Oil Edges Lower as Trump Tariff Threats Pushes Dollar Higher

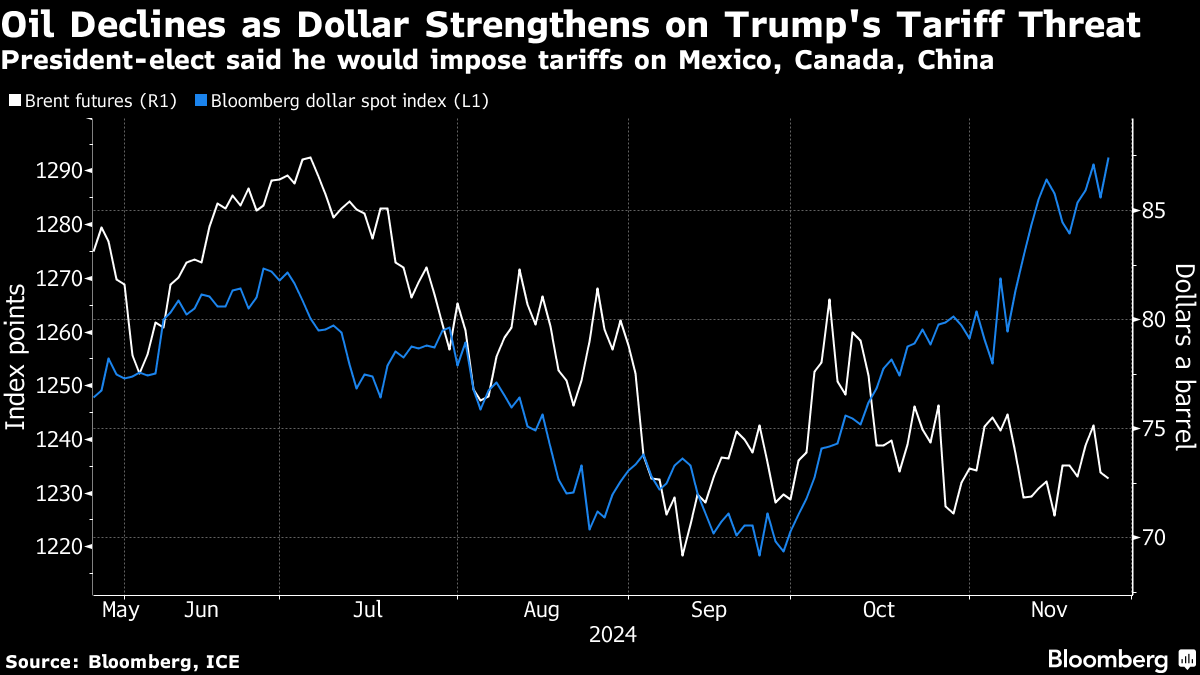

(Bloomberg) -- Oil edged lower, hit by a rising dollar after President-elect Donald Trump threatened tariffs on Canada, Mexico and China.

Global benchmark Brent dropped below $73 a barrel after losing 2.9% on Monday, its biggest drop in almost a month. West Texas Intermediate traded near $69. Trump’s announcement, which could affect energy flows from Canada to the US, weighed on commodities priced in the dollar.

Oil had fallen Monday after Israel said it’s potentially days away from a deal with Hezbollah, which could diminish the risk to Middle Eastern crude supply and ships traversing the region. Still, it remains unclear if the Iran-backed group will accept a truce.

“While the signs are looking constructive, a deal between Israel and Iran could still fail,” which would see any short positions being quickly reversed, said Chris Weston, head of research for Pepperstone Group Ltd. The Trump comments may just be “fighting talk” before the president-elect nominates a US trade representative, he said.

One of the chief architects of Trump’s tariff agenda, former US Trade Representative Robert Lighthizer has yet to land a role in the second term.

Oil has been trading in a tight range since the middle of October, with traders weighing geopolitical risks centered around supply from Russia and Iran against expectations for a glut next year. Ahead of a meeting by OPEC+ this weekend, Iran’s representative to the producer group said the cartel has little scope to reverse output cuts due to more supplies from elsewhere.

©2024 Bloomberg L.P.

KEEPING THE ENERGY INDUSTRY CONNECTED

Subscribe to our newsletter and get the best of Energy Connects directly to your inbox each week.

By subscribing, you agree to the processing of your personal data by dmg events as described in the Privacy Policy.

More oil news

Philippines’ Marcos Seeks to Import LNG From Alaska, Envoy Says

Oil Falls After Weak Technicals Accelerate Supply-Driven Losses

Buffett’s Annual Letter May Give Much Needed Support to Japanese Stocks

Oil Edges Lower With Focus on US Stockpiles, Supply Uncertainty

Oil Climbs With Focus on OPEC+ Output Plans and Ukraine Talks

Diamondback Energy announces $4.08 billion acquisition to expand Permian presence

Oil Holds Declines on Prospect of Higher Russia, Iraq Supplies

Canada’s Conservative Leader Pitches Major Natural-Resource Revamp to Counter Trump

EPA Terminates Nearly 400 Workers Amid US Government Purge