Oil Holds Biggest Drop in Two Weeks on Demand Concern and Dollar

(Bloomberg) -- Oil held the biggest drop in two weeks on a soft demand outlook in China, a stronger US dollar, and concerns the market may flip to oversupply.

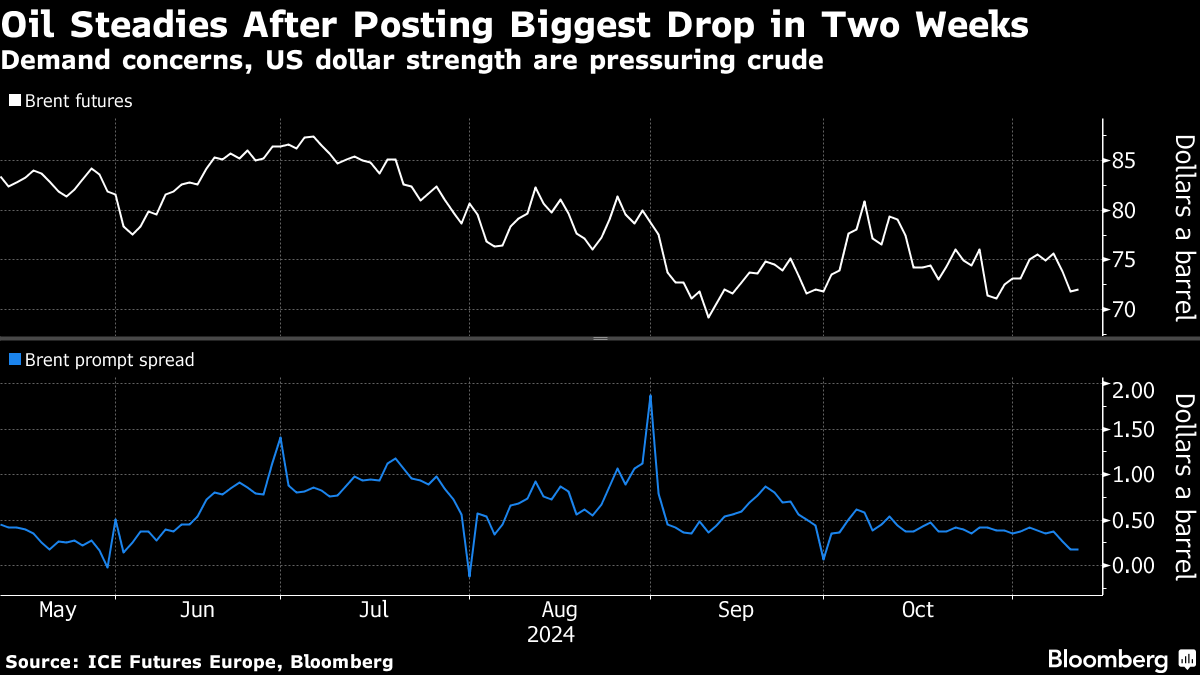

Brent crude traded below $72 after dropping nearly 3% Monday, with West Texas Intermediate around $68. China’s latest measures to kick-start its economy stopped short of direct stimulus, and inflation remains weak. A gauge of the dollar has hit a one-year high as investors adjust to Donald Trump’s victory, making oil more expensive for most buyers.

Crude has traded in a relatively narrow range since the middle of last month as traders tracked tensions in the Middle East, the race for the White House, and OPEC+ decisions on output. The outlook remains weak, with global supply expected to outpace demand next year. OPEC’s monthly market report, due for release later Tuesday, will shed more light on the outlook for balances.

Timespreads point to a less-tight market. Although most gauges are holding in a backwardated structure — with nearby contracts at a premium to longer-dated ones — spreads have been narrowing. The gap between Brent’s two nearest contracts was at 19 cents a barrel in backwardation, compared with 44 cents about a month ago.

“Sentiment in the oil market remains largely bearish: US dollar strength, demand concerns, and expectations of a loosening oil balance are keeping pressure on prices,” said Warren Patterson, head of commodities strategy at ING Groep NV. “In order to change the outlook for next year, we either have to see OPEC+ delay the return of barrels through much of 2025, or the US enforcing sanctions against Iran effectively.”

After the analysis from the Organization of the Petroleum Exporting Countries, the US will release its short-term outlook on Wednesday, followed by the International Energy Agency’s view the day after. OPEC revised demand forecasts lower in its report last month.

©2024 Bloomberg L.P.

KEEPING THE ENERGY INDUSTRY CONNECTED

Subscribe to our newsletter and get the best of Energy Connects directly to your inbox each week.

By subscribing, you agree to the processing of your personal data by dmg events as described in the Privacy Policy.

More oil news

Philippines’ Marcos Seeks to Import LNG From Alaska, Envoy Says

Oil Falls After Weak Technicals Accelerate Supply-Driven Losses

Buffett’s Annual Letter May Give Much Needed Support to Japanese Stocks

Oil Edges Lower With Focus on US Stockpiles, Supply Uncertainty

Oil Climbs With Focus on OPEC+ Output Plans and Ukraine Talks

Diamondback Energy announces $4.08 billion acquisition to expand Permian presence

Oil Holds Declines on Prospect of Higher Russia, Iraq Supplies

Canada’s Conservative Leader Pitches Major Natural-Resource Revamp to Counter Trump

EPA Terminates Nearly 400 Workers Amid US Government Purge