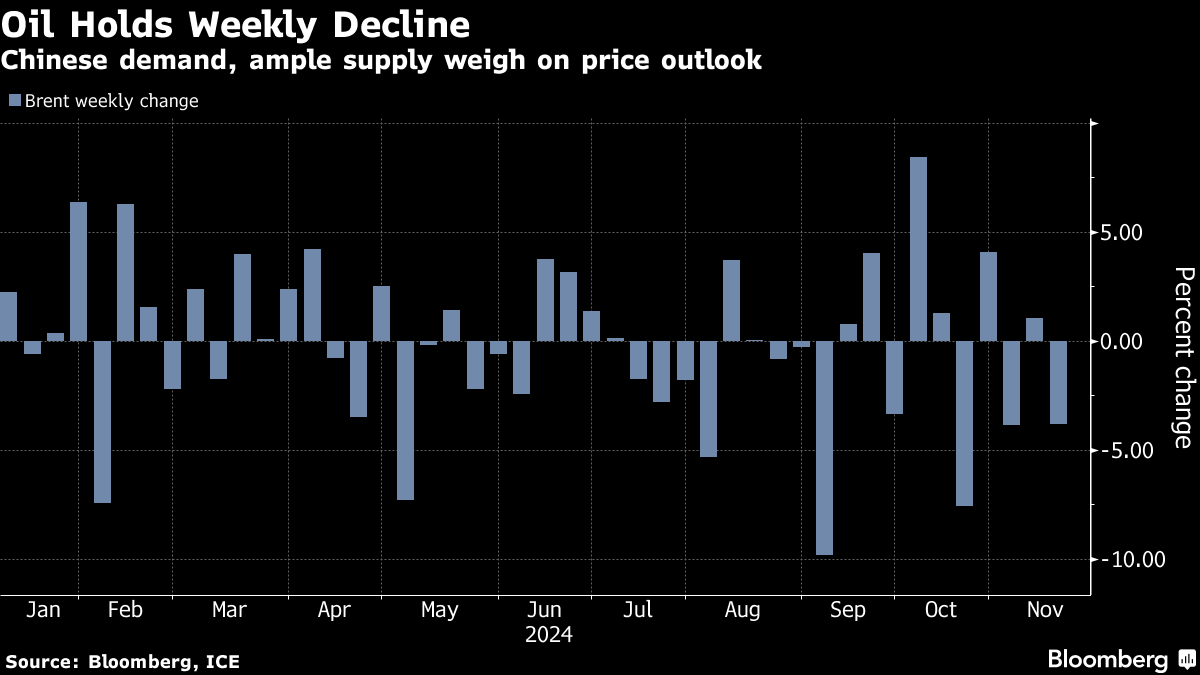

(Bloomberg) -- Oil held a weekly loss on concerns over plentiful global supply and the outlook for demand in China, the world’s biggest crude importer.

Brent traded above $71 a barrel after tumbling 3.8% last week, while West Texas Intermediate was near $67. Weak Chinese consumption has impacted sales of Angolan crude for December, while forecasters including the International Energy Agency see the prospect for a sizeable supply glut next year.

Oil has swung between gains and losses since mid-October, with hostilities in the Middle East at times raising fears of an escalation and potential disruptions to supply. A stronger dollar has added to the bearish headwinds, with an index rallying to the highest level in almost two years last week.

“Market participants continue to fret over the prospects for higher supplies from the US and OPEC+” and the outlook for China’s economy, said Jun Rong Yeap, a market strategist with IG Asia Pte. “There’s not much of a bullish catalyst for oil prices to ride on.”

Investors are monitoring developments on Russia’s war in Ukraine, with allies pushing Volodymyr Zelenskiy to consider new ways to engage Vladimir Putin to negotiate an end to the conflict. The US is also nearing a decision to lift some restrictions on Ukraine’s use of Western-made weapons to strike limited military targets in Russia, according to people familiar.

©2024 Bloomberg L.P.

KEEPING THE ENERGY INDUSTRY CONNECTED

Subscribe to our newsletter and get the best of Energy Connects directly to your inbox each week.

By subscribing, you agree to the processing of your personal data by dmg events as described in the Privacy Policy.

More oil news

Philippines’ Marcos Seeks to Import LNG From Alaska, Envoy Says

Oil Falls After Weak Technicals Accelerate Supply-Driven Losses

Buffett’s Annual Letter May Give Much Needed Support to Japanese Stocks

Oil Edges Lower With Focus on US Stockpiles, Supply Uncertainty

Oil Climbs With Focus on OPEC+ Output Plans and Ukraine Talks

Diamondback Energy announces $4.08 billion acquisition to expand Permian presence

Oil Holds Declines on Prospect of Higher Russia, Iraq Supplies

Canada’s Conservative Leader Pitches Major Natural-Resource Revamp to Counter Trump

EPA Terminates Nearly 400 Workers Amid US Government Purge