Oil Heads for Weekly Drop as Glut Concerns and Dollar Take Toll

(Bloomberg) -- Oil fell, deepening a weekly loss, on the impact from a stronger dollar and concerns that the global market will flip to a glut next year.

Brent dropped to near $72 a barrel and was down by more than 2% this week, while West Texas Intermediate was around $68. The International Energy Agency said on Thursday it expects a surplus next year as demand growth in China slows while output swells. The glut would be even bigger if OPEC+ pressed on with plans to revive halted production, it said.

In China, data released Friday showed some encouraging signs for the economy, indicating Beijing’s latest round of stimulus has boosted a number of sectors. Apparent oil demand, however, declined in October from a year ago.

“While there are some positive signs in the broader data, clearly we are not out of the woods yet,” said Warren Patterson, head of commodities strategy for ING Groep NV, referring to the Chinese economic figures. “Industrial production was weaker than expected; oil-specific numbers were also not great with both refinery activity and implied demand weaker.”

Commodities including crude have struggled this week as a gauge of the dollar rallied to the highest in two years, powering upward in the aftermath of Donald Trump’s election victory. The US currency is set for its seventh weekly gain, making raw materials more expensive for most buyers.

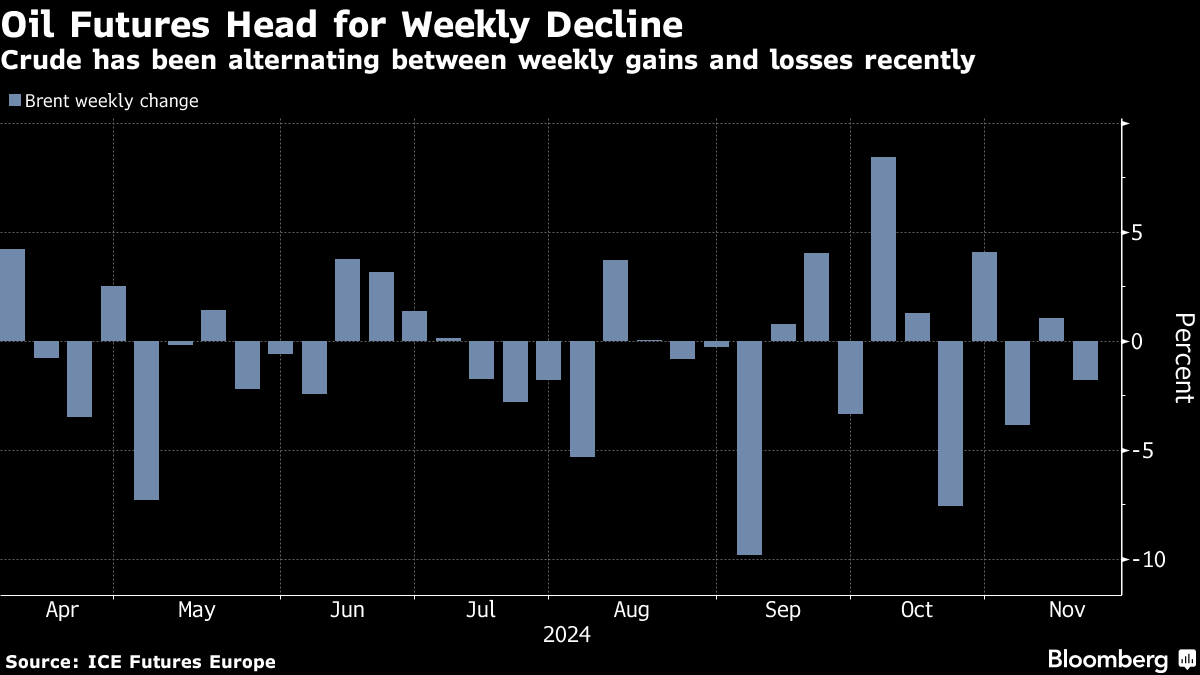

Crude has been alternating between weekly gains and losses since mid-October, buffeted by tensions in the Middle East, the prospect of oversupply going into next year, and shifts in currency markets.

Elsewhere, US oil stockpiles rose by about 2.1 million barrels last week, above an industry estimate, There was also a major, 4.4-million-barrel gasoline draw, which cut holdings to the lowest in a decade for this time of the year.

©2024 Bloomberg L.P.

KEEPING THE ENERGY INDUSTRY CONNECTED

Subscribe to our newsletter and get the best of Energy Connects directly to your inbox each week.

By subscribing, you agree to the processing of your personal data by dmg events as described in the Privacy Policy.

More oil news

Philippines’ Marcos Seeks to Import LNG From Alaska, Envoy Says

Oil Falls After Weak Technicals Accelerate Supply-Driven Losses

Buffett’s Annual Letter May Give Much Needed Support to Japanese Stocks

Oil Edges Lower With Focus on US Stockpiles, Supply Uncertainty

Oil Climbs With Focus on OPEC+ Output Plans and Ukraine Talks

Diamondback Energy announces $4.08 billion acquisition to expand Permian presence

Oil Holds Declines on Prospect of Higher Russia, Iraq Supplies

Canada’s Conservative Leader Pitches Major Natural-Resource Revamp to Counter Trump

EPA Terminates Nearly 400 Workers Amid US Government Purge