Oil Advances on Rising Geopolitical Tensions From Iran, Russia

(Bloomberg) -- Oil rose as geopolitical tensions from Russia to Iran ratcheted higher while strength in equity markets increased the appeal of risk assets.

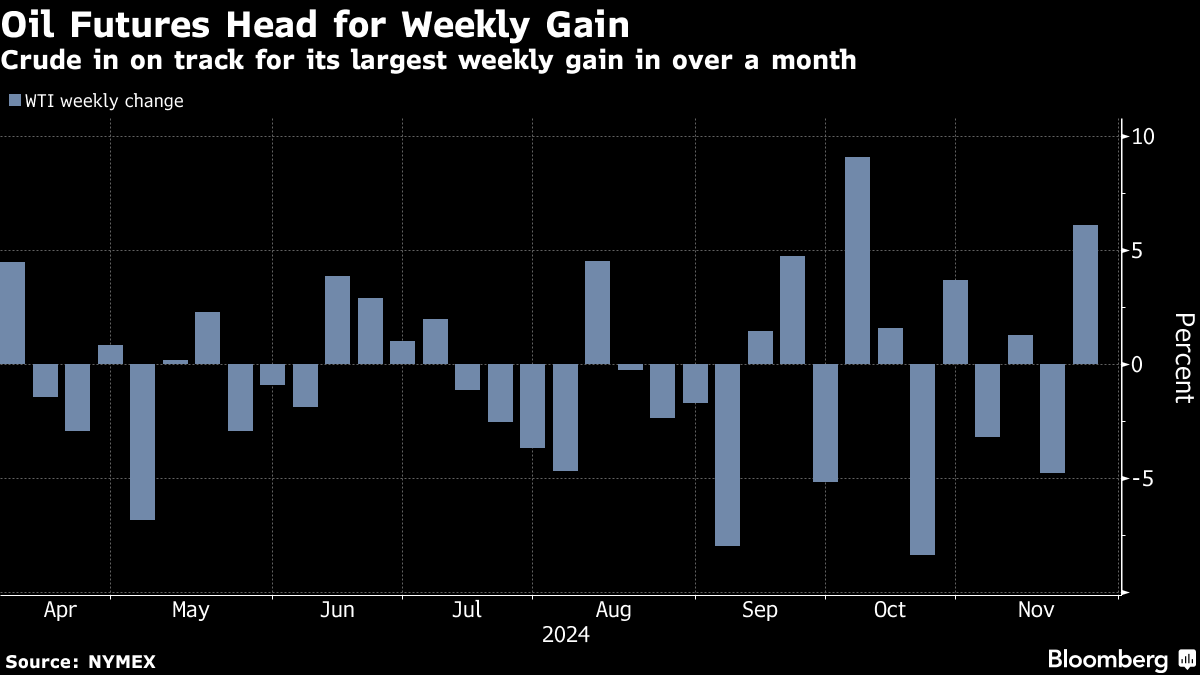

West Texas Intermediate climbed to around $71 a barrel, up roughly 5% for the week, while Brent topped $75. The Russia-Ukraine conflict has rapidly intensified following months of bloody attrition, with the use of longer-rage missiles by both sides this week. At the same time, Iran said it will increase its nuclear fuel-making capacity after it was censured by the UN’s International Atomic Energy Agency.

A gain in equity markets also gave crude a boost, though the rally was capped by a stronger dollar that makes commodities priced in the currency less attractive. Euro-area business activity also unexpectedly shrank, a sign of the risks from heightened discord over trade.

Still, bullish signs for crude have emerged this week. WTI’s nearest timespread strengthened to 46 cents — indicating tighter supplies — after briefly flipping into a bearish contango structure last week for the first time since February.

Oil has swung between weekly gains and losses since mid-October, with a strong dollar, ample supply and indications of weak demand providing headwinds. At the same time, geopolitical tensions — including the Kremlin’s revamp of its nuclear doctrine this week — have caused temporary gains but failed to provide an extended uplift in the face of widespread expectations of a crude surplus next year.

“The market is still complacent about geopolitical disruption risk,” Bob McNally, president of Rapidan Energy Group, said in a Bloomberg Television interview. “President Trump will be willing to crimp Russian energy exports to get leverage for deals he wants to cut.”

The US, meanwhile, sanctioned Russia’s Gazprombank, closing a loophole that Washington kept open over the course of the war because the lender is key for energy markets. The penalties increase the risk of a cut-off of some of the remaining Russian gas flows to a handful of central European nations.

©2024 Bloomberg L.P.

KEEPING THE ENERGY INDUSTRY CONNECTED

Subscribe to our newsletter and get the best of Energy Connects directly to your inbox each week.

By subscribing, you agree to the processing of your personal data by dmg events as described in the Privacy Policy.

More oil news

US Steps Up Houthi Campaign With Deadly Strikes on Red Sea Oil Port

Iran's Space Program Is Growing Stronger Despite US Sanctions

Abu Dhabi Defies Oil Price Plunge to Keep Building Big at Home

Oil Rises a Second Day After US Cracks Down on Iranian Supply

Oil Steadies With Glut Expectations, Trade War Souring Outlook

Oil Edges Higher With Focus on Tariff Moves, US-Iran Discussions

Oil Steadies as Progress on Iran Talks Undercuts Tariff Reprieve

Goldman Sachs Warns Oil Faces ‘Large Surpluses’ Through 2026

Chevron Ordered to U-Turn Venezuela Oil Ahead of Sanctions